Latest Insights on RDFN

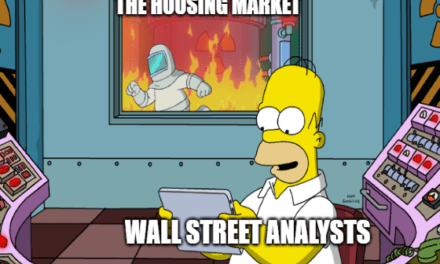

Burning Down The Housing Market; Tesla’s Trouble Is Just Getting Started June 16, 2022 Great Stuff A House Is A House Is A House… Happy Thursday, Great Ones, and welcome to another Thursday Throwdown, where — oof, good God, what’s going on with the market?! We’re doing that sell-off-the-whole-world thing again, huh? If you couldn’t tell by now, the Fed ratcheted up interest rates yesterday … and Wall Street is none […]

Burning Down The Housing Market; Tesla’s Trouble Is Just Getting Started June 16, 2022 Great Stuff A House Is A House Is A House… Happy Thursday, Great Ones, and welcome to another Thursday Throwdown, where — oof, good God, what’s going on with the market?! We’re doing that sell-off-the-whole-world thing again, huh? If you couldn’t tell by now, the Fed ratcheted up interest rates yesterday … and Wall Street is none […] The Investment of the Decade January 17, 2022 Big Picture. Big Profits., Real Estate, Trading Strategies, U.S. Economy In today’s Your Money Matters, Clint Lee and Ted Bauman discuss what Ted calls the “investment of the decade.” Crypto? Pot stocks? NFTs? None of the above. Instead, it’s the investment that has created more wealth than any other in human history. It’s a classic play on supply and demand. And right now, demand is dramatically outstripping supply … creating three types of opportunities that can bring you huge gains if you buy in now.

The Investment of the Decade January 17, 2022 Big Picture. Big Profits., Real Estate, Trading Strategies, U.S. Economy In today’s Your Money Matters, Clint Lee and Ted Bauman discuss what Ted calls the “investment of the decade.” Crypto? Pot stocks? NFTs? None of the above. Instead, it’s the investment that has created more wealth than any other in human history. It’s a classic play on supply and demand. And right now, demand is dramatically outstripping supply … creating three types of opportunities that can bring you huge gains if you buy in now. Billionaire Bitcoin Bets, Bonehead Boeing and DISH Gets Served February 22, 2021 Great Stuff From Construction to Crypto? Monday, Monday. So good to me? It’s Monday, Great Ones … and even a little The Mamas & the Papas isn’t helping shake off the weekend funk. Every other day (every other day) of the week is fine. Except for Thursday … I never could get the hang of Thursdays. Anyway, […]

Billionaire Bitcoin Bets, Bonehead Boeing and DISH Gets Served February 22, 2021 Great Stuff From Construction to Crypto? Monday, Monday. So good to me? It’s Monday, Great Ones … and even a little The Mamas & the Papas isn’t helping shake off the weekend funk. Every other day (every other day) of the week is fine. Except for Thursday … I never could get the hang of Thursdays. Anyway, […] Real Estate 2.0: How to Make Money in Today’s Market August 6, 2020 Real Estate, Technology, Winning Investor Daily For homebuyers and sellers, tech-focused real estate companies such as Redfin are more prevalent today.

Real Estate 2.0: How to Make Money in Today’s Market August 6, 2020 Real Estate, Technology, Winning Investor Daily For homebuyers and sellers, tech-focused real estate companies such as Redfin are more prevalent today.