In today’s Your Money Matters, Clint Lee and Ted Bauman discuss what Ted calls the “investment of the decade.”

Crypto?

Pot stocks?

NFTs?

Nope.

But it is the investment that has created more wealth than any other in human history.

It’s a classic play on supply and demand.

And right now, demand dramatically outstrips supply. This creates three types of opportunities that can bring you huge gains … if you buy in now.

Click here for all the details, or click on the image below:

VIDEO TRANSCRIPT

Clint: Ted mentioned to me recently his “play of the decade,” and I was caught a little off guard. I mean, because we’re obviously very bullish on the sector, but this play of the decade, this isn’t renewable energy, this isn’t vehicle electrification. It’s not 5G, Big Data, whatever the case may be.

It’s the housing sector.

And we know there’s a lot of short-term catalyst, short-term tailwinds in favor of the housing market.

But you’re taking the long view here Ted, and I want to put you on the spot today and talk about what you’re seeing there.

Ted: When I say “play of the decade,” look, I think there are some sectors that are going to probably deliver, or let’s say specific stocks, that are going to deliver higher individual stock gains than this sector will, but they’re going to come in the middle of all kinds of other stocks that aren’t.

And so, if you try to play, let’s say renewable energy or something like that, you’ll hit some winners, but you’ll also hit some losers.

And I think housing is actually, because of the basic driver behind it, which is supply and demand, you’re going to find a lot more winners than losers.

Even though the rate of increase of stock prices might not be as high as you’d get in some other sectors, when you consider dividends and all the other stuff, I think you’re going to end up in a better place, at the end of this decade, investing in housing than anything else.

It really comes down to a question of supply and demand. I mean, we know that the biggest house buying generation in history really, the millennial generation, is just coming into their buying period. They’re in their early 30s, they’re having kids, they got dogs, they got all this stuff that means that you can’t really maintain that urban lifestyle living in a studio apartment, something like that.

So it’s a given.

I mean, there are some great people around who’ve talked about demographics as being one of the big drivers and I tend to be a little skeptical of that sometimes because I think they overstate the case, but in housing, it’s just basic. You got to have it, right. What are you going to do without it?

Just to illustrate, I think the backdrop here, I want to show you a chart that shows the new privately owned housing unit started, new builds in the United States, going back to the 1960s, here’s the chart.

You can see that it tends to be very cyclical. Understandably it falls just as recessionary conditions start, those gray bars. Then it picks up again after recessions, then it falls again. But the average is pretty strong.

Right up until the 1990s there was an average of about 1.6 million units being built every year. But look what happened after the Great Financial Crisis. We went in an entire decade building way under the long-term average and never even hit anything like the peak that we had hit before.

What does that mean?

Shortage!

Clint: Yeah. I mean, we’re definitely seeing a catch up to that shortage right now. One of the things that really caught my eye last night was with the KB Homes coming out in reporting earnings. Just to flag some of the stuff they had talked about, their housing revenues for next year are going to be in the 7.2- to 7.6-billion range. That’s up 30% from last year.

Their backlog stands at just under $5 billion, that’s a 67% increase from last year.

But I think one of the biggest sighs of relief that Wall Street and investors are breathing right now is on their gross margin guidance. Because, as we’ve seen, with supply chain disruptions, inflation rising, labor costs, lumber prices are shooting up again, but with their gross margin guidance, they’re expecting somewhere around to 25.4% to 26.2%.

The key point here is that we’re well ahead of what Wall Street was expecting. So at least with these tailwinds, they’re able to offset some of those higher costs and they’re overall seeing a higher level of gross margin.

But that begs another point, is that about affordability?

Because part of what they’re seeing is higher average home prices and so that’s helping out the top line immensely, but at what point does that become a challenge or a hurdle and does that jeopardize the longer-term outlook?

Is This About Affordability?

Ted: The other day, I read something that said that the median home price in the United States, I think it’s the U.S., it could be urban, but I think it’s U.S., is over $400,000. That’s the median. That’s the middle of the market.

That’s a very, very tough ask, especially at current interest rates. But I want to flag one thing here. And here’s a chart that shows 10-year Treasury yields going back to about five years I think, it’s a five-year chart.

And we talk about interest rates going up and making housing more expensive, but look where we are relative to the past. I mean, we’re not at a situation where … I mean, the idea that you could get a mortgage, a 30-year mortgage for under 3%, that’s a gift.

So part of what’s happening here is that low interest rates drive higher prices because, when people go shopping for a house, what they’re thinking is, “what’s my payment, what can I afford?” That’s what you plug into the modeler when you start looking for a house.

