Crypto FUD Mucking

It’s time to break out your Great Stuff decoder rings!

No, it’s not time to drink more Ovaltine. It’s time for Reader Feedback! And where we’re going, we’re gonna need decoder rings, Great Ones. I’m talking stablecoins, FUD, FOMO, hodling and more!

What is that … Elvish? It’s like a whole other language! You didn’t just reread Lord of the Rings again, did you?

No, Great Ones, it’s not Elvish. It’s crypto-speak, and we’ll get into that momentarily. But first…

Reader Feedback is the day we reach deep into the Great Stuff mailbag and answer your burning questions.

Got questions on the market, stocks, options, cryptocurrencies and investing? Want to rant about the ridiculousness of the bourbon secondary market? (Don’t get me started…)

Well, today is your day! Obviously, if you didn’t write in to GreatStuffToday@BanyanHill.com, today isn’t your day. But you can fix that by dropping us a line right now!

All right, we have a lot of ground to cover, so let’s dive right into today’s featured presentation:

Hey, Mr. Great Stuff,

I love your newsletter. It’s one of only a few that I read every day, and I have come to trust your judgment.

One of the other newsletters (no need to name them here) is pushing hard on the idea that the cryptocurrency market is going to experience a cataclysmic crash in the near-to-mid-term future. Not because of regulations or cybercrime, but because Tether is on the brink of failure.

The thesis is that Tether’s USDT stablecoin is integral to the entire cryptocurrency ecosystem. The company is very shady (unable or unwilling to produce a financial audit for years), and is likely up to its eyeballs in near-worthless commercial paper from heavily indebted Chinese real estate developers, rather than the liquid assets it claims to have on hand. Among other things.

He compares Tether to Lehmann Brothers in 2008, on a smaller scale, but with no government bailout coming behind its imminent failure. When it goes down, he posits, so will the whole crypto ecosystem.

Here’s another article that makes similar points and adds in other concerns, such as Tether having no physical offices, the CEO and CFO appear to be ghosts, and shady answers to questions about Tether from their close business partners.

I’ve been on the fence about investing in crypto, but this analysis has me very skittish — to the point of considering shorting affiliated stocks. Since you’re on the bullish side of crypto, I would love to hear your take. Is it all FUD or fake news?

— Rich V.

Thank you so much for writing in, Rich! It’s Great Ones like you that make Great Stuff … well, great.

I’ve reached out to a special guest today to answer your question, because this one goes deep down the cryptocurrency rabbit hole. But before we get to that, let’s review some crypto-speak for our out-of-the-loop readers:

Stablecoin — A stablecoin is a cryptocurrency designed to have its price pegged to fiat money (such as the U.S. dollar), an exchange-traded commodity like gold or oil, or even another cryptocurrency. This price pegging (get your mind out of the gutter) makes stablecoins more … you guessed it … stable.

FUD — Fear, Uncertainty and Doubt. This is a term used by crypto traders to describe anyone spreading fear or misinformation to cause a coin to drop in price.

Tether (USDT) — USDT is a stablecoin cryptocurrency originally designed to be tied to the price of the U.S. dollar. It has since changed its backing to include loans to affiliated companies.

USD Coin (USDC) — USDC is a stablecoin cryptocurrency actually backed 1-to-1 by the U.S. dollar and runs on the Ethereum crypto platform.

Crypto’s Dyer Mak’er

Now that everyone’s mostly caught up, Rich, let’s welcome our guest crypto guru for today: Paul ’s right-hand man and editor of Crypto Flash Trader, Ian Dyer!

Hello, Rich!

I believe there’s reason to doubt that Bitfinex/Tether is being completely honest in what they’ve said about what’s backing their stablecoin.

