Spotify: For What It’s Worth…

Great Ones, how much do you believe in the “free market?”

I know. I know. Quite a few of you out there are thinking: Free market? Ha. It’s all rigged, my man!

But that’s not quite what I’m getting at today, and if you’ve read the headline … you already know that.

What I’m talking about today is Spotify’s (NYSE: SPOT) Joe Rogan situation. It’s a rather hairy case of free speech versus the free market.

Umm … Mr. Great Stuff, aren’t they kind of one and the same?

Quiet you. No spoilers.

First, let’s catch you up on the situation, just in case you’re not plugged into the streaming music scene.

So, Joe Rogan is an American podcaster, UFC color commentator, comedian, actor and TV presenter. He made his name in the UFC back in 1997 and became a near-household name by hosting the show Fear Factor back in the early 2000s.

In 2009, he started The Joe Rogan Experience podcast, and by 2015, it had become one of the most popular podcasts in the world. Five years later, in 2020, Spotify purchased the exclusive streaming rights to The Joe Rogan Experience for $100 million.

Sounds like an excellent deal for Spotify, right?

Well, it was until Rogan started pushing anti-vax and COVID-19 misinformation.

As you can imagine, this did not sit well with some recording artists. In fact, several major artists pulled their music from Spotify in protest, including Neil Young, Joni Mitchell, India Arie and Crosby, Stills & Nash.

The controversy deepened on Friday, February 4, when a compilation video of Rogan using the N-word went viral on social media platforms. Oof…

Now, at this point, you might expect Spotify to do something to mitigate the damage. You would be wrong.

Spotify CEO Daniel Ek apologized to employees for Rogan’s behavior … kinda sorta:

Why would they feel frustrated and unheard? Well, Ek continued with this:

Translation: I don’t believe not making money off this controversy is the right idea, no matter how much I “dislike” Joe’s comments.

In fact, it was Joe Rogan himself who removed a whole swath of questionable podcast content from Spotify in reaction to the growing backlash … not Spotify. Good on Rogan, I think.

Now, before you break out the pitchforks and come at me for “freedom of speech!” let me just say that I agree with you. Spotify should not fire Joe Rogan.

(And now I’ve ticked off the other half of my readers, lol.)

Let me make this clear: I do not support or agree with Joe Rogan on a multitude of issues — the COVID-19 misinformation and the use of hate speech foremost among them.

That said, one of the beautiful (and ugly) things about freedom of speech is that we can say pretty much whatever we want, and the government can’t stop us.

But … the free market can.

Yes, Joe Rogan has the freedom to say what he wants. And yes, Spotify has every right to give him a platform.

But…

Artists have every right to allow or deny Spotify streaming rights. Subscribers have every right not to subscribe to Spotify’s services. And investors have every right to not invest in a company they disagree with.

This isn’t censorship or violating a company’s First Amendment rights — only the government can do that, remember?

No, this is smart business, smart consumerism and smart investing.

Which brings us to a major risk for Spotify going forward. The company needs artists to keep their music on its service. Music streaming is still the biggest revenue generator for Spotify. So, if artists begin pulling content, Spotify is in trouble.

Furthermore, if the younger generations begin to believe that Spotify isn’t the cool place to stream music anymore, that undermines Spotify’s ability to grow or even maintain its userbase.

Free market versus free speech — it’s a fine line to walk, indeed.

Where do you fall in this great debate, Great Ones? Does a company’s behavior influence your investment decisions? Or are you in the game for the investment returns and just the returns alone?

Inquiring minds want to know! Rant at me here: GreatStuffToday@BanyanHill.com.

Editor’s Note: What Has Paul THIS Excited?

According to Paul, one former Tesla employee just released a brand-new innovation promising to make every EV out there instantly obsolete.

And it goes beyond just EVs. This brand-new tech is rolling out to power 50 million homes and businesses, setting up a new market that could turn out to be 10X bigger than EVs.

Click here for the full story.

Good: Bumble Makes A Buzz

Online dating service Bumble (Nasdaq: BMBL) drew a fair amount of buzz this morning after announcing its first-ever acquisition of French dating app company Fruitz.

True to its name, Fruitz “encourages open and honest communication of dating intentions” by pairing people based on the kind of fruit its algorithm assigns them — such as cherries, watermelons or grapes.

