Are you a coffee drinker?

I love coffee. I drink two cups every day. And I’m sure some of you reading this drink more than that.

That’s why I was shocked when I read the latest inflation news…

Arabica coffee beans are up to $2.52 a pound now on the global markets.

But they were only $1.24 a pound in February 2021.

That’s an increase of over 100% in just one year!

Severe drought and frost in Brazil — the world’s No. 1 coffee exporter — are partly to blame.

But inflation and other factors are driving up prices everywhere you look.

Data from Bloomberg shows that compared to a year ago:

- Natural gas prices are up 47%.

- It’s 38% more expensive to fill up your gas tank.

- Used cars cost 36% more.

In times of high inflation, many investors like to turn to precious metals such as gold and silver.

After all, they’re supposed to be the ultimate hedge against inflation.

But that would be a huge mistake.

Here’s why…

Smart Investors Are Ditching Precious Metals

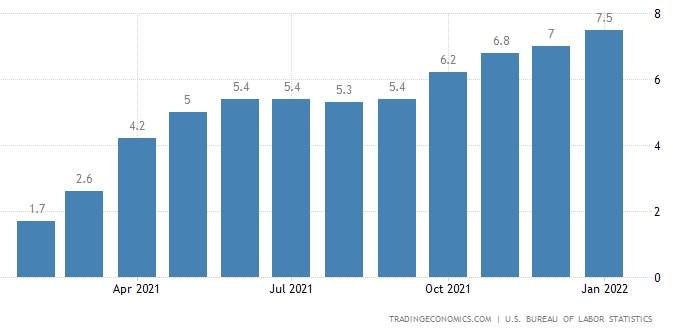

Inflation has been over 4%, on a year-over-year basis, since April 2021.

And the latest data from the Bureau of Labor Statistics has it at 7.5% — the highest reading in 40 years.

Inflation Since January 2021

That must be good for gold and silver, right?

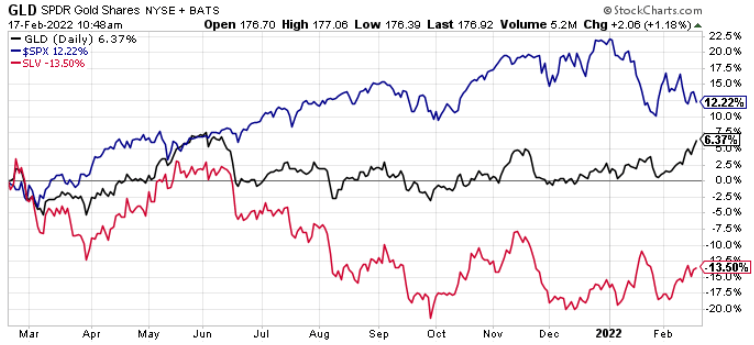

Actually, precious metals have struggled.

The SPDR Gold Trust (NYSE: GLD), which tracks the price of gold, is only up 6.4% in the past year.

That’s lower than the pace of inflation.

And silver has done even worse.

The iShares Silver Trust (NYSE: SLV) is down 13.5%.

Meanwhile, the S&P 500 Index gained double-digits over the same time frame.

And that doesn’t include dividends. (The S&P 500 currently yields about 1.3%.)

S&P 500 (Blue) vs. Gold (Black) vs. Silver (Red)

There are several key reasons gold and silver aren’t as appealing as they used to be:

- Mega-cap tech stocks such as Amazon, Apple and Microsoft are reporting record-high revenue. Investors see them as safe bets even in the face of inflation and other worries.

- Housing prices grew at their fastest pace in history in 2021. Institutions and individual investors are both putting their extra cash into real estate rather than buying gold and silver.

- Cryptos are like “digital gold.” While they’ve been volatile, the global crypto market cap is still nearly $2 trillion.

In today’s economy, investors need to be ready to adapt.

That includes ditching precious metals for higher-growth assets.

There’s a Better Way to Profit During Inflation

Coffee and other household goods aren’t the only commodities going up in price.

Metals for electric vehicles (EVs) and other tech trends have skyrocketed in cost.

For example, the price of lithium, which is used in lithium-ion batteries, is up over 300% in the past year.

And the materials needed to build motors for EVs are in higher demand than ever.

We’ve seen that EV makers are willing to pay almost anything for these materials.

One of them is so rare that there’s only one company in the entire Western Hemisphere that supplies it on a large scale.

Ian King believes this company’s stock has “tremendous upside potential.”

He goes into more detail in his new presentation. You should check it out today.

Regards,

Assistant Managing Editor, Banyan Hill Publishing

Morning Movers

From open till noon Eastern time.

Inspirato Inc. (Nasdaq: ISPO) is a subscription-based luxury travel company that is up an incredible 215% this morning. There is no specific news driving the move; rather, it is trading on continued excitement around the stock since it went public via a SPAC deal on Monday.

Global-E Online Ltd. (Nasdaq: GLBE) provides a platform to enable and accelerate direct-to-consumer cross-border e-commerce. The stock rose 19% after the company reported on the strongest quarter in company history and provided an outlook for 70% sales growth in 2022.

Ibex Ltd. (Nasdaq: IBEX) is a global provider of business process outsourcing and end-to-end customer engagement technology solutions. It is up 18% after analysts at Piper Sandler raised the price target on the stock following strong top-line growth and forecasts in the second quarter.

ACV Auctions Inc. (Nasdaq: ACVA) operates a digital marketplace that connects buyers and sellers for the online auction of wholesale vehicles. It is up 15% after its fourth-quarter earnings report showed rapid growth in the business despite the challenges facing the automotive industry.

Rhythm Pharmaceuticals Inc. (Nasdaq: RYTM) develops and commercializes therapeutics for the treatment of rare genetic diseases of obesity. The stock is up 15% on positive interim data from a long-term study evaluating its drug candidate Setmelanotide in patients with Bardet-Biedl Syndrome.

U.S. Xpress Enterprises Inc. (NYSE: USX) is a trucking and logistics company that is up 15% today. The move came after the company released its economic forecasts for the logistics industry, highlighting how it would affect business.

Outset Medical Inc. (Nasdaq: OM) is a medical technology company that develops hemodialysis systems. It is up 13% despite missing earnings in the fourth quarter because it delivered strong revenues and provided upbeat guidance for 2022.

Visteon Corp. (Nasdaq: VC) engineers, designs and manufactures automotive electronics and connected car solutions for vehicle manufacturers. The stock is up 13% after it managed to deliver strong results for the fourth quarter despite its top customers scaling back auto production.

Fiverr International Ltd. (NYSE: FVRR) operates an online marketplace for freelance services. It is up 12% after the company reported fourth-quarter results with both a top- and bottom-line beat, and with a better-than-expected outlook for 2022.

Star Bulk Carriers Corp. (Nasdaq: SBLK) is a shipping company that engages in the ocean transportation of dry bulk cargoes worldwide. The stock is up 12% after the company managed to beat both revenue and earnings estimates for the fourth quarter thanks to favorable market conditions for shippers.