Get ready, American manufacturers (and American investors), because a new player on the geopolitical stage — India — is coming for your business (and your investment dollars).

The latest company to serve notice on this trend? The giant U.S. defense contractor Lockheed Martin Corp. (NYSE: LMT).

In recent days, the company signed an agreement with India’s giant conglomerate Tata Group, the parent company of Tata Motors and a defense subsidiary, Tata Advanced Systems, to manufacture F-16 fighter jets in-country.

The agreement might not hold up. The Indian Air Force — with 200 old Soviet-built MiG fighters to replace — might choose to purchase jets with another maker of military jets, such as Sweden’s Saab.

But if Lockheed gets the formal contract, it would be yet another step toward a future where a great many globally sold advanced products have the label “Made in India.”

Season of Firsts

You can see the pace of industrial development quickening in the news headlines. To name a few:

- Apple began selling the first of its “Assembled in India” iPhones last month.

- Korea’s Kia Motors is in the process of building its first-ever car manufacturing plant in the country.

- General Electric now operates nearly a dozen factories in India, making everything from industrial electronics to wind turbine components.

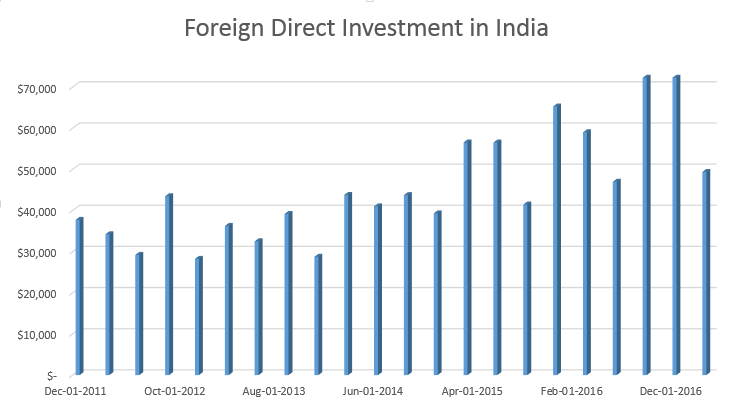

You can also see the trend in India’s foreign direct investment data, which is reported every quarter.

(Source: CapitalIQ)

And yet there’s still a long way to go. As recently as 2015, manufacturing represented a small 17% of India’s overall economic growth (compared to 40% of China’s economy).

What’s it mean for investors? There’s opportunity in broad-based India-invested exchange-traded funds such as the PowerShares India Portfolio ETF (NYSE: PIN) or the WisdomTree India Earnings ETF (NYSE Arca: EPI). Both are up better than 40% in the last 18 months, yet haven’t even broken out of their wide decade-long trading ranges.

Should the U.S. stock market begin to have trouble in the coming months, no doubt these ETFs (and many others) will lose some short-term ground. But Indian equities are set to power higher as the country takes center stage in the global economy.

Kind regards,

Jeff L. Yastine

Editor, Total Wealth Insider