Options trading is fast-paced and exciting.

But today, we’re going to slow down and take a look back. This will help us learn the best ways to trade.

Win or lose, we can benefit from looking at past trades. Whether we stuck to our strategy or cut losses early, looking back at past trades helps us see the bigger picture.

It’s easy to see what happened with trades that run up and show signs that they are winners from the start.

The market is tough right now, but it’s important to remember that our big winners are what will help set us apart from the occasional losses. It’s how we ride out the ups and downs of the market.

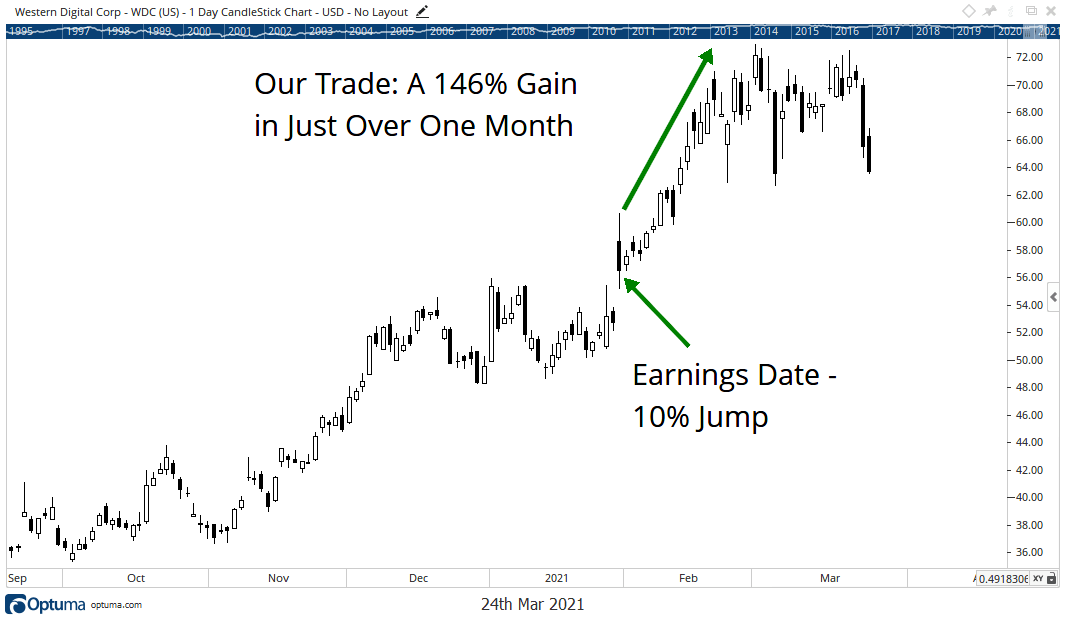

Today, we’ll break down a recent trade on Western Digital Corp. (Nasdaq: WDC). The stock was a winner for my options research service earlier this month.

The Western Digital Setup

Western Digital, an American data storage and manufacturing company, is the latest gain for my Quick Hit Profits trading research service. We exited it on March 5, 2021.

The first thing we can learn from this is what was happening with the stock before we decided to jump in.

Western Digital had gone nowhere for the last two months before the company reported earnings. Even with the sideways price movement for basically two months, the stock was up a solid 40% over the last quarter.

After a 10% jump on earnings, it was up as much as 60% over the same three-month period.

A strong rally like that would make anyone consider taking their profits and running.

But we jumped right in.

That’s because the stock hit my Profit Trigger when it topped analysts’ estimates on January 29.

Western Digital posted results that were 30% better than what analysts were looking for.

The improved results came with a wave of strong demand for storage devices and other solutions thanks to a shift in consumer spending. Laptops and tablets are moving more toward cloud storage, and Western Digital has benefited from the changes.

That news helped send the stock up more than 10% right away.

That was more than enough to hit my Profit Trigger — my buy signal. Whenever it signals, I know it’s time to jump in.

After Jumping In

See, through back testing, we know that Western Digital has hit my Profit Trigger seven times before. Five of those times, the stock headed higher over the following weeks. It only fell on two occasions. That’s a 71% win rate that we are riding into the trade.

With stock trading around $57 after earnings, we grabbed the April $57.50 call options on this stock to benefit from the expected trend higher.

Here’s what happened after we jumped in…

A 146% gain in just over a month’s time.

If we had hesitated after seeing the stock was up 60% in three months, or if we’d taken profits early, we would have missed out on the latest push higher.

When it comes to trading these short-term swings, you can’t hesitate.

You need a proven strategy to spot these mispriced stocks and jump in right away.

This one was all about earnings.

Based on my historical analysis, I knew the investment community underreacts to strong earnings reports from the company. Even though the stock jumped 10%, it wasn’t fully pricing in the good news.

That’s what helped push the stock higher over the next four weeks, allowing us to capitalize with a triple-digit gain.

And a brand-new earnings season is just getting underway, which means there will be a ton of companies hitting my Profit Trigger in the coming weeks.

We’ll use what we learned from our WDC trade to try and capitalize on these trades.

And we’ll be back next week.

Today, we looked at a winner. But next time, we’ll break down what we can learn from losses, too.

Regards,

Editor, Quick Hit Profits

P.S. If you don’t want to miss out on my next potential triple-digit gain (with my trades taking just 30-60 days on average), you can learn how to join us by watching this special presentation.