My mom once told me that no matter what happens, find a way to take something positive from it.

I’ll admit, I wasn’t mature enough to understand what she meant at the time. In fact, I thought she was talking crazy…

I had just fallen off my bike, and my knee was bleeding like a bony fountain.

What on God’s green Earth could be positive about this experience?

Today — decades later, and my wonderful mom no longer here to pick me up when I do something stupid — I get it.

And her lesson is still applicable.

My portfolio is worth less than it was just one month ago.

But you know what? I’m smarter for it. I’m more experienced.

And I now get the benefit of sifting through the stock market carnage.

This is a good thing. You see … the carnage is full of bargains.

That said, we still need to be safe.

Here’s how we can find cheap, safe names in the stock market bargain bin…

Step No. 1: Be Safe

First, though this market already fell about 30% from its February peak to March 18, we still have to be careful.

My first requirement is I don’t want a company at risk of going bankrupt. So I looked for companies with no debt.

Outside of a lawsuit, “the man” can’t pull a company into bankruptcy if the company doesn’t owe him any money.

I’m also looking for safer companies.

In general, bigger is safer. Bigger companies have more resources to work through issues.

In addition, I’m looking for a disciplined management team that generates cash.

This may sound simple. But one way to find a firm that knows how to plan for the future is to start with those that pay a dividend.

A dividend-paying firm has to squirrel away money to pay its investors each quarter … no matter what.

To ensure the company can do so, I also looked for names with positive free cash flow.

Finally, I screened for companies with a market cap of $1 billion or greater as of the market peak on February 19.

You may not believe this, but those simple metrics reduced my universe of stocks to eight.

The Winners Are…

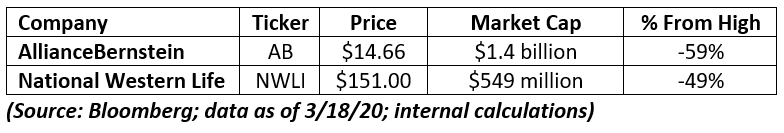

After I reviewed all of them, I chose two to present to you:

If these firms return to their 52-week highs, their prices will rise 122% on average.

AB Is Downright Cheap

AllianceBernstein Holding (NYSE: AB) may be the most familiar to you. It manages money.

The stock has sold off. Today, it’s downright cheap.

Its price-to-earnings ratio is less than 6. It hasn’t been this low since the heart of the financial crisis in 2009.

The other thing about AB is it’s a master limited partnership, or MLP.

It pays most of its earnings each quarter in the form of distributions. Based on what it paid out over the last 12 months, it’s yielding 17.3%.

(To be clear, MLPs are a bit more complex. I recommend speaking to a tax professional or researching them before you invest if you aren’t familiar.)

Investors Forgot About NWLI … Until Now

National Western Life Group Inc. (Nasdaq: NWLI) sells life insurance. And it’s super profitable.

National’s stock is $151 per share. But the company has $70 in cash per share.

And people aren’t paying attention.

You see, from 2016 to 2018, National’s revenue drifted downward a bit each year. Investors forgot about the name.

But 2019 brought a snapback.

National’s deal to buy its peer stoked its traditional life insurance premiums. And sales increased by 11%.

Today, the company trades for less than two times free cash flow. Its value hasn’t been this low since 2012.

And shares nearly doubled from the middle of that year to the end of 2014.

We’re in a Better Place Now

Now, we can’t guarantee the worst is over with stock prices. There are still a lot of dangers lurking.

But we’re actually in a better place than we were before.

Pretend you just woke up from a nap that started at the beginning of the year. You basically hibernated.

You should be happy to get to buy into a market that’s much cheaper than when you went to sleep.

That’s what we’re doing today.

Like my mom said, there’s a positive that comes out of every situation.

It’s our job to take advantage of it.

Good investing,

Editor, Profit Line

P.S. The stock market averages about 8% to 10% per year. But my colleague Michael Carr’s One Trade strategy made 30 times that much in one day. And considering you place the same trade on the same ticker symbol every time … it’s easy enough that anyone can do it. So click here now to watch Michael’s special presentation on how One Trade works.