“You are into stocks and stuff, right?” my brother-in-law asked as we sat down at Smith and Wollensky’s, a famous high-end steakhouse in Miami Beach.

He was concerned about his investments — they are managed by mutual funds.

So I dove into more about what we do and why we do it. Our mission is to help people who want to take control of their investments.

But this is where it gets interesting.

He told me then that he knows his money has grown … but he doesn’t know how much he has earned each year, whether he beat the S&P 500 Index benchmark or even what the fees are.

I’m willing to bet many people who allow someone else to manage their money don’t know the answers to these questions either.

Here’s why those answers should be the first thing you know…

You Need to Know How Much You’re Earning

As we were enjoying our Smith and Wollensky’s legendary Cajun rib-eye, my brother-in-law revealed what his understanding of the fees were.

“I think they charge me 3% a year? But only if I make money.”

First of all, I doubt they give him a free year if they don’t have a positive return. These managers usually get paid regardless of what happens to your account.

But, regardless of the details … the most important part is that he wasn’t sure.

How much money you make per year is critical to knowing your performance against a benchmark, like the S&P 500 Index. And knowing how much you’re paying in fees is important to that performance.

I wrote about why this is a big deal a few months ago. You can read more about that here.

Today, we’ll focus on the fees they charge.

For mutual funds, as he said he was in, fees are commonly up to 1.75% of your account value. And these are annual fees, they’re paid whether or not you see a profit.

Hedge funds, higher-returning funds, commonly charge what’s called “two and 20.”

They charge 2% of your account value no matter what happens. A fee to simply manage your money. Whether you make money or lose money, they get their 2% — similar to mutual funds. But to give them an extra incentive to grow your account, they take a 20% cut out of your profits.

If you have a $100,000 account that grew $10,000 (10%) last year, they would take $4,000 in fees! That means your $10,000 return that year, was really a mere $6,000. That’s insane!

And they do this every single year.

This goes back to creating returns that beat the market — it becomes extremely hard when these are the fees you are constantly paying.

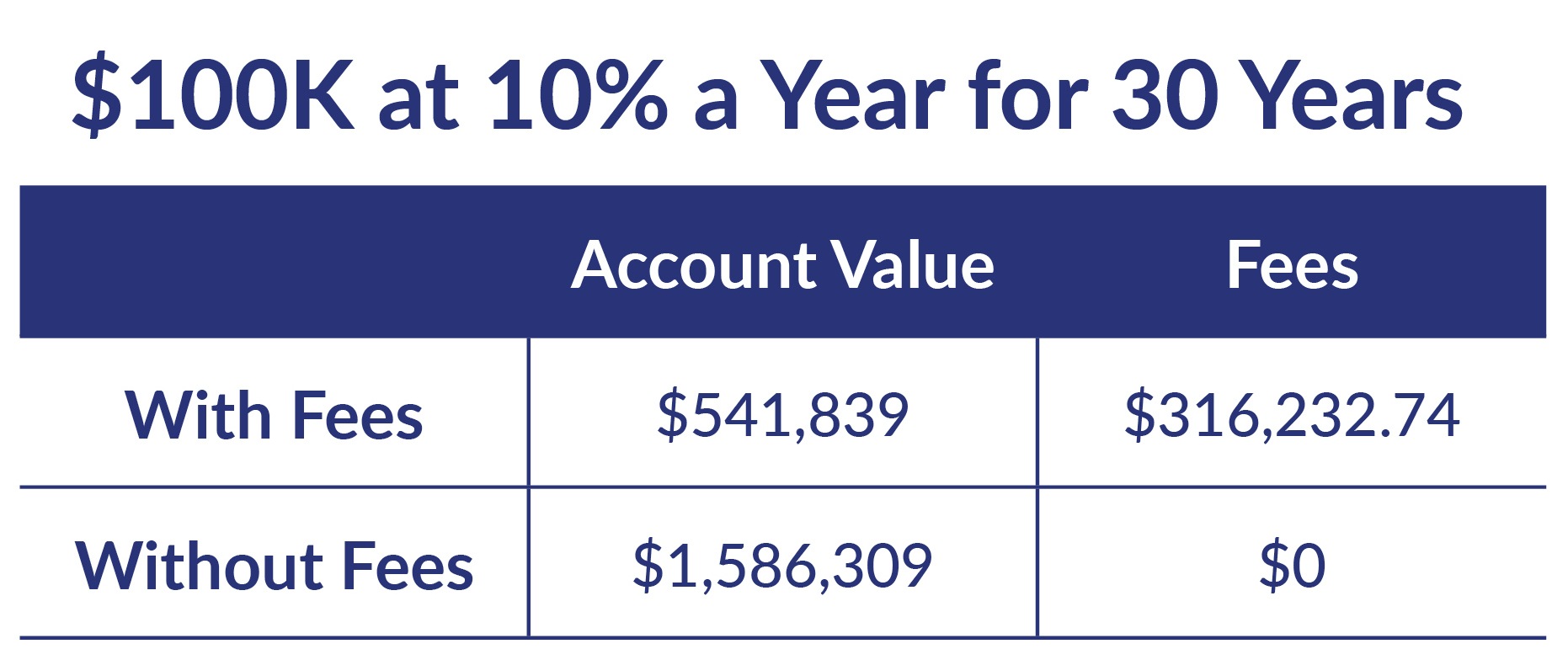

Take a look:

Not only does the two and 20 fee structure cost you over hundreds of thousands in fees over 30 years, it is costing you even more on your potential gains.

Because they chip away at your returns each year, it cuts your overall account value by more than $1 million!

And at the end of the day, these funds rarely beat the stock market’s performance. Especially over a 30-year time period. Nintey-two of actively managed funds are doing worse than S&P 500 Index, the key benchmark, after just 15 years.

If you are not happy about stats like this and where your money may be sitting … your only choice is to do it on your own.

While the easiest and safest way may be to buy index funds, you’ll never do better than “average” that way.

What about buying individual stocks? Most people don’t have the knowledge or experience to do well with that strategy.

That’s where we come in — a no-brainer fourth option.

We Don’t Work for Wall Street

We are on your side. We know how Wall Street works. And we know you have limited options outside of Wall Street.

We don’t manage your money.

We’re on a mission to help every American become financially secure. We publish our insights in Winning Investor Daily and charge a small fee for our premium services. We give you valuable insights into what stocks to trade and which ones to avoid. Helping you take advantage of the profits the stock market creates for investors without doing it all by yourself.

In short, you are not alone.

And It’s why we are launching a new summit just for you — the American Prosperity Summit.

To be there when it goes live, click this link. Bookmark it. And tune in at 8 p.m. Eastern time tonight.

Regards,

Chad Shoop, CMT

Editor, Quick Hit Profits

P.S. How have Winning Investor Daily insights helped you? Have you gotten peace of mind … double-digit gains … or a more comfortable retirement? Let us know at WinningInvestor@BanyanHill.com.