It took a decade for the gold price to break out over $1,700 per ounce. A price in this range is rare. Gold has been above $1,700 just 36 weeks out of the past decade. The last time we saw the yellow metal in this price range, it was on a historic run over $1,900 per ounce in 2011. And while we are back in record territory for gold, its cousin silver is hiding in the background.

When the gold price is over $1,700 per ounce, the average silver price was $30 per ounce. Since 1975, it has taken 60 ounces of silver to buy an ounce of gold, on average. Today, it takes 100 ounces. This year, the average silver price was $16.77 per ounce, 39% below the average. Today, the price is $17.81 per ounce.

That means the silver price needs to go up massively, just to hit the average price from the last bull market — around $50 per ounce.

We are well below that today.

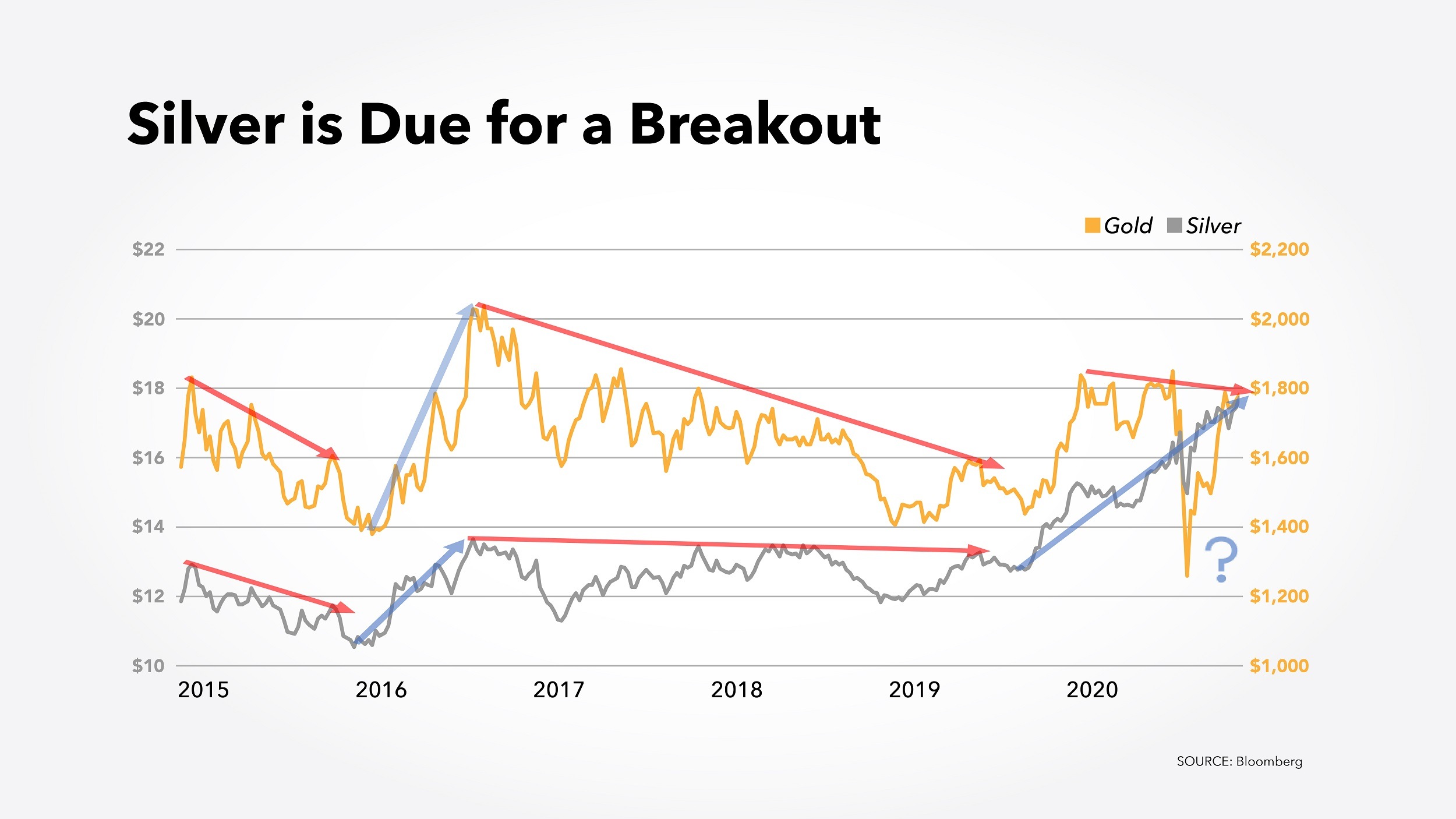

Silver hasn’t kept up with the gold price movements over the past year. You can see what I mean in chart below:

As you can see in the chart, silver and gold tracked one another well since 2015. However, since mid-2019, silver’s price has moved sideways while the gold price soared.

That’s why there is such a huge gap between the gold price and the silver price.

That ratio won’t stay out of balance for long.

So What Happens Next?

There are only two ways that ratio will get fixed: either the gold price falls or the silver price rises. And the likelihood of the gold price falling, with so much uncertainty in the market, is practically zero.

Remember, gold is historically a store of value. When there’s volatility in the market, investors flock to gold. And as my colleagues have been showing you, it’s likely that volatility will be around for a good while. And as I’ve been saying all year, I expect gold to break $1,900 before 2020 is over.

That means the silver price must go up. And when it does, it will be explosive. It will have to rise 76% to get to its historical average versus gold.

We’ve seen silver prices go parabolic in the past. From January 1978 to January 1980, the silver price rose 1,000%, from $5 to $50 per ounce. And from October 2008 to April 2011, the silver price rose over 400%.

So, there is a historical precedent for silver prices to explode higher. And that’s what I think will happen in the coming months.

There are several ways to play the rising silver price. The simplest is to buy a silver exchange-traded fund like the iShares Silver Trust (NYSE: SLV). That allows us to own silver in our retirement accounts without all the hassles of buying and selling physical silver coins or bars.

That’s direct exposure to the silver price. However, another way to play rising silver prices is through the producers.

And not all the producers are straightforward. For example, Newmont Corporation (NYSE: NEM) and Southern Copper Corp. (NYSE: SCCO) both produce enormous amounts of silver, along with their primary metals. But in a bull market for metals, like we have today, they make excellent speculations on rising gold and silver prices.

So, whether you focus on the price or the producer, put a little silver in your portfolio today. The big move is coming soon.

Good investing,

Editor, Real Wealth Strategist

P.S. We here at Winning Investor Daily have done our best to guide you through this current economic crisis. We write to you every day with our best insights and research. Our team has a combined half-century of experience in making money. But what means the most to us is you … our readers.

We want to know what matters to YOU the most. We want to know how we can make a bigger impact on helping you reach your financial dreams.

So here’s your chance to tell us how we can help YOU. We want to know what you want us to write about.