Apparently, French dating is kinda fruity? I don’t know. I’ve got nothing…

Back in the olden days, we worked around all that first-date awkwardness by actually talking to one another. Not by comparing fruits. (Get your mind out of the gutter. Shame on you!) I guess this just goes to show how behind the digital dating times I really am.

Thing is, the Gen Z crowd gobbles this gimmicky stuff up — and that’s exactly who Bumble hopes to target with this latest acquisition, now that younger generations are entering the dating pool.

Everyone over the age of 30 might be burnt out on the old “swipe left or right” routine, but now that Gen Z is coming of age, there’s a huge untapped market for online dating companies to penetrate … and apparently, the fruitier their platforms, the better. Who knew?

But, what can you expect from a generation whose idea of peak comedy is a slice of bread falling over. Seriously…

Granted, this is what I love about investing. Companies’ modern-day marketing schemes don’t necessarily need to speak to me or you … they just need to speak to someone, somewhere.

But what about you, Great Ones? Does Bumble’s latest buzz have you swiping right for profits? Or are you a digital dating curmudgeon who misses getting to know people in person? Let me know: GreatStuffToday@BanyanHill.com.

Better: That’s The Spirit!

Have you ever flown on a budget airline, Great Ones?

I’m convinced that when you book a flight with a low-cost carrier like Spirit Airlines (NYSE: SAVE), your entire trip is really a simulation, and the whole time you think you’re out having fun somewhere else, you’re actually asleep on the tarmac.

I mean, how else can you “fly” around the country for $49 round-trip?

Anywho, conspiracy theories aside, stingy Spirit Airlines has now reached the final frontier in airline travel … Frontier Group (Nasdaq: ULCC).

That’s right. All those cost-savings Spirit’s accumulated by charging its passengers for everything from bottles of water to snacks? They’ve gone toward a $6.6 billion merger with rival airline budgeter Frontier, creating what will eventually become the fifth-largest airline in the country once the ink dries on this deal.

Under the terms of the merger, Spirit investors will receive exactly 1.9126 shares of Frontier, plus $2.13 in cash for each share of SAVE stock they own. All told, that’s a 19% premium over the value that Spirit shares traded at when the market closed last week.

The announcement left Wall Street wondering whether two wrongs really do make a right … and for their part, Spirit investors seem to think so, with SAVE stock up nearly 14% on the day.

Frontier investors, on the other hand, were less enthused — with ULCC stock barely budging from its $12.43 per-share perch.

Best: Peloton’s Possible Parley

I’m not surprised that Peloton’s (Nasdaq: PTON) plummeting share price has caught the wandering eye of veteran companies like Nike (NYSE: NKE) and Amazon (Nasdaq: AMZN) as a possible takeover target.

I mean, I’ve been telling anyone who would listen that Peloton isn’t a fully-fledged company. It’s a product … and a shaky one at that.

But with the backing of a company with a proven track record of success, Peloton’s plummet-thon might finally come to an end.

Thing is, I don’t think either Nike or Amazon is the most well-suited suitor for the job — and neither does one Wedbush analyst:

We would be shocked if Apple is not aggressively involved in this potential deal process. [Acquiring Peloton] would be a major strategic coup [for Apple] and catalyze the company’s aggressive health and fitness initiatives over the coming years.

— Wedbush analyst Dan Ives

I have to say, I completely agree with Dan. Apple would be the best takeover candidate in terms of shareholder return and product growth — and in keeping with the illusion of offering premium workout equipment. Nike would be second, but only because the Apple brand carries a lot more prestige … in my humble opinion.

But Amazon? That would be a complete travesty for PTON shareholders — and for the Peloton Brand. Imagine Peloton machines being branded as Amazon Essentials … because that’s where that deal would be headed.

Can you say: “Amazon Alexa workout machines?” Sure, you can. You just don’t want to. And neither does anyone else.

To be fair — ♫ To be faaaair… ♫ — even Amazon buying Peloton would be better for shareholders than Peloton going it alone.

And that is likely why PTON stock rallied more than 15% on rumors of a possible stock market parley … proving even for struggling exercise equipment makers, it ain’t over ‘til it’s over.