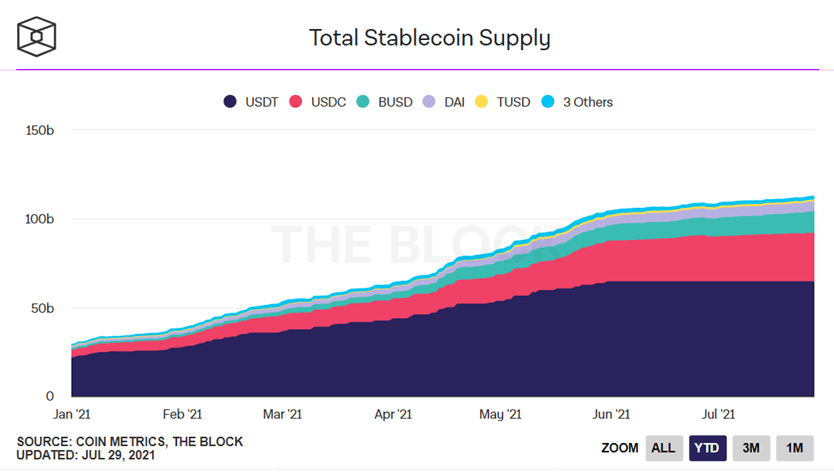

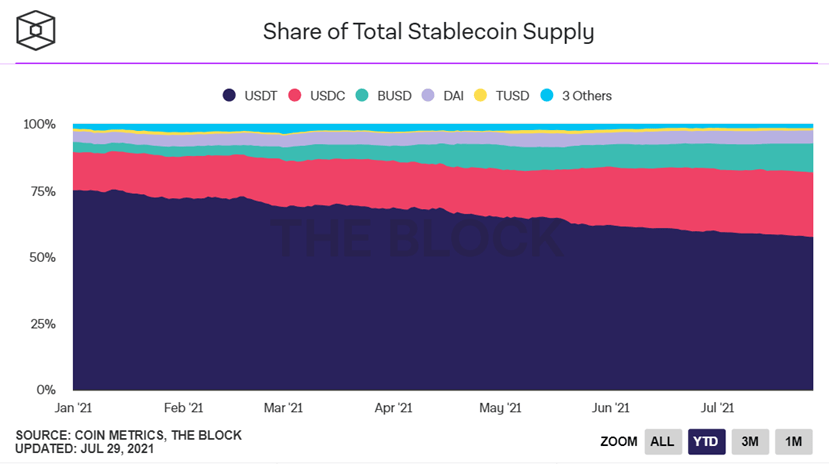

However, with any FUD, the knee-jerk reaction is always to assume a worst-case scenario. And based on what’s going on in the market, I don’t think a worst-case scenario is the most likely outcome. The market is telling us that demand for USDT is waning rapidly, and USDC is set to replace it as the most widely used stablecoin.

