U.S. investors have had plenty to grapple with on the home front this year…

Inflation … recession fears … and a banking crisis, to name a few.

So I wouldn’t blame anyone for missing a few key developments involving the U.S. dollar … and its coveted status as the world’s reserve currency.

Within just the last six months:

- The UAE began early talks with India to trade non-oil commodities in Indian rupees.

- China also expressed a desire to move away the dollar for local commodities trade.

- Brazil and Argentina are, in their presidents’ words, “advancing discussion on a common South American currency” called the sur.

- Russia and Iran made headway on their gold-backed stablecoin (a cryptocurrency pegged to and backed by a reserve asset) as an alternative to the dollar.

- French President Emmanuel Macron wants Europe to reduce its dependency on the U.S. and avoid any involvement in a U.S. — China conflict over Taiwan. He also floated the idea of Europe becoming a “third superpower” on the world stage.

Taken alone, each event seems like a one-off effort which won’t immediately impact much … and may not even get off the ground.

But taken together … it becomes clear foreign powers are trying to wean off their reliance on the U.S. And just as importantly, the U.S. dollar.

It seems impossible to imagine a world that doesn’t revolve around the dollar. The U.S. is deeply entrenched in the world economy. Unless you’re over 100 years old, the dollar has been the world reserve currency for your entire life.

And to be clear, I see no immediate threat to its importance — especially when considering the might of our military.

But over the long arc of history, currency regime changes have happened, plenty of times.

Most recently in the 1920s, when the dollar began to overtake the British pound sterling to become the world reserve currency.

Before that, it was the Dutch guilder giving way to the pound … and before that, the Spanish dollar.

Going back further, we find the Venetian ducat, the French franc and the Roman denarii all taking turns as the currency standard of the world.

History shows currency regime changes happen. So why should anyone feel confident it won’t happen again?

I don’t. The only question is when.

Whether this happens next year (highly unlikely) or a decade from now (somewhat more likely, but still no sure bet)…

Right now, amid an obvious de-dollarization push outside the U.S., it’s as good a time as any to have a closer look at the new bull market taking shape in gold…

The Shiny Yellow Metal

“De-dollarization” is complex. But its effect on gold is very simple … and bullish.

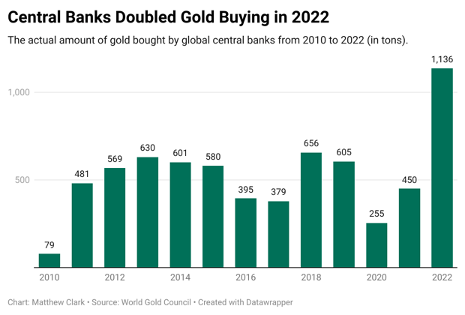

The world’s central banks bought up gold at a record pace last year, adding 1,136 tons of the shiny yellow metal, worth $70 billion, to their stockpiles. This is the most gold they’ve hoarded in over a decade — and by a huge margin.

They’re buying gold because it’s arguably the oldest and most-trusted store of value still relevant today, and it’s outside the current fiat currency system. It isn’t subject to the whims of one government entity — like, say, Treasury bonds are.

But what’s most interesting is that 65% of last year’s gold bullion purchases — 741 tons — went unreported. Analysts believe that China and Russia account for these unreported gold purchases, as they look to de-dollarize their global trade activities and circumvent Western sanctions.

See, massive gold reserves at the world’s largest central banks (outside the U.S.) are key to executing global trade without the dollar.

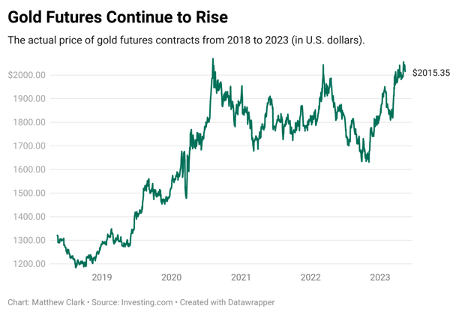

And naturally, driven by the surge of central bank demand, the price of gold has moved higher.

Since last November, the yellow metal is up more than 20% … and has even made a new all-time high.

Besides foreign central banks buying up gold — while selling dollars and U.S. Treasurys to fund them — there are a number of other factors pointing to a weakening dollar ahead…

Pandemic “Helicopter Money”

The pandemic sparked a massive money-printing event. Fiat currency supplies skyrocketed and led to the highest levels of inflation we’ve seen in 40 years.

Add onto that a massive debt-to-GDP ratio, growing government deficits, and a debt ceiling impasse, and it’s clear the dollar’s facing numerous headwinds.

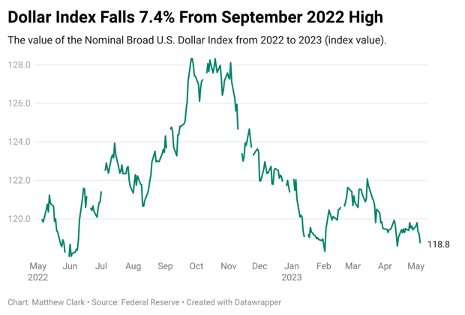

You can see the early innings of this trend in the U.S. Dollar Index. The buck topped out late last year and is already 10% off its highs:

The weakening dollar has helped boost the price of gold. But it’s not the only factor.

