What’s The Deal With ARK Innovation ETF?

Great Ones, we talked a lot about ARK Innovation ETF (NYSE: ARKK) this past week. Honestly, I didn’t even plan to talk about ARKK today, but that Michael Burry/Cathie Wood feud kinda lit a fire under my … well, you get the picture.

Now, if you’ve followed along, you already know that Michael Burry — AKA, the Big Short — bought 2,355 put contracts against ARKK in the second quarter. Those puts represent 235,000 ARKK shares, which were valued at $31 million when the position was opened.

As you know, put options are bets that a stock will go down. But Burry’s ARKK puts are now long gone — they expired at the end of the quarter.

Furthermore, there’s no word on whether Burry still holds a sizeable short bet against ARKK.

But the drama still remains, as Burry hasn’t backed away from his months-long assertion that many ARKK holdings have unstable valuations.

That’s enough Wall Street soap opera drama for one week. But what’s the deal with ARK Innovation?

What exactly is ARK, and why is it catching so much flak lately? Inquiring minds want to know.

ARK Innovation: No Covenant Required

Reuters describes ARK Innovation as follows:

Have you ever read anything drier or more boring in your life? Luckily, ARK’s investment theme is much more exciting: disruptive innovation.

Let me hear all those Bold Profits subscribers say: “Hell yeah!”

(Don’t know what I’m talking about? Click here and find out!)

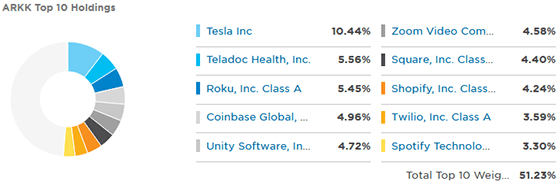

Anyway, disruptive innovation is what ARK Innovation is all about. I mean, just look at the ARKK ETF’s top holdings:

It’s a veritable who’s who of the biggest, baddest disruptive technologies on Wall Street.

You have Tesla shaking down Ford and General Motors. Roku busting up traditional cable TV and streaming — and it’s a Great Stuff Picks holding! Then there’s Shopify, Square and Coinbase … Retail will never be the same with this trio.

Furthermore, I hear a lot of chatter about ARKK not being a diversified ETF. And by traditional standards … it isn’t. There’s no gold. No traditional energy companies. No traditional manufacturers. No traditional consumer goods companies.

No, sir, ARK Innovation is anything but traditional. But I’d argue that this ETF’s holdings are very diversified … for the future. And isn’t that what we’re all investing for? Or should I say … shouldn’t that be what we’re investing for?

I mean, you don’t see anyone talking about tulip futures anymore for a reason. And pretty soon — say, about five to 10 years — you’ll see traditional retail, energy and banking companies suffer the same fate.

You adapt to the disruption, or you die. Just ask Ford and GM about the electric vehicles they said would never go anywhere…

This isn’t your grandfather’s ETF. Heck, it isn’t even your father’s ETF. This is a brand-new ARKK of the covenant, holding the promise of disruptive future innovation … and, most importantly, investing returns.

Caveats & Quid Pro Quos

Now, if it looks like I’m about to recommend buying ARKK … you’re not far off. I really, really want to recommend buying this ETF … and I don’t even like ETFs. They’re coarse and rough and irritating, and they get everywhere.

But ARKK? ARK Innovation I really like. So, why don’t I recommend buying the ETF right now?

Because at least part of what Michael Burry says is true.

As much as I respect Cathie Wood, the founder of ARK Innovation, I don’t believe her when she says stocks aren’t in a bubble.

You can’t have this much easy cash floating around in the system and not have a bubble.

I mean, just look at how the market reacted last week when the Federal Reserve confirmed it’s winding down its market stimulus spending. Red. Red everywhere.

That said, I’ll let you in on a little secret: If your investing timeframe is long enough, buying ARKK right now will still pay out in spades.

Personally? This market bubble thing has me worried about the entry point for buying ARKK. But that’s really my only concern about recommending this ETF right now.

I want you to have the best entry point on every trade I recommend. It doesn’t always work out — see Hyzon Motors (Nasdaq: HYZN) for an example. But I still strive to give you the best investing experience in Great Stuff — for free!

In other words, I think that ARKK — and the market as a whole — is vulnerable right now. But I’ll tell you this: If ARKK drops to $100 or below, buy that ETF right away. Don’t wait for me to tell you. Snap that puppy up. Because for that price, you won’t regret it.

And it just so happens that the current “stock market bubble analysts” believe a 10% correction is coming — which is about how far ARKK would need to fall to hit $100.

Until then … we wait. But you don’t have to wait for the ARKK to flood to get your tech investing fix. Around here, innovative investing has one name and one name only: Paul .

Paul believes the U.S. is on the cusp of this major economic upgrade he calls America 2.0. Check out the details for Paul’s America 2.0 strategy — including how these innovations and technologies are changing the world — by clicking here.

So go on, now, all you tech junkies and funky futuristic fiends!

Thanks for tuning in to the Great Stuff weekend edition, and have a tremendous rest of the weekend, Great Ones!

And if you have that burning yearning that only more Great Stuff can satisfy, you should check out our deets here:

- Get Stuff: Subscribe to Great Stuff right here!

- Our Socials: Facebook, Twitter and Instagram.

- Where We Live: GreatStuffToday.com.

- Our Inbox: GreatStuffToday@BanyanHill.com.

Until next time, stay Great!

Joseph Hargett

Editor, Great Stuff