“When you have an itch, scratch it.”

The above seems obvious to us. Of course, if your leg itches, you’ll scratch it.

Interestingly, though, we often don’t pursue things that make common sense in the stock market.

For example, we have tremendous job growth in the U.S. today.

The Bureau of Labor Statistics (BLS) says our unemployment rate is down to 4.1 %. That’s the lowest it’s been in more than 17 years.

The head of the UCLA Anderson Forecast just spoke about this strength at a San Francisco economic conference. “We are just growing like crazy in California. California is at full employment.”

But it’s not just Silicon Valley. My brother-in-law told me this weekend there is about 2% unemployment in the Midwest town where he lives.

Jobs are available to those who want them.

Given our current employment strength, there is a group of stocks that common sense suggests you should consider.

Shares of staffing companies are strong today. You may be familiar with names like Manpower and Kelly Services. These companies offer a broad range of staffing services.

And there’s one company in this sector I like even more…

A Subset of the Industry

Health care staffing companies are in demand right now. Specifically, I believe Cross Country Healthcare Inc. (Nasdaq: CCRN) offers at least 20% upside over the next year.

My reason for this is twofold. The fundamentals of Cross Country are compelling. Plus, insider activity supports the thesis.

Cross Country provides health care staffing services in the U.S. It can provide nurses, doctors or those who provide allied (related) services across the country.

Given the shortage of people in these roles — especially nurses — providing temporary employees to a health care system in need is a big deal.

It is also seeing strong growth helping schools find health care educators.

The unemployment rate in health care is even lower than the broader economy. The BLS reported a 2.4 % rate in this sector last month. That is the lowest since April 2001.

That means companies like Cross Country are busy.

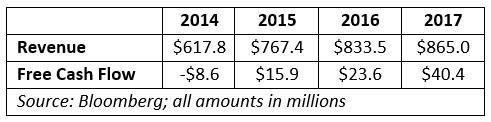

And over the past few years, it has done a solid job of turning its growing revenue into cash. Take a look at the growth of its sales and free cash flow since 2014.

Free cash flow reflects cash from operations less capital expenditures. Cross Country generally doesn’t have large expenditures, so the increase also shows the company’s cash creation growth.

It Pays to Watch Management

In addition, we have another reason to like Cross Country stock at these levels.

Its CEO, William Grubbs, buys stock on the open market from time to time. This means he uses his own money to buy shares. The shares aren’t from stock options or other grants.

Since 2014, his firm’s stock is up 41% on average during a year after he buys. The stock hasn’t finished the next 12 months lower after his five purchases.

There’s no guarantee this will happen again. But don’t doubt the power of common sense. Who knows more about what to expect from a company than the person at the top?

Grubbs just spent more than $100,000 buying his company’s stock (today he owns more than 350,000 shares). It was his first open market buy in a year and a half.

I suggest you look into shares of Cross Country Healthcare today.

Good investing,

Brian Christopher

Senior Analyst, Banyan Hill Publishing

Editor’s Note: $34.6 billion will start being paid out next month. Those who hesitate will miss their chance to be a part of the biggest cash grab in U.S. history. How much you collect will be up to you — you could make $1,000 a month … $10,000 … maybe even $100,000! But to claim your full share, you must get started right away! To find out how to stake your claim on a piece of the $34.6 billion payout, click here now.