(Peloton’s future may be up in the air, but you wanna know what’s a sure thing? Today’s leading chip companies are rapidly stepping up their semiconductor supply — and fast. Click here to see why.)

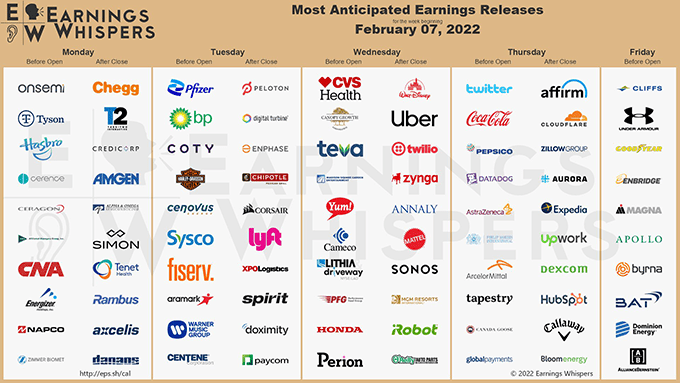

It’s gonna be a busy week in the earnings confessional, Great Ones. Just look at this week’s lineup, courtesy of Earnings Whisper on Twitter:

After the close tonight, we have Amgen (Nasdaq: AMGN) representing the pharmaceutical industry, we have Rambus (Nasdaq: RMBS) on the semiconductor side and Chegg (NYSE: CHGG), a for-profit education company that once moonlighted as a meme stock.

And all those companies will likely have already reported by the time you read today’s edition of Great Stuff. I don’t think you’re ready for this jelly…

But there are a few reports I’ll be keeping close tabs on:

BP plc (NYSE: BP): I’m curious just how far along this traditional energy company has come in the green energy space. BP began transitioning away from fossil fuels a few years ago in response to EU carbon emissions guidelines.

What I want to know is how this transition is impacting revenue and just how serious BP is about meeting EU guidelines.

Peloton: Well, after today’s news on potential takeover targets, I think Peloton’s earnings report will be among the most closely watched this week. Will Peloton accept a takeover bid? Will the company comment on the rumors?

But most of all: Is the company still hemorrhaging money due to legal fees, lawsuits, production issues and slowing growth? So many questions. So many questions…

Walt Disney (NYSE: DIS): The pandemic has been rough on the Mouse’s House, what with park closures, store closures and the slow return of guests to the “Happiest Place on Earth.” (My wife would take issue with that last bit.)

What I’m looking for in Disney’s report is Disney+ and Hulu subscriber growth. The rest will come back with time, but streaming dominance is what I’m looking for when it comes to Disney’s future. Netflix appears to be faltering once again. Can Disney pick up the slack, or have consumers finally reached their limit on subscription streaming services?

Twitter (NYSE: TWTR): If I had to invest in a social media platform right now, it would be TikTok. But you can’t invest directly in TikTok. So, Twitter makes a rather serviceable second choice. It’s popular among all age groups and is almost as good as TikTok when it comes to showing users what they want to see.

Is Twitter a hot mess? Sure. But then name one social media company that isn’t.

What I’m looking for with Twitter is whether the company’s new efforts to monetize users — Twitter Blue, Twitter Spaces, Super Follows, etc. — are having any effect on revenue and earnings. I’m seeing quite a bit of uptake on many of these new features, including, sadly enough, NFT avatars.

I’m betting Twitter will surprise more than a few investors and analysts this Thursday.

Those are my highlights this week — but what are yours? What reports are you looking forward to most this week? Let me know in the inbox if any of your personal picks are entering the earnings confessional and what you’d like to hear more about.

GreatStuffToday@BanyanHill.com is your one-stop shop for hot takes and spit takes, earnings trades and options plays, rants, raves, questions … and everything in between. Come join in the fun for Friday’s edition of Reader Feedback!

In the meantime, here’s where you can find our other junk — erm, I mean where you can check out some more Greatness:

- Get Stuff: Subscribe to Great Stuff right here!

- Our Socials: Facebook, Twitter and Instagram.

- Where We Live: GreatStuffToday.com.

- Our Inbox: GreatStuffToday@BanyanHill.com.

Until next time, stay Great!

Regards,

Joseph Hargett

Editor, Great Stuff