So, if we expect interest rates to rise, that means that house prices are going to come down. They won’t come down by as much as they went up. And I think that’s what’s going to drive the margins of people like KB Homes, but we will see affordability increase because interest rates will drive prices down a little bit and that’ll entice people into the market because the prices will have to fall.

But just to return to that question of demand, I mean, here’s a chart that shows vacant housing in the United States.

If you go back to the Great Financial Crisis, the level of vacancies, the amount of stock available has just plummeted. It rose a bit at the beginning of this year because I think some people probably ended up moving out because they couldn’t afford mortgages and ended up renting, but that’s just another play.

The bottom line is you’ve got demand, eventually if people stop buying because prices are too high, prices will come down and that may squeeze the margins of somebody like KB. But at the end of the day, it’s still a safe bet right now.

Look for Things To Stabilize

Clint: How do you feel about the cyclicality of the sector? I mean, you mentioned at the start about just the ups and downs historically. Now we’ve underbuilt…

I bring this up because I think this plays into where a lot of these stocks are being valued right now, but do you still expect, looking out with these trends in place, are we still going to see big swings, especially in earnings per share or does that start to stabilize at all?

Ted: I think it’s going to stabilize.

Obviously one of the reasons why things have been so volatile now is because of COVID, because that affects the labor force. For example, there’s a big shortage of skilled construction people, there’s a lot fewer, for example, Mexican laborers and people who come in on temporary work visas and so that’s been a problem.

But I think, at the end of the day, the main thing is that the federal government has realized that stimulus, fiscal stimulus works. If we have a recession the way that we did in 2008, it’s not going to take us 10 years to get back up to previous levels of housing production, because it’s been proven empirically that if the government puts money into a weak economy, the economy boosts back. I think that’s a much more powerful thing than interest rates … and that lesson has been learned. So that’s going to have a big, big impact on the housing market.

But I think the key thing here is that you can’t play the housing market directly, can you?

I mean, you buy your own house, maybe you buy a rental property to rent out, but the real money is to be made with what? It’s by getting into the mass housing market in rentals. And here I want to show a chart that shows rental vacancies going back to the 1960s.

We’re basically back to where we were in the 1970s or approaching it.

But since the Great Financial Crisis vacancies have just collapsed and that means that there’s fewer and fewer properties available.

Here’s a chart from ApartmentList.com that shows that 2021 had just basically record rent growth.

I mean, it was up almost 18% in a year compared … look at the previous years. Even in normal times 3%, now that’s not going to be sustainable.

But the key thing is that once rents go up, they tend not to go back down very much. That means that the margins of, for example, real estate investment trusts that own lots of rental housing, apartments, even single family are going to be having nice margins, and they’re going to have attractive yields to the rest of the market if interest rates go up. It’s going to make them nice bond proxies. People are going to want to buy apartment REITs.

Clint Lee: Right. And now you’re bringing up several ways to look at the space and play this. We’ve talked about the homebuilders themselves, you’re bringing up, there’s apartment REITs, there’s REITs out there that focus just exclusively on owning those apartment communities.

There’s a lot of work that we’re obviously doing at The Bauman Letter to look underneath the hood and understand valuations or geographic exposures, whatever the case may be.

I bring that up because it’s very important that if you’re at how to get exposure, a lot of times we think about picking up an ETF. It is very important, especially within the housing sector, to look underneath the hood at what you are actually owning, because you might not be getting exactly what you expect to be getting.

I’ll bring up a ticker XHB, the S&P homebuilders ETF, is a way to get exposure, but there is not a single home builder in their top five holdings. It’s players that supply into that channel. So it’s structure material companies, or it could be a Lowe’s or a Home Depot and you got to go all the way down to stock number seven to actually get a home builder. So that’s something to be aware of.

REITs Are Where It’s At

Ted Bauman: Right. Exactly. So it’s not just the builders, in fact, the builders, as you say, are probably, they’re steady in a way, but they’re going to have cyclical ups and downs. But if you really want the steady long term returns, I still think that the rental REITs are going to be a big deal. I mean, 18% of houses bought in December last year were bought by institutional investors and that includes REITs who buy rental homes to rent out. So 20% of what was available is increasing their stock of units to rent, which means that that’s going to be a good way to exploit the gap between their costs and the rental income that they receive.

But I’m glad you mentioned inputs because here’s a chart that shows lumber.

You mentioned lumber. Lumber traded at around, a reasonable valuation, really, for most of the period after the Great Financial Crisis … had a couple of small spikes, nothing major, but look what happened in 2021.

The big reason for that of course, is that the sawmills shut down early in the pandemic and then realized, oops, people are actually going to want to buy and build houses during the pandemic. So they had to restart, took them time and it fell again.

But now it’s starting to pick up again and it’s picking up because we’re starting to see the impact of global heating on softwood forests in the U.S. and Canada. We’re starting to see pine borer having an impact. We’re starting to see that, even the wildfires that we’ve been seeing have had an impact on lumber supply.

So that’s another way. There are big companies, big REITs that own lumber land. Weyerhaeuser is one, I forget the other one, but there’s a couple of big one that you can also play there.

And again, this is about latching onto a steady long-term growth that’s driven by irresistible demand, unless we’re prepared to see people living under bridges in their tens of thousands in the United States, which I don’t think, that these houses are going to get built, this lumber’s going to get bought. People are going to go to Home Depot and you are going to make money out of housing.

But there’s one more element I think here, and that is there’s still an untapped sector: the actual transaction process. We know about Zillow. We know that Zillow became really big as a valuation platform and doing advertising and all that. It tried to get into the actual buying and selling, really screwed that up and had to get out of it because they just realized that their information was not accurate enough to allow them to do it properly.

Clint Lee: The algorithm went haywire.

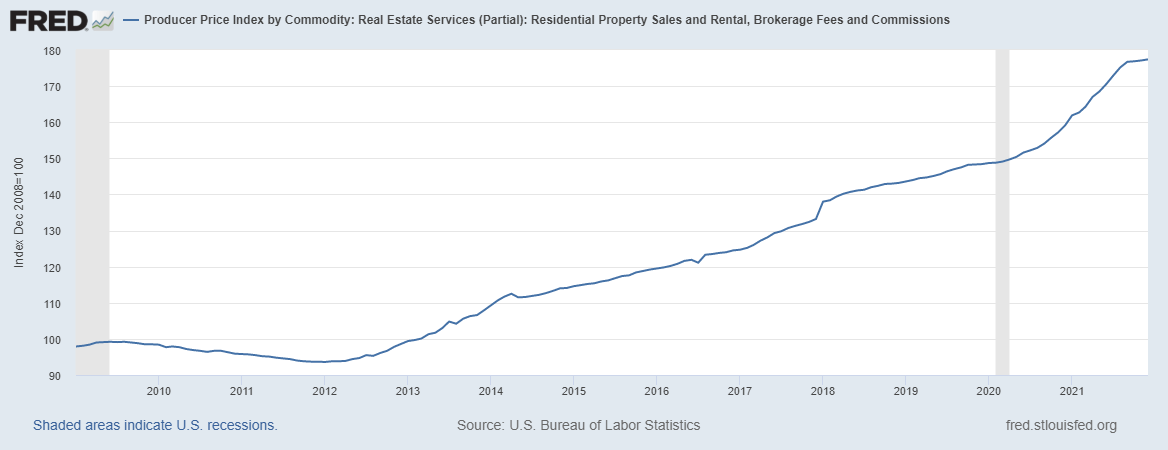

Ted Bauman: But there’s a big one. Here’s a chart that shows the growth in real estate commissions, since the great financial crisis, after falling a little bit, along with the market up until about 2013, they recovered their previous index levels.

But look what’s happened since then. They’ve risen almost 80% since 2013. And that’s in a context of declining home production.

I showed you the chart early, that showed that we weren’t building and selling that many houses … that tells me that there is a market there ripe for disruption. That if people can figure out how to make the transaction process go more smoothly and maybe smaller commissions, but also smaller costs, there’s big money to be made there. And there are some companies out there that you can play that are going to do that for you.

Clint Lee: Right. That’s really the big picture here: with the housing market and the demographic trends in place, the catalyst with interest rates still being low, the underbuilding, there’s the inefficiencies in the transaction process, as you mentioned, there’s a lot of different ways to play this … whether it’s the home builders or suppliers into the channel, with timber companies, there’s technology companies. So you can view this from multiple angles.

And once again, with The Bauman Letter, we have several picks already playing into the space, doing the very things that you were talking about right there, Ted. So once again, if you want to get started with The Bauman Letter, be sure just to check out the link here.

Ted Bauman: Well, I’m actually going to give away a pick that we hold in The Bauman Letter right now, because I don’t see any reason not to … it’s pretty obvious, when I spoke about the potential for disruption in the real estate commissions and transaction sector. We own a stock called Redfin (Nasdaq: RDFN). And right now we’re down on it, because I think, we bought it earlier last year, just before the interest rate and inflation scares pushed down the value of what are perceived to be tech stocks.

But right now, this company is trading at a price-to-sales ratio of 2.27. I mean, for a technology company that has rapidly growing revenues, that is predicting massive revenue growth in the next couple of years, there’s a great opportunity.

So I’m giving it away.

Clint Lee: There you go. All right. That’s it for us today. We’ll see you next week. Thanks everyone.

Good investing,

Angela Jirau

Publisher, The Bauman Letter