Now is a great time of year to be a short-term trader. That’s because seasonal trends are showing buy signals in stock markets around the world.

Seasonal trends are well-known in the United States. In the U.S., traders who follow the advice to “sell in May” know the best six months just started.

However, end-of-year trends exist in markets outside the U.S., too.

Strong Seasonal Trends

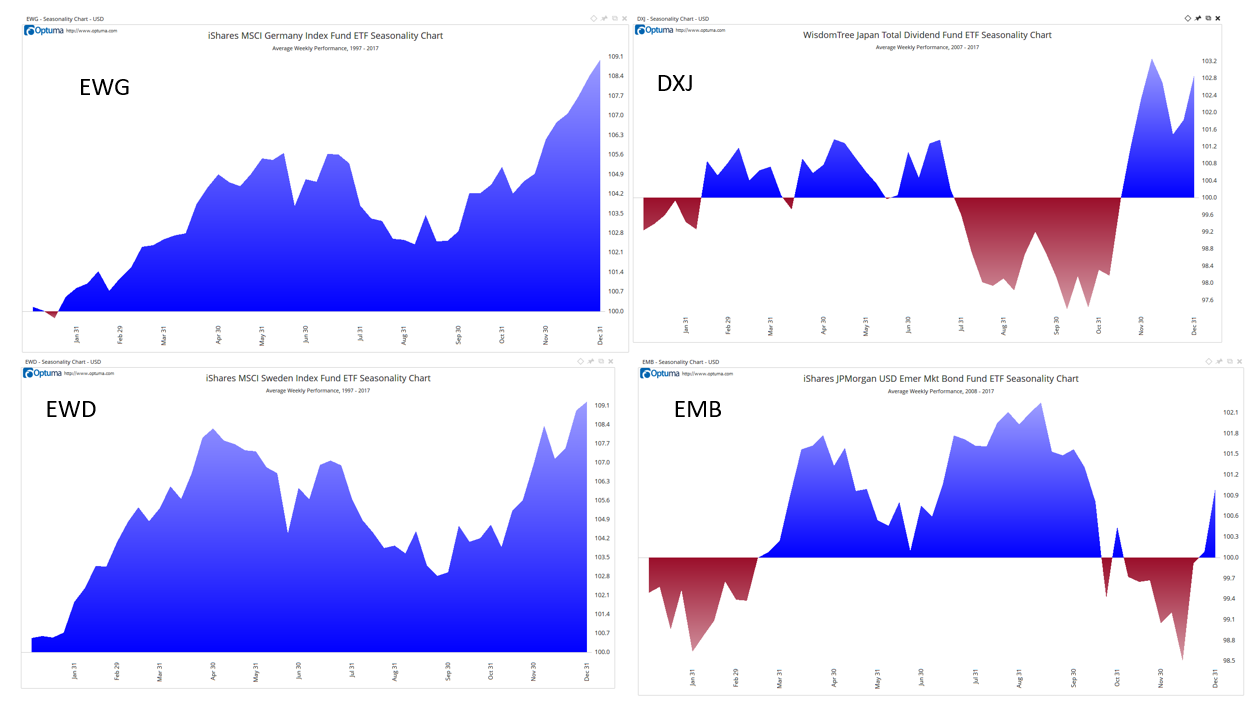

Charts show strong seasonal uptrends are beginning in Germany, Sweden and Japan. ETFs allow U.S.-based investors to benefit from these trends.

An ETF, or exchange-traded fund, is an investment fund that tracks an index. The manager will buy or sell whatever’s required to deliver the same performance as an index.

To find trades, I looked for seasonal uptrends in charts of global indexes. There were many. But not all trends were up. The chart above in the lower right corner shows a strong downtrend.

The chart in the upper left corner is the seasonal trend in the iShares MSCI Germany ETF (NYSE: EWG). This is an ETF that tracks the DAX Index, a benchmark index for German stocks.

I created a simple trading strategy for this and the other ETFs. If the seasonal trend is up and the ETF is above its 200-day moving average, buy call options on the ETF.

A call option gives the buyer the right, but not the obligation, to buy the ETF at a specified price at any time before the option expires. You won’t have to exercise the option to collect a gain. You could simply close the option with a sell order.

Options offer defined risks. You can never lose more than what you paid for the option. This means risks are small in dollar terms since options usually trade for just a few hundred dollars or less.

For EWG, traders could buy January 18 $33 call options for about $100. This is the right to buy 100 shares of EWG at $33 any time before January 18. If EWG trades at $35 before the end of the year, gaining about 6%, this option will deliver a gain of at least 100%.

So, the risk is $100, and the possible gain is more than $100 on the trade. But how likely is it that EWG will gain 6%?

Well, in the past 20 years, EWG gained an average of 9.5% in the last two months of the year. Of the 12 trade signals, 11 were winners (91.7%).

Larger Potential Returns

The iShares MSCI Sweden Capped ETF (NYSE: EWD) is also a reliable trade. Call options expiring in March offer a way to benefit from this trend. In the past 20 years, there were 11 buy signals and 10 winners (90.9%). On average, EWD gained 8.2% in the last two months of the year.

There’s another strong seasonal trend in Japan. Here, the WisdomTree Japan Hedged Equity ETF (NYSE: DXJ) is the best ETF to use. This ETF hedges currency risks and closely duplicates the performance of stocks in Japan.

DXJ gave just four buy signals over the past 10 years, but each one was a winner. The average gain was 8.2%.

There are also some downtrends at this time of year. You can see the iShares JPMorgan U.S. Dollar Emerging Markets Bond ETF (NYSE: EMB) in the chart above in the lower right corner. This ETF has a strong downtrend, falling more than 80% in the last two months of the year.

Put options allow us to benefit from downtrends. They increase in value when a stock or ETF declines in value. Puts also have limited risk, sell for a few hundred dollars or less and offer larger potential returns in percentage terms.

A January put option in EMB offers exposure to the ETF’s expected downtrend.

To learn more about using options to turbocharge your portfolio, you can watch the special video presentation for my Peak Velocity Trader service.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader