For as much as innovation constantly changes the markets and our lives, inventions that change the world don’t happen often.

In our lifetime, we might be able to witness a few life-changing inventions — from just a spark of an idea to mass adoption.

Here are just a few of the most influential ones:

- The internal combustion engine.

- The telephone.

- The light bulb.

- Penicillin.

- The internet.

- Home computers.

Just a couple hundred years ago, all of these technologies didn’t exist. Imagine investing in the companies that made them, right from the start?

What a windfall that would have been!

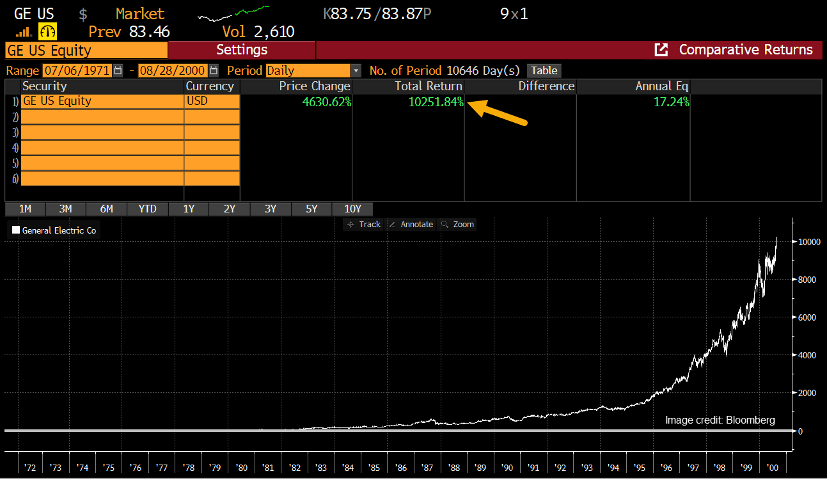

Take General Electric Company (NYSE: GE), for example.

In 1892, a merger of Thomas Edison’s Edison General Electric Company and Thomson-Houston Electric Company formed GE.

GE’s inventions include the first X-ray machine, the electric locomotive, the first voice radio broadcast and electric home appliances. All were life-changing innovations during the Third Industrial Revolution (1971) through its peak in the early 2000s.

An investment in a revolutionary company like GE during that time would have gained a total return of as much as 102,215% on a stock split-adjusted basis.

As GE aptly puts it:

No other American company can claim a heritage of innovation as deep and broad as GE.

From Thomas Alva Edison’s first incandescent light bulb to the latest jet engine brimming with internet-connected sensors and 3D-printed parts, GE has pioneered technologies that have spurred world-transforming changes and improved the lives of billions.

Our current market is offering us a similar opportunity. My colleague Ian King and I see the clean energy sector (or new energy) as the top market to invest in through 2025.

This means we’re within a three-year window to get in on the ground floor of potentially massive windfall profits.

And there are three life-changing inventions that represent the best of the clean energy market:

- Electric vehicles (EVs).

- Lithium refining.

- Battery charging.

Ian talked about them in our latest Strategic Fortunes service update (where he hand-picks growth stocks to invest in). He believes that in the next couple of years, you are going to see revenues for these markets ramp up.

So let’s talk about each of these markets, and three of the best stocks you can buy in clean energy.

3 Stocks to Buy in Clean Energy

Clean energy is a great market to invest in 2022. Not only because it’s a booming market, but because it’s an ethical investment choice.

Companies that are making impactful innovations in clean energy are ultimately trying to preserve the environment. They’re utilizing renewable resources to power our cars, phones and power grids. And they’re finding new and better ways to do it.

Now we’re focusing on the EV, lithium-refining and battery-charging industries. Each is beginning its potential three-year rise.

Here is a great stock pick for each one.

-

General Motors: Tesla’s Main Opponent in the Electric Vehicle Market

For the rising EV market, considering buying shares in General Motors (NYSE: GM). General Motors is a worthy competitor with Tesla in the EV space.

GM is investing in forward-thinking technologies that focus on zero-emission EV batteries. And it anticipates producing 1 million EVs by 2025.

One Wedbush analyst sees GM’s EV market growth as a “transformation opportunity” over the coming years.

In fact, they estimate that GM could “ultimately convert 20% of its massive customer base to EVs by 2026 and north of 50% by 2030.”

-

Livent: A Great Clean Energy Pick for Lithium Refining

For lithium refining, consider buying shares in Livent (NYSE: LTHM). With the rollout of EVs gaining serious momentum, Livent stands to gain major profits.

Livent produces the lithium compounds used in:

- EVs.

- Polymers.

- Lithium alloys.

- High-performance lubricants.

- And much more.

The company’s strategy focuses on high-growth opportunities in EVs and the broader battery markets, while also maintaining market share in other areas.

It’s a potential win-win in the clean energy market!

-

ChargePoint Holdings: The Biggest Battery-Charging Company in North America

For the battery-charging market, consider scooping up shares in ChargePoint Holdings (NYSE: CHPT).

Founded in 2007, the company’s mission is to offer the best EV charging solutions in electric mobility.

Today, ChargePoint is the largest public charging network in North America. It offers a fully integrated charging solution with hardware, software and servicing.

Want Even More Great Stocks to Buy in Clean Energy?

These three stocks are well-positioned for growth as the clean energy craze gains even more momentum.

If you want to learn more about General Motors, Livent and ChargePoint, you can check out Ian’s Strategic Fortunes service. There you’ll get access to all of his research on these companies.

Also, with this subscription, you’ll get access to his exclusive four-step system for finding “tipping-point trends.” These are market trends that are set to trigger a revolution in a specific industry, like clean energy.

With his system, Ian finds companies that are not only creating these trends, but are also enabling a host of new technologies, such as:

- Electric vehicles.

- 5G technology.

- Blockchain.

- Virtual reality.

- Augmented reality.

- Autonomous vehicles.

- Quantum computing.

And investing in the right company in the right trend could deliver you a triple- or quadruple-digit windfall.

Until next time,

Director of Investment Research, Strategic Fortunes

Disclaimer: We will not track any stocks in Winning Investor Daily. We are just sharing our opinions, not advice. If you want access to the stocks in our model portfolio with tracking, updates and buy/sell guidance, please check out Strategic Fortunes.