The men and women of Iron Workers Local 17 literally built Cleveland’s skyline.

If you happen to go to the Rock and Roll Hall of Fame, catch an Indians game at Progressive Field, fly into Cleveland’s airport, drive across its bridges or visit the convention center…

The members of the local union built the steel spines of all those structures and many more.

And what might they receive as thanks for a hard and dangerous job well done?

Looming cuts in their pension benefits.

Welcome to the first of many such battles in the great American pension rollback of 2017 and beyond…

It’s a trend that our Jeff Opdyke, editor of Total Wealth Insider, warned us all about.

In order for pension plans to stay solvent and meet their payout obligations to retirees, they need steady, low-risk investment returns of around 7% to 8% a year.

Those rose-tinted assumptions might have seemed perfectly reasonable 20 years ago when interest rates and economic growth were a lot higher.

But, as we all know, that’s not the case now.

Imminent Danger of Insolvency

Jeff called the pension problem a “great disaster in waiting.” But for Cleveland’s local union of about 2,000 active and retired ironworkers — the waiting is over.

It’s here, now.

The ironworkers’ pension plan administrators said the fund was in “imminent danger of becoming insolvent.”

You can figure out the math yourself when I tell you that the local union has roughly 700 active members, but almost twice as many retirees.

So later this week, the entire membership, active and retired, will vote — and face an excruciating choice:

- Save the fund by approving an average 20% reduction in their pension benefits … some members would face much bigger cuts — as much as 50% to 60% in some cases.

- Reject the proposed cuts — and watch their pension fund run out of money by 2024.

This will be the first-ever test of the Pension Reform Act, approved by Congress in late 2014. The bill allows proposed cuts in “multiemployer” pension plans (an ironworker, for example, might work for numerous contractors and developers over several decades of work) to be put up for a membership vote if there’s a danger of a pension fund’s insolvency.

Neither of the above choices is a good one. Which would you choose?

Open the Floodgates

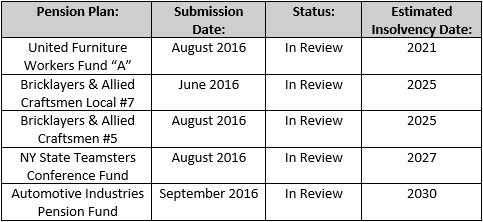

The scary thing is, according to data from the U.S. Treasury Department, there are five other multiemployer pension funds asking for government permission to do the same thing, and no doubt dozens more waiting in the wings:

“This could just open the flood gates,” was the way one pension rights expert put it to the Washington Post regarding the ironworkers’ pending vote.

And what about the federal government’s Pension Benefit Guaranty Corp. (PBGC)?

The PBGC, after all, was created in 1974 to serve as a backstop for private pensions.

But the “guaranty” part comes from private companies that pay an insurance premium (roughly $27 a worker right now) into the PBGC so the agency can meet any and all pension insolvencies in the future.

At least that’s how it works on paper.

The problem? The agency says it needs more than $60 billion to cover the expected tide of insolvencies over the next decade. Congress would need to hike companies’ PBGC insurance premiums by more than 300%!

Good luck there.

It points out a stark fact that we talk about again and again here. Whether we’re talking about gold, overseas real estate, international stocks or a second passport — they all represent ways to reduce uncertainty and risk to your wealth. As the ironworkers’ pension problems show, there are no “guarantees” in the financial world.

Kind regards,

JL Yastine

Editorial Director