Latest Insights on UNH

Angry. Disillusioned. Doomed?

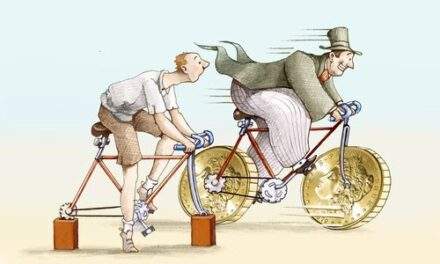

Angry. Disillusioned. Doomed? February 8, 2022 Big Picture. Big Profits., Economy, Investing

South Africa is drop-dead gorgeous. Its people are the salt of the earth. But it is one of the most unequal societies in the world, which makes it a challenging place to live … to put it mildly. One thing I've learned in my travels is that when inequality reaches extreme levels, dire consequences follow. So, when a new data set on inequality in the U.S. arrived in my inbox, I realized I had the makings of this week's Bauman Daily. If you doubt the relevance to growing and protecting your investments, read on… Spotify’s Rogan Rabble Rousing, Bumbling Into Fruitz & Peloton’s Parley

Spotify’s Rogan Rabble Rousing, Bumbling Into Fruitz & Peloton’s Parley February 7, 2022 Great Stuff

Spotify: For What It’s Worth… Great Ones, how much do you believe in the “free market?” I know. I know. Quite a few of you out there are thinking: Free market? Ha. It’s all rigged, my man! But that’s not quite what I’m getting at today, and if you’ve read the headline … you already […] Microsoft’s Boundless Bounty, Dreamliner Nightmares & Disney’s Mattel Cartel

Microsoft’s Boundless Bounty, Dreamliner Nightmares & Disney’s Mattel Cartel January 26, 2022 Great Stuff

Microsoft’s Sweet Sales Soliloquy But Microsoft (Nasdaq: )! What light through yonder Windows breaks? It is quarterly earnings, and Azure is the sun! Arise, fair sun, and kill the envious cloud computing competitors who are already sick and pale with grief that thou, the OG tech company, art far more fair than they. Oh, Great […] The Fed’s Great Switcheroo

The Fed’s Great Switcheroo January 7, 2022 Big Picture. Big Profits., Education, U.S. Economy

The narrative around the Fed’s increasingly hawkish stance is that it’s reacting to consumer price inflation. That’s part of it, but I’m convinced Powell & Co. are playing at a much bigger game. Ever since the great financial crisis, asset markets have become unhealthily dependent on easy money. Besides exacerbating inequality, artificially inflated asset markets are prone to bubbles and bust. That’s why the most incisive market watchers have been saying for a long time that the Fed’s biggest challenge is to end this dependency once and for all. If that’s what the Fed is doing, how’s it going to affect markets? More importantly, which assets will suffer, and which will prosper? Nio’s Not The One, YouTube’s DISphoria & Speaking Meta-phorically

Nio’s Not The One, YouTube’s DISphoria & Speaking Meta-phorically December 15, 2021 Great Stuff

Red Dawn: Chinese Edition The time has come, Great Ones, to talk of many things: Of batteries and chips and electric vehicles (EVs) … of cabbages and Xi Jinpings. And why China is boiling hot — and whether Chinese stocks have wings. Great Stuff Picks readers have probably already noticed that our Nio (NYSE: ) […]