Europeans were ready to celebrate in 1815. Napoleon was defeated and in exile. The continent was finally at peace after 12 years of the Napoleonic Wars.

The British were especially excited. Their second war with America, the War of 1812, was also over. The textile industry was booming.

But by the end of the year, both Europe and the U.K. were in an economic depression.

This downturn isn’t a surprise to economic historians. Economic troubles often follow wars.

At least since the time of Napoleon, wars are massive effort. Troops in the field need weapons, ammunition, uniforms, meals and other supplies. These demands often lead to economic booms in countries at war.

Militaries demobilize when wars end. Troops are discharged and returned home. This increases the size of the civilian workforce at exactly the wrong time.

With the war over, orders for new supplies are canceled. This slows the economy. At the same time, returning troops need new clothes and items to restart their lives. There are now new consumers competing for the limited supply of goods that a contracting economy is producing … and the limited number of jobs.

This pattern occurred a century later, at the end of World War I. Recessions and inflation also followed World War II, the Korean War and the Vietnam War.

You may not realize it, but the United States is in a post-war economy right now. And as we continue to unwind, it threatens another economic downturn that will only be apparent in hindsight.

Wartime Spending for COVID-19

The coronavirus unleashed a pandemic in 2020. Governments responded as if they were at war.

Resources were marshaled against the enemy. Spending soared as governments bought supplies. As a percentage of gross domestic product, COVID spending rivaled the efforts of global wars.

In the old days, policymakers understood that war demobilization would disrupt the economy. They took steps to avoid that disruption.

As World War II was drawing to an end, the U.S. developed the GI Bill. This offered educational opportunities to returning veterans. That helped keep the workforce from swelling.

VA loans were also offered to help veterans buy homes. This led to a construction boom, creating jobs in homebuilding to absorb workers no longer needed in factories. Wartime economic policies were gradually lifted to ease the transition to the peacetime economy.

But policymakers haven’t been following this kind of approach in the past few years. As the COVID-19 crisis eased, they resisted change. They kept spending at wartime levels. The Federal Reserve kept interest rates at 5,000-year lows.

All this doesn’t come without consequences…

Bracing for the Economic Downturn

Today, we’re paying the price for those policies. Inflation is easing but remains high. Businesses are struggling to profit as costs rise and price hikes reduce sales.

Consumers are also struggling. Wages aren’t keeping up with inflation. Consumers are turning to debt to keep up with expenses. Simultaneously, companies are downsizing their workforces as the pandemic restrictions have eased and more workers are available.

As consumer stress rises, delinquent loans will rise. That adds pressure to the banking system that is already under stress because interest rates are no longer at 5,000-year lows.

History can help us understand the magnitude of the problems we face. We don’t know how long the economic pain will last, but the pattern indicates it’ll certainly make an impact.

That post-Napoleonic depression lasted for years. It contributed to the panic of 1819 in the U.S. The country’s economy needed two years to recover from that.

The recession after the Civil War lasted 32 months. Two recessions followed World War I. The economy finally recovered three years after the end of that war.

World War II led to an eight-month recession. The Korean War recession lasted 10 months. A 16-month recession followed the Vietnam War.

The post-covid recession hasn’t officially started yet. The effects will certainly last into 2024. Now is the time to prepare for a downturn that is increasingly inevitable.

At a minimum, you need to define where you will sell. Many investors saw the economy slowing in 2019 and decided there was nothing to worry about. Some got lucky when stocks quickly recovered from the pandemic bear market.

But there’s no reason to expect a rapid recovery this time and hoping for one won’t reduce bear market losses.

There is no “one size fits all” plan for the upcoming bear market. It will depend on the strategy you use and your personal level of risk tolerance.

You might want to increase cash holdings … or add gold as a hedge. You may want to sell based on the worst-case losses you are willing to bear, or use a trailing-stop strategy to exit positions with gains.

The important thing is to plan now. Because all the signs I’m seeing point to a prominent downturn still to come.

Regards, Michael CarrEditor, One Trade

Michael CarrEditor, One Trade

Americans Are “Slumming It”

In finance, sometimes the real kernels of truth are in between the data.

Consider the fast food chain Wendy’s. On the first quarter earnings call, CEO Todd Penegor made the offhand comment that Wendy’s was “seeing nice growth with the over $75,000 [in income] cohort.”

Now, I think it’s safe to assume that the Wendy’s menu hasn’t upgraded to wagyu beef. It’s the same mediocre hamburger it’s always been.

If they’re seeing more sales from professionals earning $75,000 or more per year, it’s because that demographic is cutting back on expenses.

We saw a similar story coming out of Walmart. Earlier this year, the low-cost retailer commented that about half of its improvement in market share was due to higher-income Americans slumming it.

Okay, so maybe he didn’t actually use the words “slumming it,” but you get the idea.

When you see higher-income shoppers trading down, that’s not typically a sign of a healthy economy. Inflation has taken a bite out of purchasing power, and it’s showing.

There may be at least a little relief on that front. April Consumer Price Index inflation grew at an annualized rate of 4.9% — its lowest increase in two years.

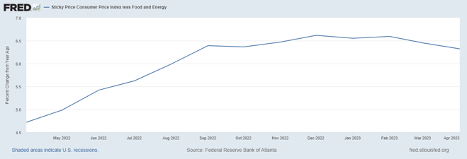

“Sticky” inflation, or inflation in goods and services that tend to be slow to raise prices, has been slower to retreat. But it’s trending ever so slightly lower. We’ll call that a win.

The inflation rate is still a long way from the Federal Reserve’s target of 2% though. And that’s not something that Fed rate hikes alone can fix.

You get inflation from two major sources:

- There’s too much demand, which is outstripping the economy’s ability to supply.

- There’s a disruption to supply.

At the moment, we have a little of both.

However, the Fed’s rate hikes (and inflation itself!) have done a decent job of dampening demand — at least for things that generally require credit.

And if we get a recession in the coming quarters (which I do expect will come), that will further help to reduce demand.

It’s the “supply” part that takes longer to solve.

Because we’re not just talking about backed-up supply chains, which have mostly been fixed at this point. We’re also talking about a reversal of 40 years of globalization.

China exported deflation to the rest of the world via its cheap labor and manufacturing. The reversal of that trend (a term we call “deglobalization”) is a major driver of inflation.

The good news is: The investments being made today in automation and artificial intelligence are poised to boost productivity to levels last seen in the 1990s … and according to the projected data, much higher.

If you want to take advantage of this tech trend that’s taken the world by storm, check out Ian King’s latest research in microchip stocks.

This is the technology that’s driving AI and automation software. And in Ian’s free webinar, he explains how chip manufacturing itself is projected to reach a $1 trillion value by 2030. Just go here for all the details.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge