I believe this article will surprise you.

But first, some background…

The S&P 500 Index is on a roll.

On Monday, August 24, it closed above 3,400 for the first time ever.

That was a big deal. The market closed at 3,386 on February 19. That’s was its all-time high at that point.

Closing above that old high in August was a sign that this market has strength.

And then it did it again. It closed above 3,500 less than a week later.

Now, the surprising part.

We’ve seen a huge move in the S&P 500 Index since March. But the S&P 500 Index only includes big stocks. The median market cap of the group is $24 billion.

It may surprise you to learn that there’s a group of stocks that have done even better. Read on to learn which ones…

It Pays to Stratify the Market

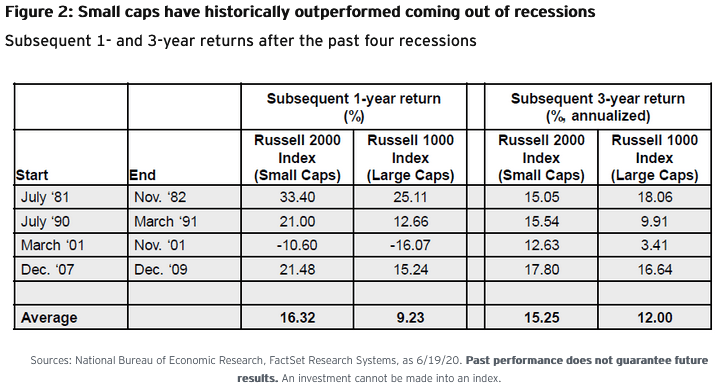

Asset manager Invesco did a study.

It compared small-cap stocks in the Russell 2000 Index to their larger peers in the Russell 1000 Index.

(These two indices comprise the Russell 3000 Index. It includes 98% of the investable stocks in the U.S. market.)

A solid rule of thumb is that small caps have a market cap between $300 million and $2 billion. Large caps have a market cap of $10 billion or more.

Invesco found that after a recession, small-cap stocks do better than large-cap stocks.

Take a look:

(Source: invesco.com)

In seven of the eight time frames, small caps did better than large caps.

The only period it didn’t happen was the three-year stretch after the early ‘80s recession.

Where We Are Today

That is great news for us.

You see, the Federal Reserve Bank of St. Louis President James Bullard just said the U.S. economic situation is improving:

(Source: Springfield Business Journal)

If the recession is over, small caps should outperform their larger peers.

Or, we should say, continue to outperform them.

As you can see in the chart below, they have bested large caps since the market bottomed in March:

(Source: Bloomberg, internal calculations)

This chart shows the Russell 1000 divided by the Russell 2000. When the line is trending up, that means large caps are outperforming small caps.

However, since mid-March, small caps have taken the lead.

This should continue.

Small caps tend to do better after recessions. And Bullard says that’s exactly where we are right now.

He also said the third quarter should be “one of the best quarters ever for economic growth in the U.S.” And he expects to see more of that growth in the fourth and first quarters as well.

Wrapping Up

It may seem strange. We only hear about large caps.

And you may know the largest names make up the bulk of the market.

The top-five stocks comprise 25% of the market cap of the S&P 500 Index. They’ve done well, no doubt.

But history suggests small caps will outperform going forward.

I encourage you to pay attention.

Ian King will have a special webinar on small caps a few weeks from now. It will be the perfect chance to learn more about some of the best opportunities in this space.

We’ll have more information about how you can sign up in future Smart Profits Daily articles.

Good investing,

Editor, Profit Line