Gold is also making new highs when priced in yen and euros, so the new bull market in gold isn’t merely a “weak-dollar” phenomenon.

If the world’s central banks are buying up gold to attempt to diversify away from the U.S. dollar, there’s nothing the U.S. government can do to stop them. But as investors…

We can take part in the new gold bull market which, at this point, is strong enough to proceed even if the U.S. dollar reserve currency regime lasts many decades more.

And you have so many good options to do so…

A Buffet of Gold Plays

An investor today has no shortage of ways to play the gold bull market, and at multiple risk levels…

- Physical bullion. Hard to argue against hold-in-your-hand gold as the lowest-risk trade of all. It’s the most direct way to protect your wealth from inflation, hands down. (If you’re looking for a great place to buy, our friends at the Hard Assets Alliance have you covered here.)

- Gold mining stocks and ETFs. Mining stocks are often called “leveraged gold” trades, for their volatility both to the upside and downside to the gold price.For individual companies, Canada-based B2Gold (BTG) rates a Strong Bullish 96 on the Green Zone Power Ratings system. That’s a good place to start your search. For ETFs, the VanEck Gold Miners ETF (GDX) covers you on the majors, and VanEck Junior Gold Miners ETF (GDXJ) holds smaller companies … offering a slight bit more of that natural leverage.

- “Curveball” gold plays. There are a few companies out there that don’t meet the description of a traditional miner, but are still great players in the gold business.

Royalty and streaming companies, for example own mine assets and take a cut of miner’s profits — avoiding the “dirty work” altogether.

“Slug water” processors are another unusual play — they basically pan for gold in the waste runoff from larger mining operations.

I recently recommended two such plays to my Green Zone Fortunes and 10X Stocks subscribers, respectively. I think there’s a lot of money to be made in each — and, because of the stocks we selected, a lot less risk than many traditional miners.

Now listen, I’m not saying you should go all-in on gold right now. De-dollarization will take years … likely more than a decade to play out.

But the data clearly suggests that gold deserves a bigger place in your portfolio right now. And you don’t want to be caught flat-footed in what may quickly become the ultimate investment mega trend.

To good profits,

Adam O’DellEditor, 10X Stocks

Adam O’DellEditor, 10X Stocks

P.S. To get the name of that royalty and streaming company I recommended to my Green Zone Fortunes subscribers, go here to learn more about a subscription.

For the equivalent of just $4 a month, you’ll gain access to an advisory that currently holds an average open gain of 31%, with new recommendations all the time.

It’s the perfect source for high-quality investment information you can use to stay ahead. Just click here for all the details.

Inflation’s Coming for Mickey Mouse

Disney’s stock price has been in the dumps for the past two years. After topping out at just over $200 per share in early 2021, the shares are now trading in the low $90s.

Despite the news coverage, it’s not the ongoing legal spat with Florida Governor Ron DeSantis that is pushing the shares lower.

I own some shares of Disney, so I might be a little biased here. But it looks to me like Governor DeSantis brought a knife to a gunfight.

As one of the largest and most powerful corporations in America, Disney has access to the biggest, baddest, most cutthroat lawyers to ever carry a briefcase. This is a company that sued an elementary school in 2020 over an “unsanctioned screening” of The Lion King at a PTA event … and won.

Good luck beating them in court.

No, it’s not legal risk that weighs on Disney’s stock.

It’s streaming. And by extension, inflation.

In Disney’s earnings release this week, the company reported that it lost 4 million Disney+ streaming subscribers.

Now, make no mistake. Disney’s parks are still busting at the seams, its toys and merchandise are still selling and its Marvel superhero movies are still the only thing that consistently makes money in the movie theaters.

The company will weather this. Much to my chagrin, I’m sure that I will be fighting the crowds myself when my daughter is old enough to go through the “Disney princess” experience. Like college and a wedding, this is just one of those expenses you have to budget for when you have a daughter. But I digress…

Even the loss of 4 million subscribers out of a base of 161 million would be tolerable by itself. It’s just that Wall Street bet heavily on streaming being the future of media, so shrinkage rather than growth is a major problem.

But why Disney is losing subscribers?

Well, I covered this last week. It’s inflation, partnered with “payments creep.”

Wages haven’t kept pace with inflation, and the savings rate has already dwindled back to pre-COVID pandemic levels. If you’re spending an extra dollar on necessities, that means a dollar less to spend on other things.

And if you already have Netflix and five other streaming services, suddenly that Disney+ subscription looks like low-hanging fruit on the cutting table. You can always resubscribe when the kids are on summer break.

Inflation is falling. But it’s not falling fast enough, and the damage is already done. Americans are trading down — or slumming it, as I joked yesterday. And this is going to show up in earnings releases over the coming quarters.

This would seem like a good time to stay nimble, to focus on shorter-term tradable trends. And this is exactly where Adam excels.

His Green Zone Fortunes financial service is structured with his AI-based Green Zone Power Ratings system, which he created to help investors like you find the best trades.

And the best part? It takes the current economic conditions into account, so it’s a great investing tool for any market. Check it out here — and learn more about how Adam can help you in your investing goals.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge