Editorial Director’s Note: Hope you all had a wonderful New Year. We’ve officially stepped into 2019, and in the spirit of transitions, I’m excited to announce that you’ll now be able to follow Michael Carr’s expert analysis in our other daily publication, Sovereign Investor Daily. Be sure to continue tuning in there to discover what he sees for the market ahead. — Jessica Cohn-Kleinberg

Recent stock market action indicates either a pullback or the beginning of a bear market. Investors are worried and searching for clues.

Unfortunately, many of the clues point to a bear market.

Those clues include many momentum indicators for stocks. Breadth indicators tell analysts to expect more declines. Financial media reports focus on these indicators.

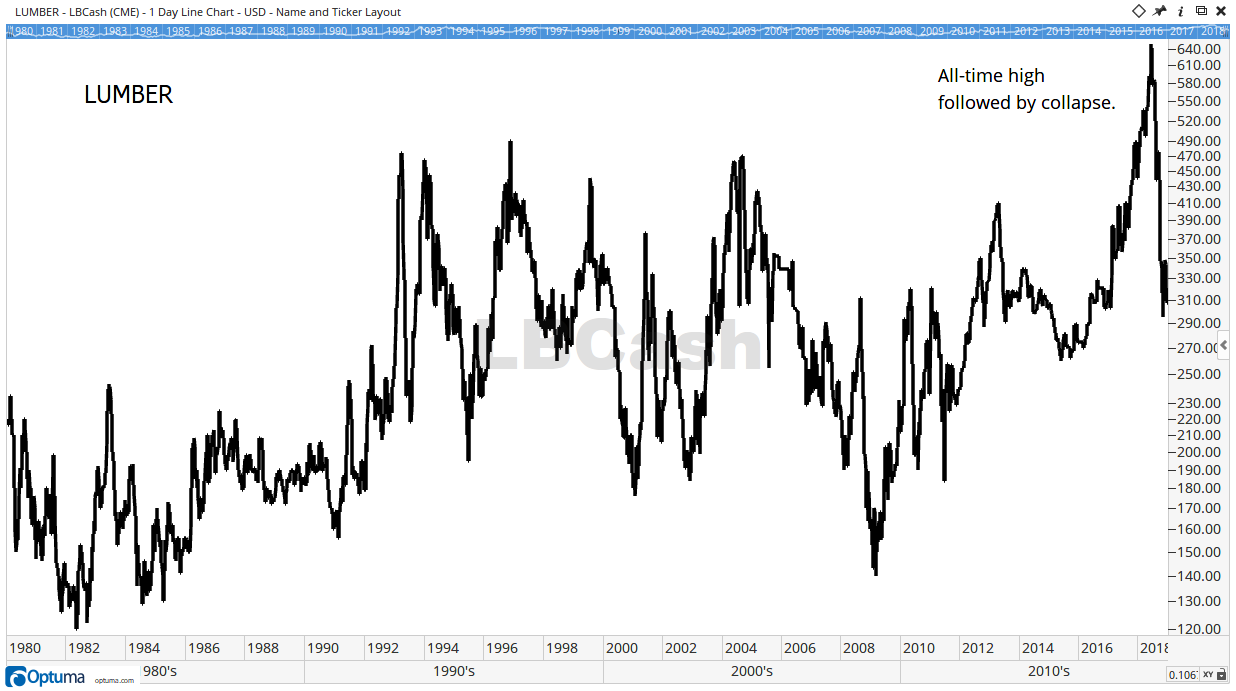

One story some analysts are missing is the price of lumber. After surging to a new all-time high in May, futures prices fell 48% by the end of the year.

If analysts notice lumber, many blame weakness in commodity markets. A benchmark index, the Bloomberg Commodity Index, fell 13% last year.

It is possible lumber was simply among the worst performers in a bad market.

But lumber should be up. The news was bullish.

Tariffs on Canadian wood pushed prices up in the first half of 2018.

Wildfires and hurricanes destroyed acres of woodlands, crimping supply.

A beetle infestation in British Columbia added to supply concerns.

Bad news pushed prices to new highs. Then prices collapsed.

Tariffs Are Bad News for Markets

Tariffs contributed to the decline.

Suppliers and users knew tariffs were coming. Both rushed to get ahead of the news.

Suppliers rushed lumber to market as users ordered as much as they could before tariffs hit.

In part, the price collapse reflects oversupply that developed because of tariffs. This is one of the reasons the decline in lumber shows 2019 could be difficult for the economy.

Tariffs and the threat of tariffs distort behavior. Both suppliers and consumers react irrationally and unpredictably. Wild price swings are one result of the irrational behavior.

Unpredictable prices drive other patterns of behavior. Some buyers wait for more stable times. This dampens economic output.

Other buyers rush their orders. If too many buyers do this, it results in inflation.

Rushed orders also reduce economic output when inventory levels increase too much. That leads to wasted capital.

The problem is no one knows which behavior will dominate in advance.

In lumber, supplies built up in lumber yards. But consumers are deferring purchases of homes because prices are too high.

The result is pressure on many small businesses that have too much inventory. There is also pressure on small businesses employing craftsmen who would build homes if prices were lower.

In this case, low lumber prices will not be enough to resurrect home building. Builders are wary of price swings in raw materials and must estimate contracts based on higher prices.

Consumers are worried about overpaying after seeing home prices crash a decade ago. They’re now unwilling to buy at current prices.

Unpredictability Is Rising

This is the first stage of what could become a housing crisis.

And lumber is just one commodity that is more volatile than usual.

Threats of tariffs are affecting farmers and businesses associated with grain. This is a large part of the Midwest.

Industrial companies are concerned about tariffs. So are consumers. The result could be a spiral in prices and a decline in the economy.

It’s possible the economy will survive 2019. But that’s only possible if businesses know what to expect.

In the current climate, unpredictability is rising. That points to problems.

For now, expect a bear market unless policies in Washington, D.C., become clearer.

Regards,

Michael Carr, CMT, CFTe

Editor, Peak Velocity Trader