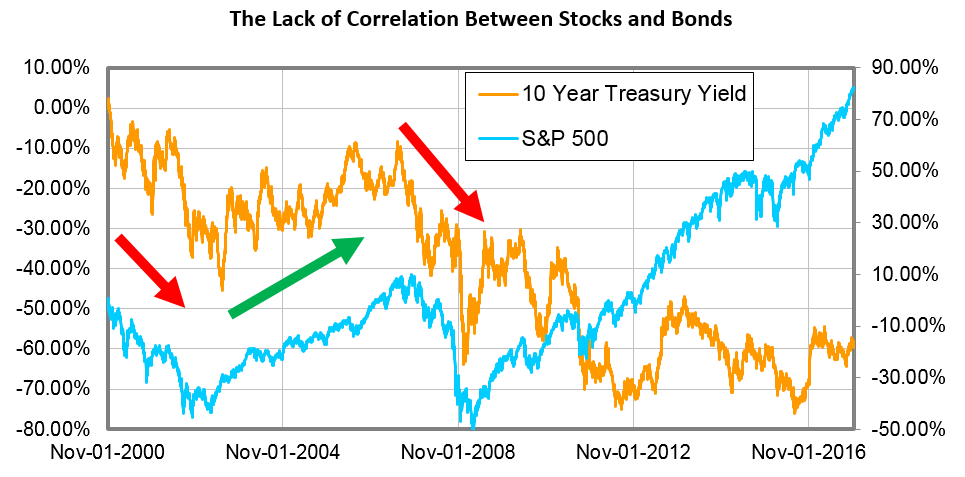

As the Federal Reserve is set to see a new leader, the one area all eyes will continue to watch is the diversion between the S&P 500 and rates on U.S. Treasuries, specifically the 10-year.

The two, historically, have moved in tandem, meaning as the S&P 500 rose, so did the yield for the 10-year Treasury. And when the S&P 500 declined for a prolonged period, the yield for the 10-year Treasury declined.

This can be explained rationally.

As stocks march higher, investors want greater returns, and therefore sell Treasury bonds and buy stocks. Selling bonds pushes those prices down and the yields up.

Likewise, when investors are experiencing losses in stocks, they look to find safety in Treasury bonds, pushing those prices higher and the yields lower.

It is a rational process, but one we haven’t seen for nearly a decade. Take a look:

This uncorrelation can be explained as well.

After the 2008 global financial crisis, the trend arrows indicate the general trend for both ends. That’s when central banks sent interest rates to historic lows, keeping pressure on the 10-year Treasury yield to remain subdued even as investors fled — the Fed has been a big enough buyer to make up for the selling of bonds by investors.

But, as the Fed gets set to normalize interest rates and its balance sheet, this correlation will be renewed.

And considering the wide disparity thus far, we can expect this to be an occurrence that sends shocks in both the bond and stock market. This would bring back volatility, which has been gone for many years as well.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert