Latest Insights on GO

Economy Grapples; Targeting Apples; New Great Stuff Pick! April 23, 2020 Great Stuff Goodbye Yellow Brick Road When are you gonna come down? When are you going to land? Filings for initial jobless claims jumped by 4.4 million last week, the U.S. Department of Labor reported today … and the market rallied. No, this isn’t déjà vu. This isn’t a glitch in the Matrix … no matter how […]

Economy Grapples; Targeting Apples; New Great Stuff Pick! April 23, 2020 Great Stuff Goodbye Yellow Brick Road When are you gonna come down? When are you going to land? Filings for initial jobless claims jumped by 4.4 million last week, the U.S. Department of Labor reported today … and the market rallied. No, this isn’t déjà vu. This isn’t a glitch in the Matrix … no matter how […] Copy Warren Buffett Today … Make Big Money Tomorrow April 23, 2020 2020 Financial Crisis, Trading Strategies, Winning Investor Daily You would think Berkshire Hathaway would be investing right now. But it isn’t. And it’s a great reminder that you don’t have to do anything right now.

Copy Warren Buffett Today … Make Big Money Tomorrow April 23, 2020 2020 Financial Crisis, Trading Strategies, Winning Investor Daily You would think Berkshire Hathaway would be investing right now. But it isn’t. And it’s a great reminder that you don’t have to do anything right now.  3 Key Industries Expected to Rebound After 2020 Stock Market Turmoil April 23, 2020 American Investor Today, Investment Opportunities Investors who sit on the sidelines when bad news hits often miss out on huge gains. With the market down over coronavirus and economic fears, now’s the time to buy great companies trading at discounted prices. Charles Mizrahi shows you how to benefit from three ETFs set to outperform over the long term.

3 Key Industries Expected to Rebound After 2020 Stock Market Turmoil April 23, 2020 American Investor Today, Investment Opportunities Investors who sit on the sidelines when bad news hits often miss out on huge gains. With the market down over coronavirus and economic fears, now’s the time to buy great companies trading at discounted prices. Charles Mizrahi shows you how to benefit from three ETFs set to outperform over the long term.  Oilers Upset; Nothin’ Streamin’ but Debt April 22, 2020 Great Stuff Much Ado About Nothing? For the past several days, Wall Street fretted over plunging oil prices. Well, Wall Street was concerned for a while … the financial media just decided it was finally time to take notice. In classic financial media form, however, it appears that the hype surrounding negative oil prices actually prompted a […]

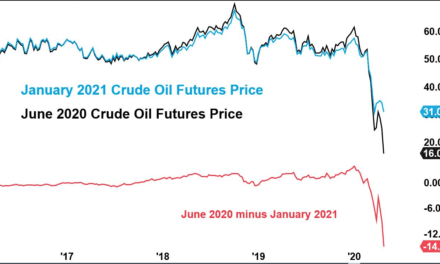

Oilers Upset; Nothin’ Streamin’ but Debt April 22, 2020 Great Stuff Much Ado About Nothing? For the past several days, Wall Street fretted over plunging oil prices. Well, Wall Street was concerned for a while … the financial media just decided it was finally time to take notice. In classic financial media form, however, it appears that the hype surrounding negative oil prices actually prompted a […] Oil Collapse Will Ignite an Epic Rally April 22, 2020 2020 Financial Crisis, American Investor Today Traders are paying to get rid of their oil. And that’s creating a massive opportunity that we haven’t seen in a decade. John Ross explains why investors need to be ready to capture the rebound in oil.

Oil Collapse Will Ignite an Epic Rally April 22, 2020 2020 Financial Crisis, American Investor Today Traders are paying to get rid of their oil. And that’s creating a massive opportunity that we haven’t seen in a decade. John Ross explains why investors need to be ready to capture the rebound in oil.