Article Highlights:

- At the end of 2018, I suggested being greedy when others were alarmed.

- One of the stocks I recommended then is already up 96%.

- In today’s article, I have three new names for you to invest in.

Did I make you richer?

At the end of last year, you may have read my essay “How to be Greedy — and Smart — in 2019.”

At least, I hope you did.

Since that essay, one of the stocks I recommended has almost doubled!

The last quarter of 2018 was challenging. People had seen their portfolios fall for so many weeks in a row that they had come to doubt stocks.

But now the narrative has changed. Six months later, we’re in the opposite situation.

This past weekend, President Donald Trump and Chinese President Xi Jinping agreed not to levy tariffs on each other … for the moment.

The market loved the news. On Monday, the S&P 500 Index opened more than 1% higher.

It’s up 8% since it bottomed on June 3. That’s just one month.

But will it continue? And how should you make the second half of 2019 profitable? Keep reading to find out…

A Solid 6 Months

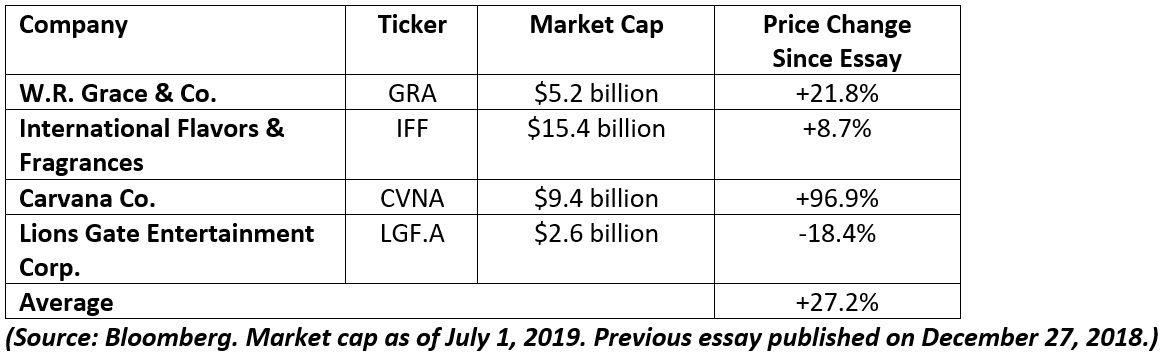

As I mentioned, at the end of 2018, I suggested being greedy when others were alarmed. And I recommended four stocks to take advantage of the fear.

It’s been a solid six months. Here’s how they did since then:

The S&P 500 is up 19% since the essay, so our collection of stocks outgained it.

History tells us it’s unlikely we’ll see this strength continue, though. Since 1988, the S&P 500 has only returned more than 18% in a six-month period five times (from January to June, or July to December).

The fifth was the first half of this year. The other four times, the market has generated a 6% total return in the next six months.

That’s OK. It’s just not stellar.

A Sector That Should Outperform

The last two times the market returned more than 18%, real estate stocks performed the best over the next six months. (The previous two times, the real estate sector of the S&P 500 didn’t even exist.)

So, we’re going back to that sector to outperform in the second half of this year.

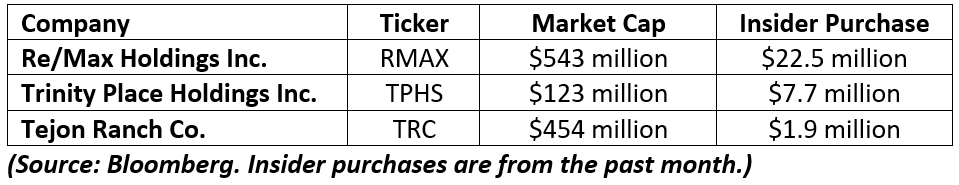

And like we did last time, we’re going with the stocks that have had the most insider buying of late.

Here are the recommended names:

Each of these stocks has had some struggles of late. The insiders who are reaching into their own pockets to buy shares see serious upside here.

In addition to the insider buying, this sector is also seeing the lowest mortgage rates since the end of 2017. That helps buyers buy and owners refinance.

Re/Max

Many of you are likely familiar with the name Re/Max Holdings Inc. (NYSE: RMAX). I see its “home for sale” signs often.

The company sells residential and commercial real estate around the world. It has more than 125,000 agents in at least 110 countries.

When this stock went public in October 2013, nine insiders bought shares on the open market at $22. They spent more than $1.1 million.

Over the next four years, those shares tripled! And that doesn’t count the additional 15% they received in dividends over that stretch.

Today, shares are less than $10 above those 2013 lows. And insiders are at it again.

Three of them — including co-founders David and Gail Liniger — bought $22 million of shares on eight trading days in June.

Re/Max’s revenue and free cash flow are growing. We want to take advantage of this recent sell-off before the market remembers this stock will benefit from today’s lower rates.

Trinity Place

Trinity Place Holdings Inc. (NYSE: TPHS) is the smallest stock on the list, but it owns and is developing property in the real estate mecca of the U.S.: Manhattan, New York City.

The jewel is 77 Greenwich Street. This new 500-foot tower is being built next to the famous Trinity Church, and is within a block of the New York Stock Exchange. Prices for a one-bedroom condo start at $1.78 million.

Alexander Hamilton is buried near there. If you’re ever in the neighborhood, I encourage you to visit his white marble pyramid grave in the cemetery next to the church.

Trinity Place expects to complete the 300,000-square-foot building by 2020. And units are already selling fast.

The company also owns two buildings in Brooklyn, a seven-acre property in Paramus, New Jersey, and a leased property in West Palm Beach, Florida. Walmart anchors the 12-acre Florida parcel.

The company estimates the net asset value of its shares is more than $9. That would be great, but it’s OK even if it’s less. Today’s sub-$4 price makes buying here a no-brainer.

Tejon Ranch

Tejon Ranch Co. (NYSE: TRC) is one of the largest private landowners in California.

Its major asset, Tejon Ranch, was established in 1843 as a Mexican land grant. Today, the 270,000-acre property sits just off Interstate 5, about 60 miles north of Los Angeles.

It generates cash flow from operations there, including its Tejon Ranch Commerce Center. This center includes distribution centers for major companies, as well as retail shopping and outlets.

Tejon Ranch is also in the process of permitting three residential communities. Together, they will host 35,000 homes and more than 15 million square feet of commercial space.

Shares have fallen recently because it’s working through a legal challenge associated with one of these communities.

Management is confident this will go forward, though. It has methodically planned these communities with environmental groups such as the Sierra Club, Audubon California and others.

And they’re only 10% of the 270,000-acre property. Keeping a small footprint will maintain the natural beauty of the area while delivering returns to shareholders.

The temporary lull is offering us a solid opportunity to buy shares below $18 each.

Conclusion

If you followed my recommendations for the first half of the year, you beat the market.

Monitoring what insiders are doing is a great way to see what the “smart money” thinks about a given name.

History suggests returns may not be quite as strong in the second half. But we can still earn solid profits by following the smart money.

Jeff Yastine and I rely on this lucrative source of intelligence in our Insider Profit Trader service.

The smart money is always investing in stocks and sectors that generate outsized returns. I encourage you to do so as well.

And I hope you all have a happy and rewarding second half of the year.

Good investing,

Brian Christopher

Editor, Insider Profit Trader