3,787,464%…

That’s what Warren Buffett’s Berkshire Hathaway returned to shareholders.

A $10,000 investment would’ve turned into more than $370 million.

Those returns came over 58 years and it wasn’t from having alot of winning investments.

According to Buffett, it came from about a dozen “truly good decisions.”

If you do the math, that works out to about one great decision every five years.

Investing success isn’t about being right all the time or having a string of winners.

It’s about making a few decisions and being phenomenally right.

In fact, at the Berkshire Hathaway shareholder meeting last Saturday, Charlie Munger pointed that:

“More than half of all the investment returns that Ben Graham, Buffett’s mentor, made in his whole life came from one stock: GEICO.”

Just one stock!

Investing is not about having a high batting average.

And that’s a lesson I wish I had learned earlier in my life.

Less Is Best

I started on Wall Street as a floor trader when I was just 20 years old.

Since I had limited capital, I traded future contracts for very small gains or losses.

I would make roughly 50 trades a day.

And quickly realized that the more decisions I made, the higher my chances of them being wrong.

Over time, I limited my trading to only 10 trades a day — only trading when I had a high conviction. Pretty soon I was making more money than I ever did.

I was then blessed to become friends and learn from some of the greatest investors on Wall Street.

They made less than a handful of decisions a year.

One of my mentors laughed when I told him how many trades I made a day.

“Charles, you make more trading decisions than I do in two years.”

Over time I modified my approach and only traded when I had the highest conviction.

And that made all the difference in my success.

It took me several years to figure it out, but when I did, I was able to sleep better at night and make more money.

I don’t know about you, but I wouldn’t want to put any of my money in my 27th best idea.

It made all the sense in the world to put most of my money in my top two or three ideas.

Because at the end of the day, life, like investing, boils down to making a few key decisions…

Stress-Free Gains

When it comes to your portfolio, this approach can simplify your life and build your net worth.

Because you don’t have to worry about chasing the new “flavor of the month” stock…

You don’t have to be glued to your computer watching every tick of the stock market.

Or trade options, or lose sleep figuring out when to get in or out of the market…

Instead of investing in a dozen mediocre companies, it’s a whole lot more profitable and less stressful to invest in just a few great ones.

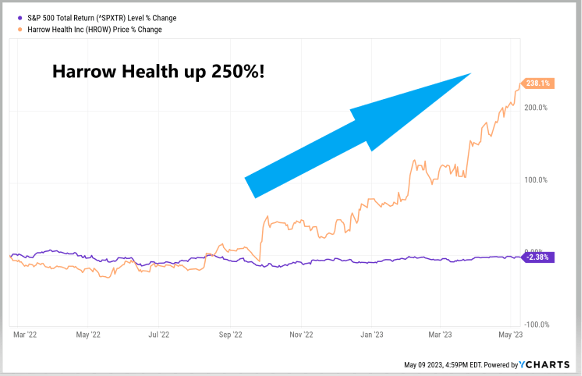

Harrow Health Inc. (Nasdaq: HROW) is a great example.

Shares more than tripled since I first recommended the stock in February of 2022.

(Click here to see how Harrow is beating the market.)

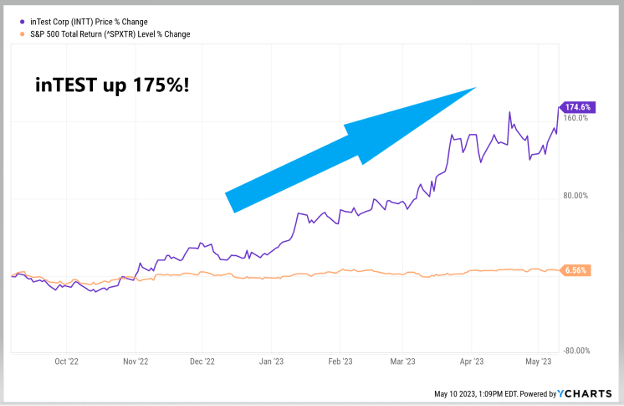

I also recommended inTEST Corp. (NYSE: INTT) last September, right before the stock soared 175%.

(Click here to see how inTEST is beating the market.)

Just by making two decisions — and nothing more — you would have made a huge return that would’ve been the envy of traders, hedge funds and Wall Street professionals.

And since September, the opportunity with stocks like these has only gotten better…

So I’ve created a detailed special report on the next three stocks you should add to your portfolio immediately — before shares start taking off …

Regards,

Founder, Alpha Investor

P.S. My father told me that just one decision — who I choose as a spouse, would determine 90% of my happiness or sadness for the foreseeable future.

I now see the wisdom of his words. My life has been filled with happiness because of who I married.

My wife and I will soon be celebrating our 37th year of marriage and it feels like we were married yesterday.

What’s the biggest decision you’ve ever made that changed your life? Let me know here at BanyanEdge@BanyanHill.com.

What’s Warren Buffett Up To?

Warren Buffett isn’t a value investor.

I know that sounds odd, given that the man is almost universally associated with value investing. And there was a time, decades ago, when he really was a pure value disciple studying at the feet of Benjamin Graham.

Sure, today Buffett still jumps at the occasional deep value opportunity when one comes along. But in the late 1970s and ‘80s, Buffett evolved away from pure value investing.

He’s even dismissively called it “cigar butt investing,” and adopted what we would call “growth at a reasonable price” (GARP for short).

In Buffett’s own words, he shifted to buying “wonderful businesses at fair prices,” as opposed to cruddy businesses at great prices.

But the key word here is “fair.” When there isn’t much to offer at good prices, he’s willing to sit on his hands and bide his time.

It seems that he’s been doing more of that these days. In fact, his company Berkshire Hathaway (NYSE: BRK.A) has been a net seller of stock.

In the first quarter, Berkshire sold $13.3 billion of its current positions and only bought $2.9 billion. (Though he did also spend $4.4 billion buying back the stock.)

Berkshire Hathaway is sitting on $130 billion in cash — its highest level in two years.

What You Have That Buffett Doesn’t

Remember, Buffett isn’t just another stock picker.

He’s also the chairman of one of America’s largest private business conglomerates, with interests as diverse as BNSF Railway, See’s Candies and even Fruit of the Loom underwear.

Buffett doesn’t have to wait for the quarterly results of his public companies (like Apple or Coca-Cola) to get an idea of what direction the economy is going. He sees it in real time, in his wholly-owned operating businesses.

In Berkshire’s annual meeting, Buffett commented: “It is a different climate than it was six months ago,” and that some of his managers “had too much inventory on order.”

It could be that Buffett sees storm clouds ahead and is positioning his portfolio defensively. Or it could simply be that he likes the yields T-bills have to offer, and is enjoying a nice 4% to 5% risk-free return.

But one thing is certain. As talented of an investor as Buffett is — arguably the greatest of all time — Buffett is massively handicapped by Berkshire Hathaway’s massive size.

This is a $700-billion company, the sixth largest in the S&P 500 and the largest nontechnology company. Buffett can’t dabble in small or microcap companies.

At Berkshire’s size, buying a meaningful position would mean buying the entire company. Out of practicality, Buffett is limited to only large-cap stocks.

We don’t have that problem. As individual investors, we have the flexibility to out-Buffett the man himself, because we can invest where he can’t.

In some ways, Charles Mizrahi is like our resident Buffett. He invests in solid companies, and solid leadership above all else.

Like he mentioned, his latest research reveals three great opportunities. And according to Charles, the time is right now.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge