At last year’s Banyan Hill Total Wealth Symposium — sadly canceled this year due to the pandemic — an attendee asked me to summarize my advice to investors in one sentence.

“Keep reminding yourself to operate in the real world,” I replied.

Of course, there are as many definitions of reality as there are investment advisors.

One view is relentlessly optimistic. The world is on an upward trend, and everything is going to end up well … eventually. Ignore the ups and downs.

The problem is that many people can’t afford to ignore the ups and downs. Bauman Letter subscribers tell me that every day.

Particularly for retirees and people with small portfolios, saying “ignore volatility” is like asking a resident of North Carolina’s Outer Banks to ignore a barometer reading under 28 inches and falling fast.

Experience and human nature just won’t let you do it.

So for everyone who lives in the same turbulent reality as me — with COVID-19 cases rising rapidly and a week to go before the most tumultuous presidential election in our lifetimes — here are some things you can do to take control of events … before they take control of you.

My Top 4 Strategies to Survive and Thrive

To have a 20-year time horizon for your investment goals, where short-term dips don’t matter, you either need to be under 40 or have a lot of money set aside for your heirs.

Everyone else needs strategies to help them through tough times in the market. Here are my personal favorites.

No. 1 — Diversify.

The worst thing any investor can do is to go all in on one type of investment … especially the latest shiny objects in the tech sector.

No matter how promising it may be, don’t put all your investment eggs in one future-oriented basket. It’s a big mistake. Even if new technologies deliver payoffs down the road, up-and-coming growth companies are usually the first to see big drops in a crisis, as investors flee to security.

Exciting growth companies have a place in your portfolio. But it’s also important to shift your equity investments into higher-quality companies — and into international stocks, as I advocated in a recent Bauman Daily article.

High-quality stocks are less volatile. They include those with strong balance sheets able to withstand economic downturns and those with high returns on invested capital (ROIC). During the last big bear market, stocks with high ROIC bucked the trend and actually posted strong gains.

One way to play less volatile high-quality U.S. stocks is with the iShares MSCI USA Min Vol Factor ETF (NYSE: USMV). It’s built around 150 solid companies and has an expense ratio of just 0.15%.

For international exposure to low volatility companies, you could buy the iShares MSCI EAFE Min Vol Factor ETF (NYSE: EFAV). It takes the same approach as USMV, but focuses on foreign firms. Its expense ratio is also very low, at only 0.2%.

No. 2 — Raise Cash.

Another way to diversify your portfolio is to turn some of it into cash. This has both financial and psychological benefits.

Jesse Livermore, one of the greatest traders of all time, advocated “selling down to the sleeping level” during times of volatility. Raise the cash portion of your portfolio to 20%, 30%, 40% or whatever feels comfortable to you. That way you’re less likely to overreact if the market takes a dive.

You don’t have to sell your entire position in a stock to do this. As I’ve been telling Bauman Letter and Alpha Stock Alert subscribers all summer, just lock in a percentage of your profits regularly.

The great thing about locking in profits by selling a portion of your positions is that it generates income and reduces risk by reducing your exposure to the underlying stock. And of course, the cash generated from profit-taking is available to buy the next dip.

A profit-taking strategy can be based either on specific price targets or specific percentage gains.

I like to use 20% increments as a rule of thumb. Let’s say you bought 100 shares of a stock at $100 a share. When it hits $120, you could sell 20 shares. When it hits $140, sell another 20, and so on.

This way, you take some money off the table and reduce your risk if the stock were suddenly to turn lower.

Of course, many investors are reluctant to sell because of tax implications. But you can mitigate this by deducting stock market losses from your tax bill to offset profitable sales.

No. 3 — Buy Volatility.

The great thing about the CBOE Volatility Index (VIX) or “Fear Index” is that bets on it pay off whether stocks go up or down. As long as there’s volatility, you win. That makes it a useful hedging tool.

As we saw yesterday — with the VIX up nearly 15% at one point — nervous markets bring an additional surge in volatility. That makes long bets on volatility a rational hedging tactic right now.

One way to play increased volatility is to buy call options on VIX futures listed on the Chicago Board Options Exchange (CBOE).

