There is an uptrend that’s forming in coffee, one of my personal favorite commodities.

In the 1990s, java became a national obsession. Upscale coffee houses, led by Starbucks, opened left, right and center.

The fad grew so intense that donut shop coffee beans became mainstream — thanks to Dunkin’ Donuts. Even McDonald’s added a growing list of coffee drinks to sit alongside Big Macs and Chicken McNuggets.

The trend is in our favor to make a quick buck off this beverage of choice.

The Coffee Market Is Heating Up

Our favorite bean became so popular that there are now two ways to invest in it: the iPath Bloomberg Coffee ETN (NYSE: JO) and the iPath Pure Beta Coffee ETN (NYSE: CAFE), launched in 2008 and 2011, respectively.

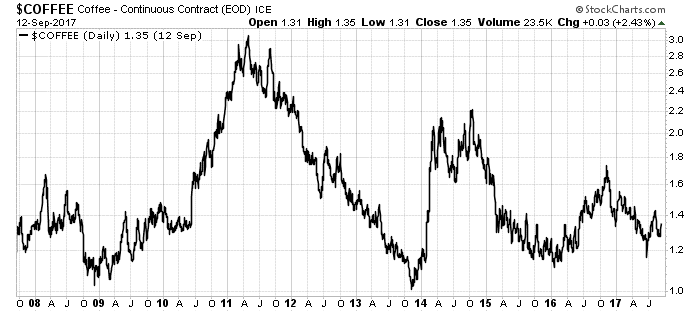

The price of Arabica beans spent nine years in a bull market, from 2002 to 2011, as you can see in the chart below:

In the short term, the commodity price found a tailwind. Right now, producers have locked in prices on the most coffee since 2015. That’s called hedging (locking in a price for delivery, rather than selling for the spot price). When we see extremes (high and low), it gives us a sign of the direction of a trend.

When everyone is on one side of the boat, we want to be on the other side.

In this case, everyone believes that the price of coffee is going down, so they locked in a price. The price is up 5% since September 6 … and should continue rising. With so much production locked into contracts, that means supply for spot markets will be thin.

That’s good for the spot price, which could go up.

In fact, the consensus estimate is a climb of another 5% for Arabica bean prices over the next year. I believe that’s conservative.

The short-term volatility should give us a double-digit move in the short term. This isn’t a slam-dunk, huge gain, but the sentiment extreme and the traders’ forecasts line up for a solid gain.

If you are looking for a short-term trade, pick up some JO or some CAFE. If you make 10% or 20%, cash out. And be sure to catch some of the other bull markets that I’ve identified for trading, such as lithium and gold.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist