Investor Insights:

- I looked at companies that have raised their payouts for at least 25 years in a row.

- I also screened for the names that have beaten the market for the past three years.

- In the end, two names stuck out to me.

Running stock screens is a valuable thing for all investors to do.

I run screens every day to get ideas.

By this, I mean I generate a list of stocks by putting certain criteria into a screening system.

I use Bloomberg to create most of my screens, but there are free versions on the Banyan Hill Stock Ticker Section, Yahoo Finance or CNBC too.

Most online brokers offer them as well. The important thing is to find one that you like and will use.

For example, if the gold price is moving higher, I can run a screen that shows me the companies that produce the most gold and their cost to do so.

Gold miners that produce the most at the lowest price should benefit when gold prices are rising.

That’s just one example, though. The potential is almost limitless.

For example, I’m a big fan of dividend-paying stocks. I’d like to share something with you about them.

Here’s how I found two of the most consistent payers that deliver returns along with payments. (I name names at the end…)

The Stock-Screening Process

I started with companies that pay dividends.

But I didn’t want just any dividend-payers, because I know you guys don’t want average. I looked at companies that have raised their payouts for at least 25 years in a row.

These stocks aren’t average.

And I know there’s a lot of worry out there today. These stocks will appease investors who don’t want to miss out on stock market gains, but don’t want to chase returns.

These companies are going to pay dividends regardless of the economy. That’s what they’ve been doing for a least a quarter century. Seven names on the list have increased their dividends for at least 60 years.

Starting with these longtime payers gives me comfort. But there were 90 names on the list. That’s too many.

I wanted to limit the list so I could find a name or two to recommend. So I searched for the stocks that have outperformed the S&P 500 Index so far this year. That cut the list down to 35 names.

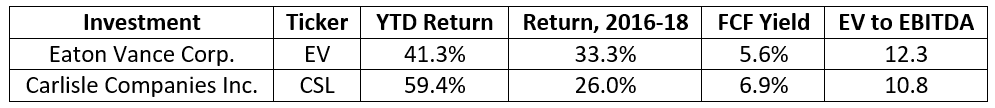

Then I screened for the names that have beaten the market for the past three calendar years as well. There were 22 left.

Now we’re talking.

Valuation Is Always Important

These stocks have been moving higher, but we don’t want to pay too much.

So I further reduced the number by only considering the stocks with the highest free cash flow (FCF) yield.

FCF is the cash a company has left after deducting its capital expenditures in a given period. I talked about it in this article.

FCF yield is free cash flow divided by market cap.

I looked at the names that yielded at least 4%. That cut the list down to 12.

Finally, I looked at the stocks’ enterprise-value-to-EBITDA ratio.

Enterprise value is the market cap and net debt (debt minus cash) of a company — its total value, if you will.

EBITDA is a company’s earnings before interest, taxes, depreciation and amortization. It’s a commonly used metric in the financial industry.

I compared the ratio to the stocks’ average. I ignored names that were higher than average because I don’t want to pay too much for these stocks.

In the end, two names stuck out to me.

Crowning the Dividend Kings

As investors become fearful of missing out on these amazing gains, wealth manager Eaton Vance Corp. (NYSE: EV) will shine.

It pays a 3.1% yield, which it just increased in July. And it has increased its dividend for 38 years in a row.

Carlisle Companies Inc. (NYSE: CSL) makes engineered products for industrial markets. In the year that ended in September, it generated the greatest free cash flow it ever had.

Its dividend yield is 1.2%, and it has grown its per-share payout for 42 years in a row.

Carlisle also buys back a lot of shares.

It has reduced its share count by more than 12% since 2016. And it paid much less than current prices to do so. Buying inexpensive shares is a solid use of excess capital.

I suggest you look into both of these names. They pay dividends with cautious abandon … and they offer profits for the right price.

I also recommend you run some screens yourself. Try out several different screeners so you can find one you like.

If you’re reading this article, you’ve already taken responsibility for your investments. Screening for ideas is a logical next step if you’ve never done it before.

Good investing,

Editor, Profit Line

P.S. I recorded a video with my colleague Ian King about an incredible new $400 billion tech market. You can watch it now by clicking on the image below: