Latest Insights on DRI

Clarifying Crypto, Tesla’s Self-Driven Debate & Intel’s Shifting Goal Posts July 27, 2021 Great Stuff Tales From The Crypto Keeper Great Ones, every now and then, we run into some … let’s say “gems” … in the financial media. Little nuggets of nonsense, some ill-informed info that’s inflammatory enough to end up as our Anti-Quote of the Week. I just wanted to preface this junk before we dive in — […]

Clarifying Crypto, Tesla’s Self-Driven Debate & Intel’s Shifting Goal Posts July 27, 2021 Great Stuff Tales From The Crypto Keeper Great Ones, every now and then, we run into some … let’s say “gems” … in the financial media. Little nuggets of nonsense, some ill-informed info that’s inflammatory enough to end up as our Anti-Quote of the Week. I just wanted to preface this junk before we dive in — […] China: The Party’s Over … in More Ways Than 1 July 27, 2021 Big Picture. Big Profits., Global Economy, News Not for the first time … and certainly not for the last … China’s rulers have gutted the business model of one of the country’s thriving, growing technology sectors.

The question is … why? Is it safe to invest in any Chinese companies?

China: The Party’s Over … in More Ways Than 1 July 27, 2021 Big Picture. Big Profits., Global Economy, News Not for the first time … and certainly not for the last … China’s rulers have gutted the business model of one of the country’s thriving, growing technology sectors.

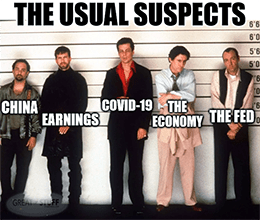

The question is … why? Is it safe to invest in any Chinese companies? The Fed Is Keyser Söze, Robinhood’s IPO In Tights & Amazon Basic Coin™ July 26, 2021 Great Stuff Wall Street’s Usual Suspects ♫ Into the thick of it! Into the thick of it! ♫ I’ve had that Backyardigans song stuck in my head all weekend, Great Ones … and I just had to share. But it’s not just a massive earworm, it’s also rather appropriate for this week on Wall Street. We’re definitely […]

The Fed Is Keyser Söze, Robinhood’s IPO In Tights & Amazon Basic Coin™ July 26, 2021 Great Stuff Wall Street’s Usual Suspects ♫ Into the thick of it! Into the thick of it! ♫ I’ve had that Backyardigans song stuck in my head all weekend, Great Ones … and I just had to share. But it’s not just a massive earworm, it’s also rather appropriate for this week on Wall Street. We’re definitely […] Before You Invest, You Need to Ask Yourself This Question July 26, 2021 American Investor Today, Education, Investing (3-minute read) If you don’t have a simple investing approach that you can sum up in a sentence or two, you’re at a big disadvantage. So today, I want to give you insight into my approach and why it makes sense…

Before You Invest, You Need to Ask Yourself This Question July 26, 2021 American Investor Today, Education, Investing (3-minute read) If you don’t have a simple investing approach that you can sum up in a sentence or two, you’re at a big disadvantage. So today, I want to give you insight into my approach and why it makes sense…  2 Quality ETFs to Combat Volatility July 26, 2021 Big Picture. Big Profits., Investing, Investment Opportunities, U.S. Economy This year’s big theme in the stock market? Well, there isn’t one! As soon as you think the market is moving one way, it changes to another. Ted has said many times that external factors, such as COVID-19, the Federal Reserve and politics, drive the market. Fundamentals just don’t seem to count for much lately.

2 Quality ETFs to Combat Volatility July 26, 2021 Big Picture. Big Profits., Investing, Investment Opportunities, U.S. Economy This year’s big theme in the stock market? Well, there isn’t one! As soon as you think the market is moving one way, it changes to another. Ted has said many times that external factors, such as COVID-19, the Federal Reserve and politics, drive the market. Fundamentals just don’t seem to count for much lately.