Latest Insights on GILD

Short-Term Trading: A Moneymaking Path Few Dare to Tread December 8, 2022 Banyan Edge, Investing, Stocks I don't make money the way others do. I focus on short-term trading... and I'm backed by the strongest technical evidence there is.

Short-Term Trading: A Moneymaking Path Few Dare to Tread December 8, 2022 Banyan Edge, Investing, Stocks I don't make money the way others do. I focus on short-term trading... and I'm backed by the strongest technical evidence there is. DeFi vs. Traditional Banks: Why Crypto Wins October 5, 2022 Cryptocurrency, Investing, Winning Investor Daily DeFi vs. traditional banks is a long-standing battle. Ian breaks down why DeFi cryptos and blockchain will beat out traditional banks!

DeFi vs. Traditional Banks: Why Crypto Wins October 5, 2022 Cryptocurrency, Investing, Winning Investor Daily DeFi vs. traditional banks is a long-standing battle. Ian breaks down why DeFi cryptos and blockchain will beat out traditional banks! OPEC’s Essential Oil, Gilead’s Glee & Rivian’s Rising October 4, 2022 Great Stuff Crude Intentions Great Ones, we’re talking oil again today. You know, black gold? Texas tea? Unlike back in old Jedd’s day, crude doesn’t just bubble up anymore. You have to drill, drill, drill and pump, pump, pump for those greasy dinosaur bones these days. Now, you’d think that with gas prices remaining stubbornly high, and […]

OPEC’s Essential Oil, Gilead’s Glee & Rivian’s Rising October 4, 2022 Great Stuff Crude Intentions Great Ones, we’re talking oil again today. You know, black gold? Texas tea? Unlike back in old Jedd’s day, crude doesn’t just bubble up anymore. You have to drill, drill, drill and pump, pump, pump for those greasy dinosaur bones these days. Now, you’d think that with gas prices remaining stubbornly high, and […] Musk Buys Twitter? Expect Fireworks April 26, 2022 Big Picture. Big Profits., Investing, News During those 65 weekend hours, Elon Musk’s people and Twitter’s people will have “material conversations” about the former’s deal to buy the company. (During market hours they’d have to share everything publicly, given their potential impact on the company’s share price.) But we’re interested in the bigger picture. The longer term. The endgame. On the stock price front, the impact on Twitter’s share price is already baked in. Unless something derails the deal … entirely possible, as you’ll see … TWTR will cease to trade at $54.20 a share, about 4% upside from Monday’s closing price. But as Jay Gould discovered, the path to media’s commanding heights is never smooth.

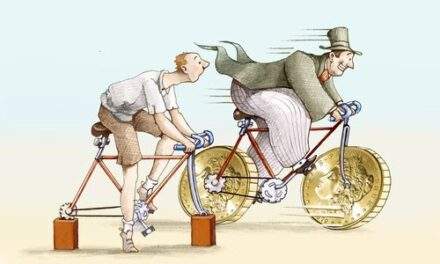

Musk Buys Twitter? Expect Fireworks April 26, 2022 Big Picture. Big Profits., Investing, News During those 65 weekend hours, Elon Musk’s people and Twitter’s people will have “material conversations” about the former’s deal to buy the company. (During market hours they’d have to share everything publicly, given their potential impact on the company’s share price.) But we’re interested in the bigger picture. The longer term. The endgame. On the stock price front, the impact on Twitter’s share price is already baked in. Unless something derails the deal … entirely possible, as you’ll see … TWTR will cease to trade at $54.20 a share, about 4% upside from Monday’s closing price. But as Jay Gould discovered, the path to media’s commanding heights is never smooth. Angry. Disillusioned. Doomed? February 8, 2022 Big Picture. Big Profits., Economy, Investing South Africa is drop-dead gorgeous. Its people are the salt of the earth. But it is one of the most unequal societies in the world, which makes it a challenging place to live … to put it mildly. One thing I've learned in my travels is that when inequality reaches extreme levels, dire consequences follow. So, when a new data set on inequality in the U.S. arrived in my inbox, I realized I had the makings of this week's Bauman Daily. If you doubt the relevance to growing and protecting your investments, read on…

Angry. Disillusioned. Doomed? February 8, 2022 Big Picture. Big Profits., Economy, Investing South Africa is drop-dead gorgeous. Its people are the salt of the earth. But it is one of the most unequal societies in the world, which makes it a challenging place to live … to put it mildly. One thing I've learned in my travels is that when inequality reaches extreme levels, dire consequences follow. So, when a new data set on inequality in the U.S. arrived in my inbox, I realized I had the makings of this week's Bauman Daily. If you doubt the relevance to growing and protecting your investments, read on…