It’s summertime, and that means my kids are outside all the time — and I’m usually right there with them.

Not that I am a “helicopter parent” — rushing to protect my kids from every little danger in the world — but I am there to teach my kids and help build them up. And also to have a little fun … but that’s not the point today.

Of course, I’m more aware of risks — risks that don’t seem to worry my son.

Like trying to do a backflip into our pool … riding his bike alongside moving cars on our street … or climbing up to the top of trees.

These are all things I wouldn’t deprive him of doing even though I know the dangers. But the one thing I point out to him is that he has to know the risks involved.

If he hits his head on our pool trying to do a backflip, he could have nerve damage from it or be paralyzed. Riding beside cars could get him run over if he wobbles and falls. And falling from a tall tree could kill him — not just result in broken bones.

It’s these risks that are part of the thrill, which is why he will still do backflips, ride near cars and climb trees. But by being there and walking him through the risks, at least I know he is aware of what could happen, instead of just being caught up in the moment and doing stupid stuff.

I take the same approach to investment advice.

I can’t stop you from taking risks. After all, the greater the risk, the greater the possible reward. But I can warn you about the risks so that you can make an informed investment decision.

And today, there is one aspect of the market that is riskier than normal — the high-yield bond market.

Chasing Yield

High-yield bonds are bonds that are rated below investment grade and offer a premium in yield over less-risky assets. So they are already a risky proposition.

The yield is what entices investors to buy these bonds, but the yield is market-driven, so it is prone to being mispriced — as it is now.

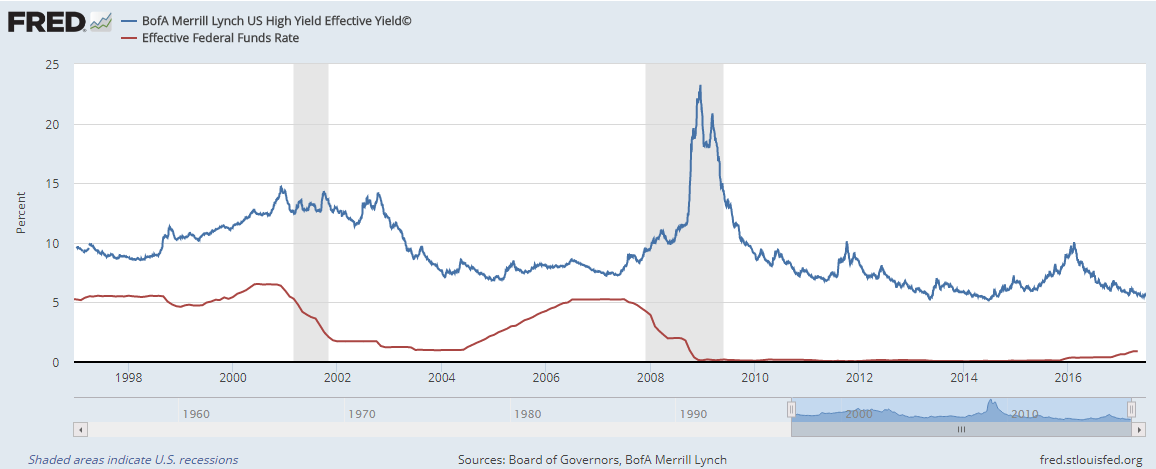

For example, during the 2008 financial crisis, these yields topped 22%. Prior to that, they were about 7.5% — tripling in just two years.

If you know anything about bonds, then you know as the yield rises, the price falls. So as the yield surged, prices were plunging, and investors were panicking and selling because these were below-investment-grade bonds that were at higher risk of not being paid back.

We are at even lower yields today — just above 5% for below-investment-grade bonds.

You can thank the Federal Reserve for this. Since the Fed pinned its rates near 0% from 2009 to 2015, investors had no choice but to chase yield.

But the Fed raised rates again in June by a quarter of a point, marking the fourth rate hike in the past two years.

The Fed’s decision to stay on a path of raising rates will have implications throughout the interest-rate world, from credit cards and home loans to your certificates of deposit at your local bank … and yes, the high-yield debt market.

Risk Vs. Reward

Here’s a chart of the yield on high-yield bonds (the blue line) and the Fed’s effective rate (the red line).

Think of the blue line as investors’ appetite for risks. As it falls, investors are prone to take more risks, and when it rises, they tend to take less risks. Where it currently sits today, a yield of 5.6% is indicating that investors are taking a lot of risks.

We saw this in the run-up to the financial crisis, where, as the Fed raised rates, investors still poured into high-yield bonds, keeping yields at relatively low levels.

The Fed is only getting started in its current rate-hike environment, but one thing is for sure — high-yield bond rates should rise as well.

It may not be immediate like in the stock market boom of the 2000s, but at some point, these yields are going to migrate higher, and prices will fall.

So if you are seeking yield, high-yield bonds pack a lot of risk for a minimal amount of yield.

Again, I can’t force your hand to sell these today. But I can explain the current risk-versus-reward environment, and right now, there is little reward to be had.

Now that you know the risks, I’ll add that there is a unique but very successful way to generate yields without investing in the high-yield debt market.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert