A Virginia-based software company just made a big change.

It got out of cash!

I’m not joking.

In a nondescript section of its quarterly earnings report, it said: “We will seek to invest up to another $250 million over the next 12 months in one or more alternative investments or assets, which may include … digital assets such as bitcoin or other asset types.”

The story isn’t new. This happened in August. But, thus far, few in the media have realized how big of a deal it is.

And I want to make sure you do.

Why You Should Care About a Company You May Have Never Heard Of

MicroStrategy Inc. (Nasdaq: MSTR) helps its customers use and analyze data.

That’s a critical service today. Ian King says data is the new oil.

But the company’s recent headlines aren’t about its operations. They’re about its thoughts on the dollar.

In July, it announced it was getting out of cash. Literally.

It sent half of its cash to its investors and converted the rest to bitcoin.

Yes, you read that correctly.

And if you haven’t heard about this, you need to pay attention.

Per the Federal Reserve, the purchasing power of the U.S. dollar has fallen 96% since 1913.

If that time frame seems too long to you … what if I told you the dollar lost 85% of its purchasing power over the past 50 years? And 49% over the last 30?

Are you OK that the dollar lost 16% over the past decade? And that the Fed just resumed its money printing?

Chairman Jerome Powell says the Fed will “remain committed to using our full range of tools to support the economy for as long as is needed.” (Emphasis mine.)

I assure you that doesn’t mean it will raise rates or reduce the dollars sloshing around.

So, MicroStrategy’s story is an intriguing one.

Unlike most, the company is willing to address this problem head-on.

The Volatile Solution

MicroStrategy leaders decided it was critical to put the company’s excess cash into a tangible asset that will accrete in purchasing power.

They knew history shows the dollar will lose value over time

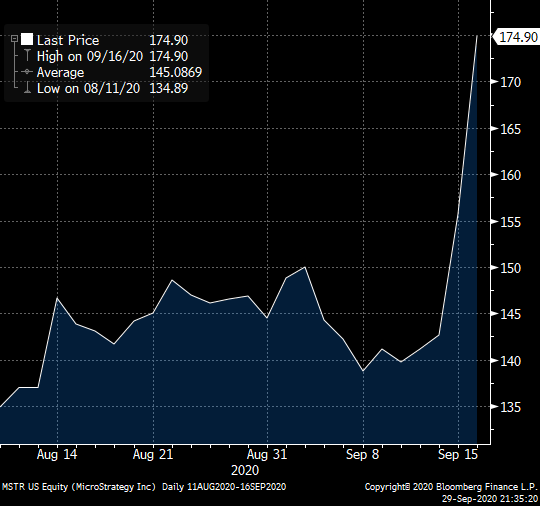

The market has agreed with the move thus far. Here’s what happened to the company’s stock price after it made the call on August 11:

MSTR Surged After the Company Ditched Cash

Shares have slipped back a bit since the stock peaked on September 16. But the market is still in favor.

Can I Trust Bitcoin?

Bitcoin has had a volatile past:

Bitcoin’s Rise and Fall in 2017-18

In 2017, it rose 2,300% from trough to peak.

It then lost 83% of that gain over the next year.

That’s a big drop.

But that still means bitcoin quadrupled from the start of 2017 to its 2018 bottom.

And it’s still rising.

The other pro of bitcoin is its output has a ceiling.

No more than 21 million coins will ever exist. And there are already 18.5 million of them.

This is stark when you consider the incessant growth of the supply of the U.S. dollar.

The U.S. money supply is up $3.2 trillion since March.

It’s up 51% — or $6.3 trillion — since the start of 2016.

History shows the Fed has no planned end for the printing. So, you should expect the dollar will continue to have trouble maintaining its value.

It makes sense to convert at least a portion of your excess cash to something that will hold up.

Bitcoin isn’t the only option to choose from. But I gave you an example of a management team that put $425 million of its cash into the asset.

I don’t think they’re crazy. The company understands the balance could be flat or lose a bit over the near term. It also expects it could rise 100 times over the long term.

I believe we will look back on this in future years as a prudent step.

Good investing,

Editor, Profit Line