Latest Insights on SIX

U.S. Shrinkage, Box Office Trolls, Boeing Blows April 29, 2020 Great Stuff Country Jerome and the Fed And it’s a one, two, three … what are we buying for? Don’t ask me, I don’t care a wit; next stop is a bull market. And it’s a five, six, seven … open up the pearly gates. Well there ain’t no time to wonder why, whoopee! Stocks are gonna […]

U.S. Shrinkage, Box Office Trolls, Boeing Blows April 29, 2020 Great Stuff Country Jerome and the Fed And it’s a one, two, three … what are we buying for? Don’t ask me, I don’t care a wit; next stop is a bull market. And it’s a five, six, seven … open up the pearly gates. Well there ain’t no time to wonder why, whoopee! Stocks are gonna […] 3M’s Mask-on Magic; Pfizer Pfalls; Caterpillar Crawls April 28, 2020 Great Stuff It’s Different This Time It’s the mantra of the hopeful and the rally cry of bullish investors whenever the market takes a turn for the worse. As I scanned headlines in the financial media this morning, the simple truth of these words struck me. Take this morning’s original MarketWatch headline for example: “Stocks rise for […]

3M’s Mask-on Magic; Pfizer Pfalls; Caterpillar Crawls April 28, 2020 Great Stuff It’s Different This Time It’s the mantra of the hopeful and the rally cry of bullish investors whenever the market takes a turn for the worse. As I scanned headlines in the financial media this morning, the simple truth of these words struck me. Take this morning’s original MarketWatch headline for example: “Stocks rise for […] Gold Stocks Hit 7-Year High — You Should Be Buying April 27, 2020 American Investor Today, Gold, Investment Opportunities (3-minute read) Gold mining stocks just hit their highest price since 2013 — but two forces will propel them to a double from here. This is why you need to buy gold miners today.

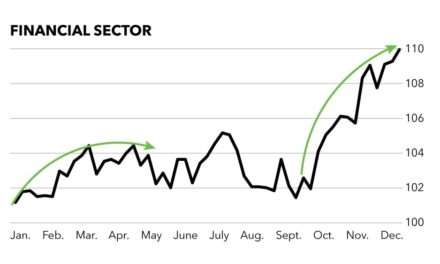

Gold Stocks Hit 7-Year High — You Should Be Buying April 27, 2020 American Investor Today, Gold, Investment Opportunities (3-minute read) Gold mining stocks just hit their highest price since 2013 — but two forces will propel them to a double from here. This is why you need to buy gold miners today. Rest Easy: Use These Cycles to Triple Your Money April 25, 2020 American Investor Today, Trading Strategies Last Saturday, I told you about how Chad Shoop’s unique “Profit Stacks” strategy can help you turn a $10,000 stake into over $1 million in just a few years. (You can catch up here if you missed it.) But you don’t even need $10,000. You can start with a small stake of $500 a month […]

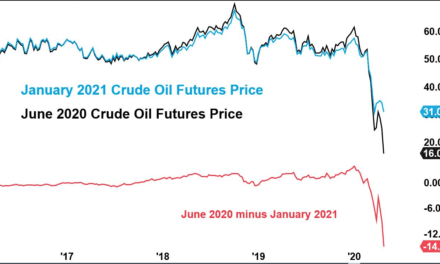

Rest Easy: Use These Cycles to Triple Your Money April 25, 2020 American Investor Today, Trading Strategies Last Saturday, I told you about how Chad Shoop’s unique “Profit Stacks” strategy can help you turn a $10,000 stake into over $1 million in just a few years. (You can catch up here if you missed it.) But you don’t even need $10,000. You can start with a small stake of $500 a month […] Oil Collapse Will Ignite an Epic Rally April 22, 2020 2020 Financial Crisis, American Investor Today Traders are paying to get rid of their oil. And that’s creating a massive opportunity that we haven’t seen in a decade. John Ross explains why investors need to be ready to capture the rebound in oil.

Oil Collapse Will Ignite an Epic Rally April 22, 2020 2020 Financial Crisis, American Investor Today Traders are paying to get rid of their oil. And that’s creating a massive opportunity that we haven’t seen in a decade. John Ross explains why investors need to be ready to capture the rebound in oil.