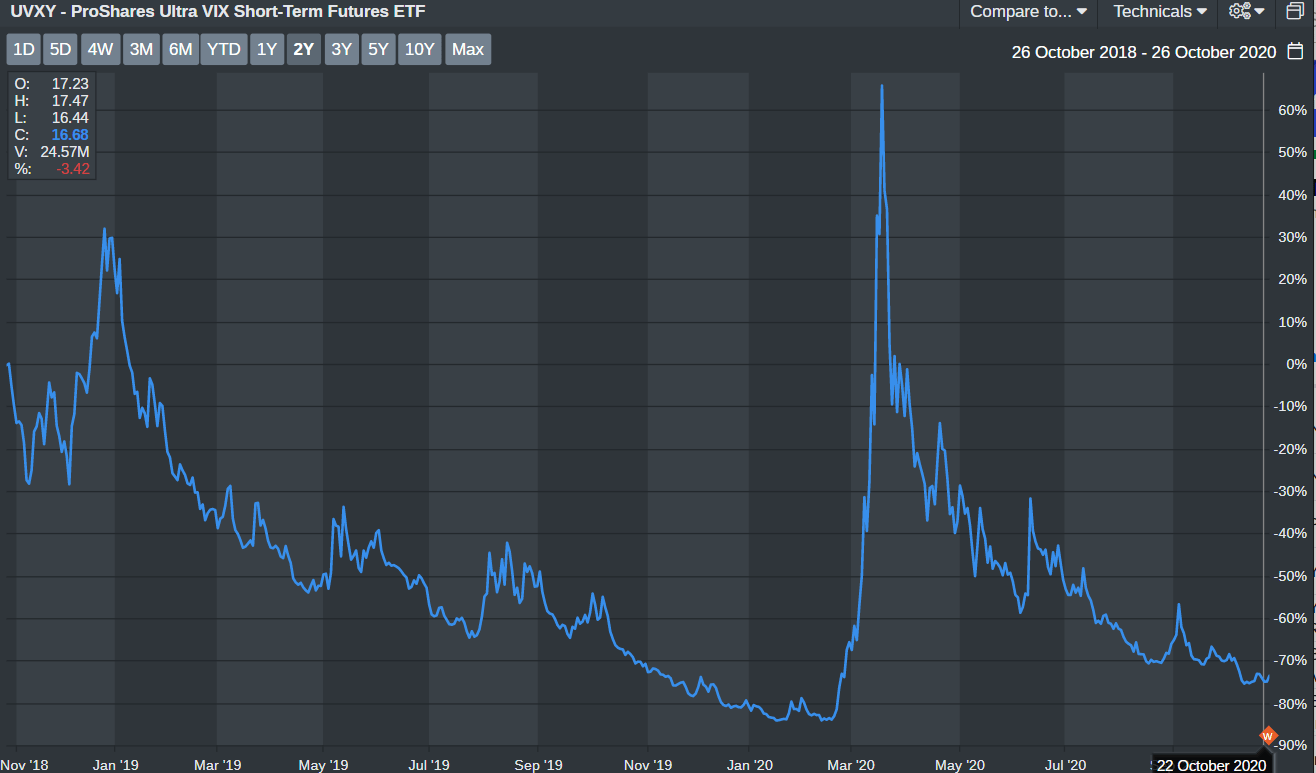

But if complex options trading isn’t your thing, you could buy the ProShares Ultra VIX Short-Term Futures ETF (UVXY). This is an exchange-traded fund (ETF) which owns options on the VIX. The value of your shares rises and falls with the price of those options. Here’s how it has performed over the last year:

UVXY has an expense ratio of 1.65%, which is on the high side.

But like buying inverse ETFs, which go up when its linked index goes down, you should only do this for short periods — like the end of March. That makes the higher fees worth it.

No. 4 — Relax … but Stay Smart and Tough.

I know it sounds corny, but even in the worst times, “this too shall pass.”

As a scholar of military history, I’m constantly amazed at the steadiness of well-trained troops or sailors under pressure. The lesson is that even when faced with vastly superior forces, sticking with your plan and trusting yourself is the key to eventual victory.

So it is with investing … no matter what comes, stay smart and tough!

Kind Regards,

Editor, The Bauman Letter