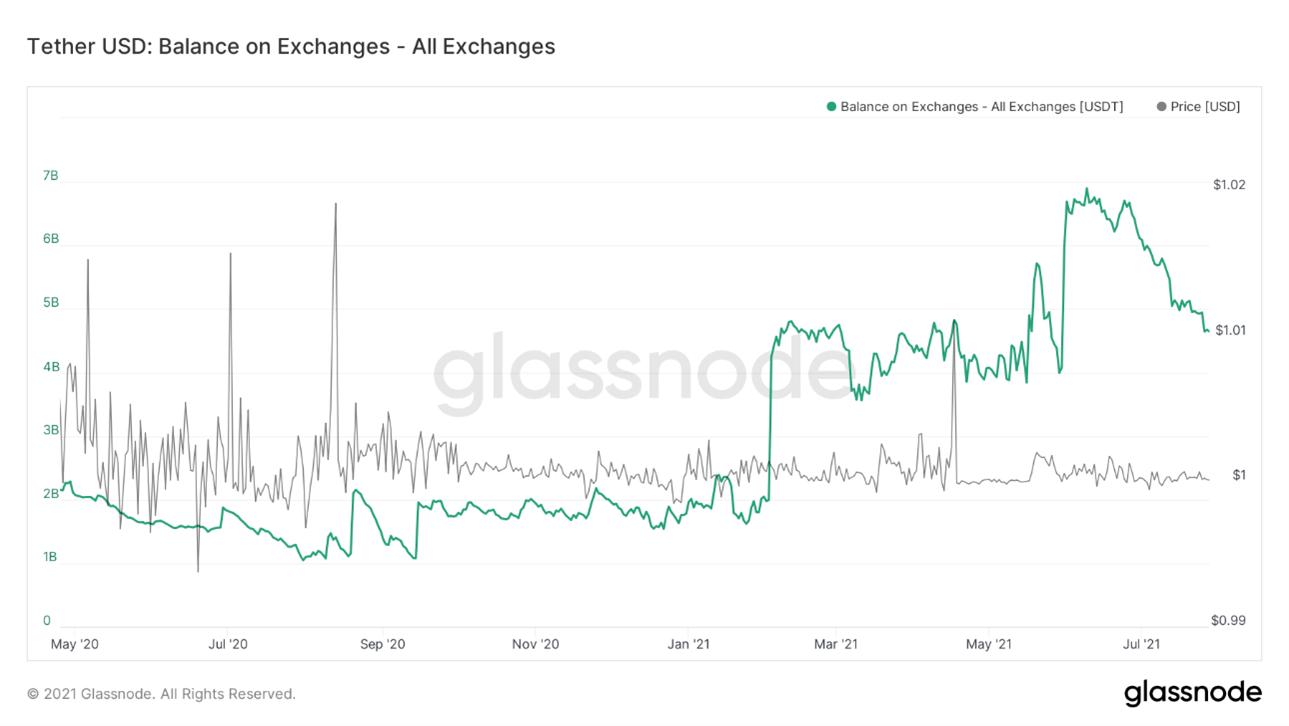

New Tether “minting” has come to a halt with no new coins being put into circulation since May 31:

Since then, USDT’s market share has dropped from 75% to 57.42% as of July 28:

The amount of Tether on Ethereum is only 2% of the crypto market, as Ethereum is focused on making USDC their top stablecoin. Right now, there’s $26.5 billion USDC on Ethereum vs. $30.91 billion USDT. (Source: https://www.theblockcrypto.com/data/decentralized-finance/stablecoins.)

Demand for USDT from centralized exchanges is plummeting…

…while demand for USDC is skyrocketing.

OK, Rich. Since you’re clearly a longtime hodler, Ian’s answer likely made a lot of sense to you and probably answered your question. For everyone else, let me break Tether down a bit further as to why this is a concern in the first place.

You see, banks don’t like cryptocurrencies. In fact, most banks won’t exchange crypto for cash. This is where Tether, or USDT, comes in.

Since USDT is supposed to trade 1-to-1 with the U.S. dollar, it makes converting bitcoin to cash very easy. In fact, somewhere between 60% and 75% of all bitcoin trading takes place using USDT. As you can see, if USDT crashes … the formerly easy way to exchange most cryptos for cash goes with it.

However, as Ian Dyer says, the market has already realized that USDT is sketchy and it’s moving toward a replacement — USDC, which is directly backed by the U.S. dollar and not whatever Tether decided to back USDT with.

So, while the Tether situation wasn’t FUD a couple years ago. It is now.

You wanna know the biggest reason why I know that Tether won’t take down cryptos like bitcoin? Because too many billionaires, banks and hedge funds are invested heavily in bitcoin. And government bailout or not, they aren’t going to lose billions just because Tether is being stupid.

Thanks again for writing in, Rich! And thank you, Ian, for jumping in to help the Great Ones avoid crypto calamity.

To keep up with Ian Dyer’s romp through the crypto verse, click right here!

It’s finally Reader Feedback time! What better way to kick things off than with our self-proclaimed biggest fan? The king of the Great Ones! No wait, that’s me…

Anyway, take over the mic, James:

I Swear, If This Is About Crypto Too…

Big Joe, buddy, I’m still here but haven’t written in a while. As you know from past correspondence I’ve been all over cryptos. Bitcoin and ETH have been lagging to say the least for the better part of two months now and if they can break out it will be humongous for the crypto market as a whole.…

Personally, I am into the technology that drives these cryptos. Blockchain and what it is going to do for the world…

I’m also looking forward to the death of many of the companies that leech money off of the regular population. I’ve made incredible money off these already and the way I’m positioned now with this dip the Lamborghini is well within sight!

Still LOVE reading you daily and my wife no longer asks why I’m chuckling when reading my emails anymore. By the way, Great segway with the Dire Straits intro today!! You should focus a little more into blockchain. Maybe not in your letter but personally. It is going to change the world! ROLL TIDE!

Biggest Fan — James S.

