Check this out…

There’s a pair of Louis Vuitton x Nike sneakers on auction right now for $80,000.

That may seem like a crazy amount of money to pay for some fancy shoes.

But if you’ve been following the sneaker market the past few years, you may not be surprised.

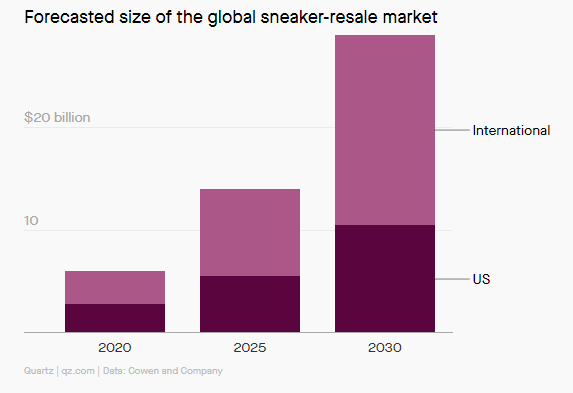

Investment firm Cowen estimates the global sneaker resale market was worth about $6 billion in 2020.

It expects the market to more than double by 2025. And it could reach $30 billion by 2030.

That’s 400% growth in a decade!

(Source: Quartz.)

As it stands, Nike and other sneaker companies don’t make any money from resales.

But thanks to the metaverse, that’s about to change…

Welcome to Nikeland

Nike is partnering with game developer Roblox and blockchain firm RTFKT Studios to create Nikeland.

Visitors to this virtual world can play classic games like tag and dodgeball with their friends.

Nikeland also lets you customize your playing field and even make up your own sports.

Another aspect of Nikeland is players can buy digital sneakers and other Nike products for their avatar.

Basically, Nike wants to sell NFTs.

This is a game-changer for several reasons:

- NFT creators can get a royalty every time their NFT is sold on the blockchain. That means Nike could take a 5% or 10% cut of the resale market.

- Digital content is cheaper to make and sell than physical goods.

- “Sneakerheads” — superfans who buy and trade sneakers — can easily and quickly make transactions on the blockchain.

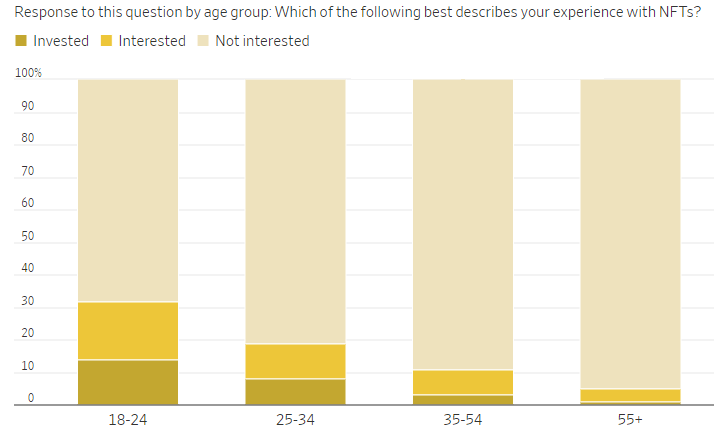

Plus, Nike mainly caters to young people ages 15 to 34. This group also has the most interest in NFTs.

The NFT Market Skews Young

(Source: CivicScience.)

We’ve already seen that limited-edition sneakers can fetch high prices.

The Louis Vuitton auction is just the latest example of that.

So, it’s not hard to imagine exclusive Nikeland sneakers getting a lot of attention.

We might even see virtual sneakers sell for much higher than $80,000.

Digital Merchandise Is the Next Big Thing

Nike is far from the only retailer getting into digital merchandise.

Under Armour sold sneaker NFTs in December for $333.

One of them went for over $20,000 in Ethereum on the OpenSea market.

Adidas’ “Into the Metaverse” NFTs sold out within hours when they debuted last month.

The sportswear giant made $23 million from the sale.

And Gap started selling hoodie NFTs a few weeks ago.

Collectors who bought an “Epic level” Gap NFT will also receive an exclusive physical hoodie.

Even Walmart, the world’s largest retailer, is getting into the metaverse.

The company just filed trademarks to sell virtual items such as furniture, electronics and toys.

It also plans to create its own digital currency.

Check Out Ian King’s Metaverse Play

It’s an exciting time for e-commerce, NFTs and the metaverse.

If you’re looking to invest in this trend, Ian King recently recommended a metaverse stock to his Strategic Fortunes subscribers.

You can learn more about Strategic Fortunes by clicking here.

Regards,

Assistant Managing Editor, Banyan Hill Publishing

Morning Movers

From open till noon Eastern time.

Vistas Media Acquisition Co. Inc. (Nasdaq: VMAC) is a special purpose acquisition company that is set to take Anghami, a Middle Eastern music streaming platform, public. It is up 47% today after Anghami rang the opening bell at Nasdaq to celebrate its approval for listing on the exchange.

Lightning eMotors Inc. (NYSE: ZEV) designs, manufactures and sells electric vehicles. The stock is up 16% after the company struck a deal with General Motors to electrify its medium-duty truck platforms.

Modine Manufacturing Co. (NYSE: MOD) provides engineered heat transfer systems and heat transfer components for HVAC systems, heavy duty equipment and vehicles. The stock rose 14% after it beat both earnings and revenue estimates for Q3.

DXC Technology Co. (NYSE: DXC) provides information technology services and solutions globally. It is up 12% after it posted a Q3 earnings beat and gave Q4 and full-year guidance that exceeded analyst expectations.

T-Mobile US Inc. (Nasdaq: TMUS), the telecom giant, is up 11% this morning. The company managed to shake off fears of industry competition by reporting strong results for Q4 and by providing guidance for 2022 that improves the outlook for the company.

Alpha Metallurgical Resources Inc. (NYSE: AMR) is a mining company that produces, processes and sells coking coal. It is up 9% as part of a broader market move in certain U.S. coal stocks as the price of coking coal rises.

Redwire Corp. (NYSE: RDW) is a space infrastructure company that develops, manufactures and sells mission-critical space solutions and components. The stock is up 9% after the company announced preliminary revenue figures for 2021.

Phunware Inc. (Nasdaq: PHUN) provides an integrated software platform that equips companies with the products, solutions and services to engage, manage and monetize their mobile applications. The stock is up 8% on a rebound following a drop caused by a shelf registration filing for the issuance of additional stock and warrants.

Skyline Champion Corp. (NYSE: SKY) offers manufactured and modular homes, park model RVs, accessory dwelling units and modular buildings. The stock is up 7% after the company managed to beat estimates for Q3 despite supply chain challenges.

Humana Inc. (NYSE: HUM) is a health insurance company that offers medical and supplemental benefit plans to individuals. It is up 6% after it produced strong Q4 earnings that were supported by membership growth and higher premiums.