Consider this everyday scenario: You shop at a grocery store and pay with a credit card.

It seems like your payment is instant. But in reality, it can take up to three business days to process.

That’s because it’s not just you and the merchant involved in this transaction.

Typically, there are five entities involved.

You, the merchant, your bank, the merchant’s bank and the credit card network.

The process isn’t just lengthy. It’s also expensive.

Each entity charges fees that ultimately come out of your pocket.

But imagine a system where it’s just you and the merchant. And it’s instant.

The Federal Reserve is already thinking about this.

Digital Currencies Can Make Life Easier for Americans

The Fed recently released a report on a central bank digital currency (CBDC).

A CBDC works exactly like cryptos by using blockchain technology.

The key difference is that a CBDC is controlled by a single entity — the central bank.

In other words, it’s still the same U.S. dollar, just in a digital form.

The Fed’s report highlights the advantages of this approach.

For one thing, it could help the 7.1 million unbanked Americans.

With a CBDC, the Fed would set every person up with a digital wallet.

This simplifies things when paying at the grocery store.

The money would go directly from your digital wallet to the merchant’s in seconds.

And without all the middlemen involved, it would be cheaper.

These digital wallets would also make it easier for the government to help the public.

Take the example of the stimulus checks at the beginning of the pandemic.

There would be no more waiting for the checks to arrive via mail or be processed through banks.

It would just be an instant transfer straight to your digital wallet.

How the Dollar Can Remain the World’s Reserve Currency

The merits of adopting a CBDC go beyond helping the public.

A U.S.-issued CBDC could preserve the dominant international role of the U.S. dollar.

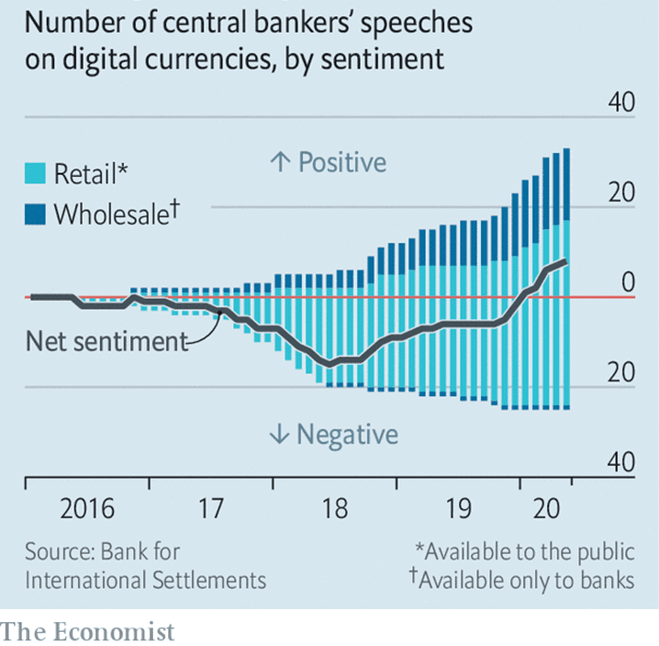

Central banks around the world have discussed CBDCs for years.

And recently, these discussions have taken a positive turn.

So, it’s no surprise that 91 countries expressed an interest in CBDCs.

Most are in the research phase like the U.S.

Some, like the Bahamas and Nigeria, have already established a CBDC.

But what puts pressure on the U.S. is its economic rivals.

For example, China is so far ahead that it’s already launching pilot programs.

However, despite the sense of urgency, the Fed stressed the importance of getting it right.

That’s why it has opened up a public comment period until May.

You now have the opportunity to voice your opinion on CBDCs.

You can check out and comment on the Fed’s report here.

And keep following us at Winning Investor Daily as we continue to track the Fed’s moves on this.

Regards,

Research Analyst, Strategic Fortunes

Morning Movers

From open till noon Eastern time.

S4 Capital PLC (OTC: SCPPF) operates as a digital advertising and marketing services company worldwide. It has no specific news to report. Rather it is up 20% as part of a broader climb in U.K. stocks ahead of the Bank of England’s interest rate decisions tomorrow.

Allegheny Technologies Inc. (NYSE: ATI) manufactures and sells specialty materials and components to various industries. It is up 18% after reporting Q4 earnings and revenues that topped estimates thanks to a recovery in the aerospace industry, which is a major segment for the company.

TeamViewer AG (OTC: TMVWY) develops and distributes remote connectivity solutions for enterprises. The stock is up 15% after it announced a share buyback program following strong profitability and cashflows in Q4.

Pharming Group N.V. (Nasdaq: PHAR) develops products for the treatment of rare diseases and unmet medical needs. It is up 10% on positive results from a pivotal phase II/III study of Leniolisib, its treatment candidate for APDS, a rare primary immunodeficiency disease.

Environmental Impact Acquisition Corp. (Nasdaq: ENVI) is a special purpose acquisition company that is up 10%. The move came after its business combination with Greenlight Biosciences was approved by shareholders, allowing Greenlight to go public on Thursday under the ticker GRNA.

SIGNA Sports United N.V. (NYSE: SSU) operates sports e-commerce sites in Germany and is up 10% today. It is one of the many European stocks that staged a recovery on strong earnings from U.S. companies this week.

NGL Energy Partners LP (NYSE: NGL) engages in the crude oil and liquids logistics and water solution businesses. The stock is up 10% after it announced a collaboration with XRI Holdings, a produced water recycling company, to increase recycled and reused water volumes.

IceCure Medical Ltd. (Nasdaq: ICCM) develops and markets minimally invasive cryoablation systems for women’s health and oncology markets. It is up 8% after analysts at Brookline Capital initiated coverage on the stock with a buy rating.

IStar Inc. (NYSE: STAR) is a real estate investment trust company that is up 8% this morning. The stock rose on the news that it is selling a portfolio of its owned and managed net lease assets for $3.07 billion to a unit of the private equity firm Carlyle Group.

Alphabet Inc. (Nasdaq: GOOGL), the online search and advertising giant, is up 8% today. The stock is up after beating Q4 expectations and announcing a 20-for-1 stock split.