Big Joe? Am I really gaining weight? And I was so good during the pandemic lockdown. I didn’t even touch my secret office desk bag of peanut M&Ms yet…

It’s been a hot minute since we’ve heard from you, so thanks for touching base again, James, you biggest fan you. And in return, we shall try and cover every base here.

Crypto breakouts? We’re for ‘em … if you couldn’t tell by us tapping in resident crypto sleuth Ian Dyer up above.

I’m glad you were able to nab some buys on the dip but gee, man, don’t go flaunting those secret picks out in the wild! I broke up your email a bit, is what I’m saying.

Blockchain tech, on the other hand, is probably as far as we’d stray into the crypto seas in Great Stuff Picks. It’s literally the best thing to happen in digital security since … well, not many great things have happened in this space lately. Not since … the incident.

For those of you out of the know, it’s blockchain’s digital ledger that tracks transactions, payments and changes — makes it kinda handy for cryptocurrencies, no? You can (and should) catch up on all things blockchain right here.

Companies leeching off the regular population? You’re going to have to be more specific here. Like … a lot. I think you’re talking about most companies, but don’t let my jaded-ness rub off on you.

And finally, as much as I love Dire Straits, you’ll never find me rollin’ rollin’ rollin’ down the Wild West End in a Segway. A smooth segue is much more my speed, unlike this next abrupt transition.

Your Own … Personal … Tele-Nurse?

Hi Joseph, thought you may like to see this link to a letter from the medical community to Congress asking it to make the pandemic use of telemedicine permanent. Note the list of signatories. My guess is that this will happen. This will clearly be bullish for Teledoc, etc. — Barry

Thanks for the info, Barry!

For those of you just joining us, Barry is talking about recent efforts made by 430 health care organizations to help maintain access to telehealth.

So, I checked out this list of organizations that signed the letter, half expecting it to be all telemedicine companies hoping Congress can help prolong their one chance at greatness with the pandemic. But oh nay nay! This is not the case.You have a veritable who’s-who of medical organizations standing their ground for telehealth: American Heart Association, a smattering of hospital companies, medtech companies like Hillrom, the American Nurses Association… Click here to see them all.

Sure, a few telemedicine companies signed the letter but why the heck wouldn’t they?

The appeal is multi-pronged; the signees are asking Congress to continue Medicare coverage/access for telehealth as well as outfitting more health care facilities with the tools for remote care. Basically: “Please stop making it harder for people to take care of themselves via telemedicine.”

Now, what this shows me is that telehealth’s actual role in health care is less about “replacing” common visits and more about reaching underserved patients. Telehealth companies (though maybe not their investors) are finally realizing that completely replacing in-person visits isn’t where this trend is going.

Telehealth’s biggest boon post-pandemic is reaching those who don’t want to — or physically can’t — go into a doctor’s office.

For comparison, this is the same niche role that Cuentas (Nasdaq: CUEN) is trying to play in the realm of personal finance. Remember when we talked about Cuentas? It was like, over a month ago now; I know that’s literally forever in Internet time.

Health, much like banking, requires relationships of trust. And if telehealth is the only way many hard-to-reach patients are able to access health care providers they trust, it’s all gravy in my book. What this all boils down to is equitable access to health.

Anyway, on a semi-related note … I also want to give a shoutout to the improving availability of virtual mental health services amid the pandemic. Maintaining this access is truly life-saving. I guess this is the part where I remind you to reach out and talk to someone if your thoughts get overwhelming. You are not an island!

If your trades get overwhelming, on the other hand, you’re already in the right place. If you’d like to join in the Reader Feedback fun and rant about the market with us, write to: GreatStuffToday@BanyanHill.com.

I read each and every email personally, so don’t think you’re just sending words off into the void. Keep on writing in, Great Ones! In the meantime, here’s where you can find our other junk — erm, I mean where you can check out some more Greatness:

- Get Stuff: Subscribe to Great Stuff right here!

- Our Socials: Facebook, Twitter and Instagram.

- Where We Live: GreatStuffToday.com.

- Our Inbox: GreatStuffToday@BanyanHill.com.

Until next time, stay Great!

Joseph Hargett

Editor, Great Stuff