Cash is finally dead.

It was well on its way before the pandemic. But once that hit … well, you know what happened.

Cash businesses were the first places to shut down in March.

Many of them are still closed or limited — restaurants, grocery stores, laundromats and public transport.

And those that are open aren’t seeing cash anymore. That’s because the world has gone digital.

Early in the pandemic, news swirled that the virus could live on cash longer than on other surfaces. A drastic shift in payment trends took place as a result. Retailers started asking customers to use cards or mobile payments. And many customers made the jump on their own.

One survey showed that nearly two-thirds of people avoided in-person payments for the first several weeks.

But as the months have dragged on, we’re seeing a more long-term shift. It’s one that will live long past the pandemic, even with the vaccine.

And it means one sector is showing deep cracks…

Who Wins in a Cashless World?

Think about the last time you withdrew cash from the ATM.

I don’t know about you, but I haven’t done it since March.

Many people have switched to online or mobile payments at big-box stores as well as at restaurants. Forbes reports that people are “more digitally savvy than they were just six months ago.”

It’s opened up an entire new world to many.

I’m talking about things like PayPal, Google Pay and Apple Pay. These platforms store users credit cards and help them pay online — with the push of a button. We’ve talked about these kinds of stocks before. And we highlighted how PayPal’s long-term profits have been climbing since before the pandemic.

Many of these apps also allow customers to store money directly on the app, meaning they can serve as checking accounts.

Others, like PayPal, also offer credit services, cutting out banks and credit cards entirely.

This shift to online payments has been coming for a while. Emerging tech trends and expanded access to the internet have helped. But now, it’s sped up at a rapid pace. We’re seeing a more permanent move.

That means one big loser. And we want you to be ready…

Why It Matters

We’ve been talking about the two-track recovery for a while. As we said, when the COVID-19 pandemic is finally in the rearview, there’ll be winners and losers.

The winners will be the companies that were able to adapt to the shifting economy. The losers will be the ones that didn’t — places like movie theaters, airlines and brick-and-mortar retailers.

Today, we’re talking about another loser.

Banks.

As I mentioned, digital wallet apps give consumers the ability to bypass banks. And adding to banks’ problems, people are withdrawing cash reserves to cover their concerns. The Federal Reserve reports that cash holdings are up 90% this year.

But the problems aren’t only at the customer level. They’re at the business level, too.

According to World Bank: “The COVID-19 shock on banks was much more pronounced and long-lasting than on corporates.”

That’s because banks are the ones bearing the brunt of the financial issues when other businesses suffer.

Think about it. If a small store goes out of business, who’s on the other end of that small business loan? And who’s losing out when multiple landlords can’t make their payments?

Governments have stepped in to help, but most of that burden has fallen on banks as well. For example, the government help for customers to get favorable loans right now means customers are getting lower rates from the banks. That’s good for the customers, but it means that the banks are taking less income from those deals…

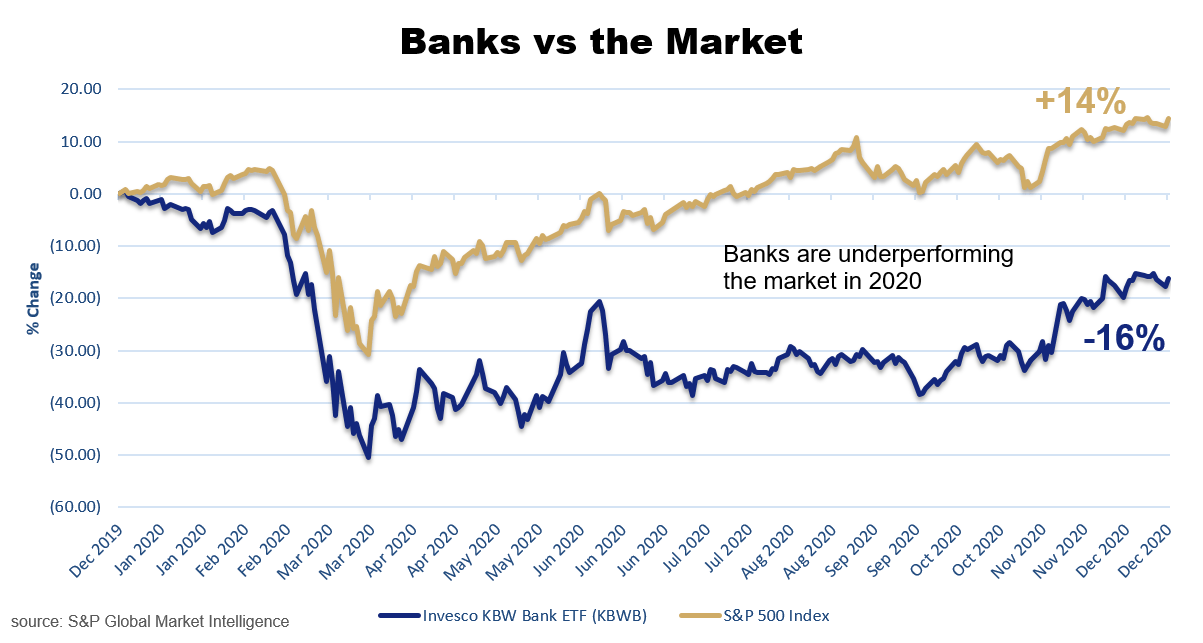

All this means that banks are underperforming the rest of the market.

And that’s set to continue.

In the meantime, digital wallet technology continues to grow. PayPal’s Venmo was the largest consumer finance application in the U.S. in 2019, and it’s had another 2 million downloads since then.

Financial research firm ARK Invest believes that these apps will probably cut even further into banks’ balance sheets as time goes on.

By 2024, ARK expects this sector to grow to $800 billion — that’s nearly 30 times its size today.

As we navigate the post-COVID-19 world, we expect digital wallets and other financial tech to continue booming.

I know that I, for one, have ordered all of my Christmas gifts online. And I used PayPal for most of them.

That’s why, at American Investor Today, we’ve positioned you to profit.

We’ve told you about the Vanguard Information Technology Index Fund (NYSE: VGT) before. It’s an exchange-trade fund that gives you a one-click way into some of our favorite companies in this sector. That’s companies like PayPal, Apple and credit card company Visa. And as we told you last week, this fund is up nearly 56% since we first showed it to you in late 2019.

If you’re looking to capitalize on the move away from banks, VGT is one of your best bets.

We hope you’ll be ready.

Regards,

Managing Editor, American Investor Today

P.S. Wall Street veteran Charles Mizrahi has had his eye on the financial sector for a while. He’s recommended three companies in finance in the past 18 months. And they’re all showing gains.

If you’re ready to dig deep and take advantage of these mega trend in the market, you need to sign up for Alpha Investor today. You can click here to get all the research from Charles and his team.