Here’s a hypothetical example…

Let’s say you rent your home, and you love it. So much so that you signed a three-year lease when you moved in.

In addition, your landlord agreed to include a rent-to-own clause in the contract if you committed to that length. That clause allows you to buy the house for $300,000 at the end of the three-year period.

The purchase price was based on market value at that time. Real estate has jumped, though. Today, the estimated value of the home is $400,000.

That option has a lot of value.

At the end of the third year, you could continue to rent, or you could buy the house outright … with $100,000 or more of equity.

That’s a big deal.

Would you believe it if I told you that you could buy stocks below market, too?

You can … by selling put options.

Why Selling Put Options Makes Sense

A put option gives you the right to sell a stock at a given price on or before a given date.

If you sell a put and shares are trading above the strike price at expiration, you get to pocket the premium you receive when you sell the put.

If you sell a put and shares are trading below the strike price when it expires, you can buy the put back … sometimes at a loss.

Or … you can buy the shares. That’s what we want to do.

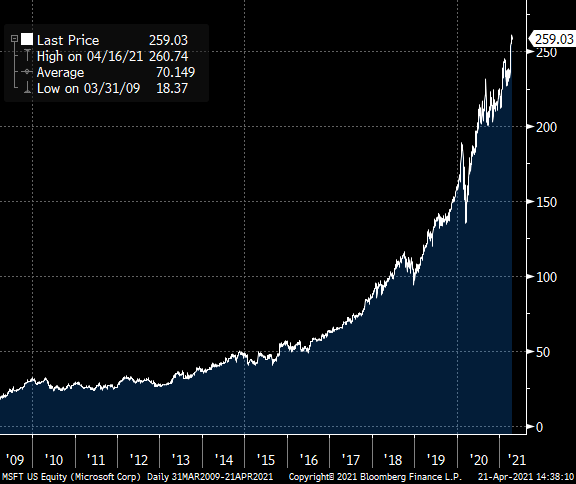

Let’s say you want to buy 100 shares of Microsoft Corp. (Nasdaq: MSFT). You’ve got some extra cash, and you know the stock tends to go up:

MSFT: 2009–2021

You expect shares will be trading around today’s price — about $259 — in a month.

You could sell one $260 put option for about $8 today:

If you do, you can choose to buy back the put at any time.

But if shares are trading at their current price ($259) in a month, you could also choose to buy 100 shares of MSFT for $260 each.

That may sound like a bad deal, but remember that you sold the put for $8.

That means your net purchase price wouldn’t be $260. It would be $252.

You would buy MSFT shares for about $7 less than the current market price.

And that’s just one example. You can do that with any stock you want as long as it offers options.

Take This 1 Step Further

Imagine the possibilities with this.

There are some stocks out there that are super volatile. That means their put options are even more expensive than Microsoft’s. Since you’re selling the put options, that’s good for you.

Or you may believe that certain stocks are cheap right now. The beauty of this strategy is you can buy them even cheaper.

What about analytics firm Palantir Technologies Inc. (NYSE: PLTR)? Do you believe in this name?

It’s currently trading near $22. And it’s been as high as $35.

Many are worried about this stock. They think it’s overpriced. But you may not.

Or you may simply want to buy it and hold it for the long term. You may think the quality of the company’s technology will eventually push its stock price higher. This strategy is super useful for that.

A $23 May put on PLTR is about $2 today:

If you sell this put for $2, and shares are trading below $23 on May 21, you could buy PLTR shares for a net price of $21!

That’s nearly 7% less than its current price.

The Downside

The only downside to this strategy is you may not get a chance to buy the shares.

That can happen if they’re trading above the strike price at expiration.

In the above example, you’ll miss out on buying the stock if PLTR is trading above $23 when the option expires.

That said, if the stock is above the put price, you still get to keep the $2 you sold it for. And you can sell another set of put options if you’d like.

You really don’t lose.

I encourage you to look into this strategy today.

Good Investing,

Editor, Profit Line

P.S. Selling puts is a straightforward option strategy.

My colleague Mike Carr has another simple way to trade options.