Latest Insights on GOOGL

POLL: Is Office Work Going Extinct? June 4, 2022 Technology, Winning Investor Daily This past week, Elon Musk told Tesla workers to come back to the office or resign. But he’s in the minority…

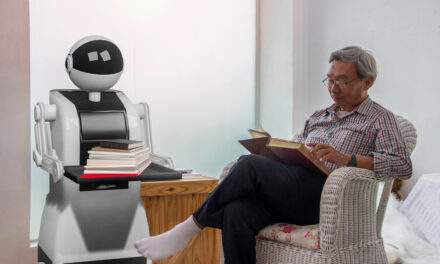

POLL: Is Office Work Going Extinct? June 4, 2022 Technology, Winning Investor Daily This past week, Elon Musk told Tesla workers to come back to the office or resign. But he’s in the minority… These Next-Gen Robots Will Care for the Elderly June 1, 2022 Technology, Winning Investor Daily We’re in a new age of robotic assistants that are better and smarter in every way.

These Next-Gen Robots Will Care for the Elderly June 1, 2022 Technology, Winning Investor Daily We’re in a new age of robotic assistants that are better and smarter in every way. Ignore the Media — the Housing Market Isn’t Crashing May 30, 2022 U.S. Economy, Winning Investor Daily I can understand the fear. But I don’t see a housing crisis on the horizon.

Ignore the Media — the Housing Market Isn’t Crashing May 30, 2022 U.S. Economy, Winning Investor Daily I can understand the fear. But I don’t see a housing crisis on the horizon. The Next Fed Put Could Be Weeks Away May 25, 2022 Investing, Options Bootcamp, Trading Strategies, True Options Masters The Fed put saved traders from a prolonged decline in 1987, 1990, and 1998. If Powell takes note, he could turn this bear back into a bull...

The Next Fed Put Could Be Weeks Away May 25, 2022 Investing, Options Bootcamp, Trading Strategies, True Options Masters The Fed put saved traders from a prolonged decline in 1987, 1990, and 1998. If Powell takes note, he could turn this bear back into a bull... Bank on This 15.6% Yield May 24, 2022 Big Picture. Big Profits., Investment Opportunities, U.S. Economy You can certainly profit by using a stock’s price history to spot opportunities. But in times of major upheaval, like today, “technicals” are a poor guide. Normally, reliable information on the history of individual assets is overwhelmed by external factors. In this case, I prefer to focus on the Big Picture. And right now, the Big Picture is telling me to be opportunistic … but to let someone else do the work.

Bank on This 15.6% Yield May 24, 2022 Big Picture. Big Profits., Investment Opportunities, U.S. Economy You can certainly profit by using a stock’s price history to spot opportunities. But in times of major upheaval, like today, “technicals” are a poor guide. Normally, reliable information on the history of individual assets is overwhelmed by external factors. In this case, I prefer to focus on the Big Picture. And right now, the Big Picture is telling me to be opportunistic … but to let someone else do the work.