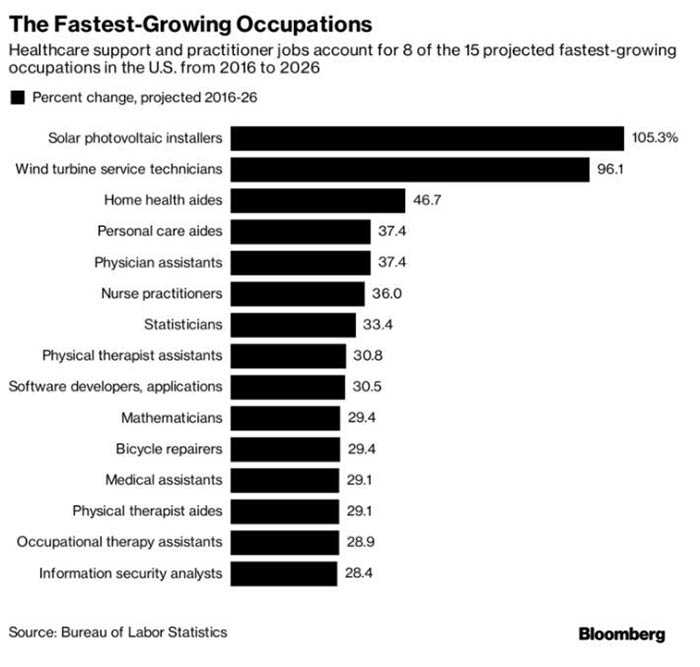

Looking at the job market can tell you a lot about the economy.

Not just the number of people who are employed or looking for employment, but also the jobs that people have. And in the chart below, there are two clear trends that stick out.

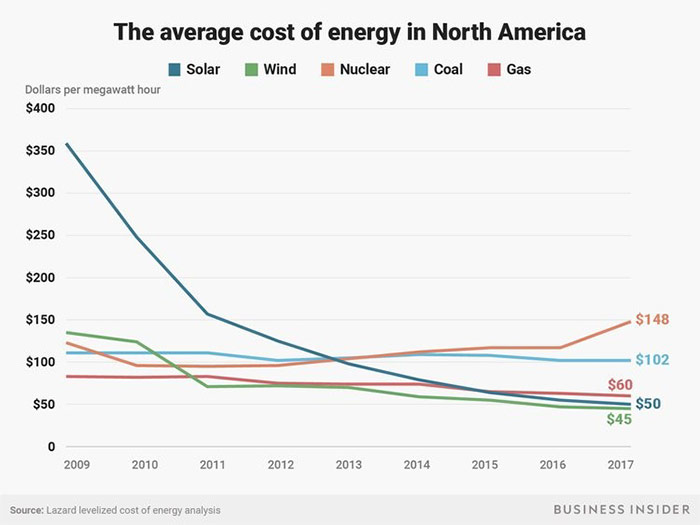

One is that we’re moving toward a world of alternative energy.

A report by Lazard points out that the cost of producing solar energy is now just half of what it costs to get energy from coal.

Overall, the cost of solar energy has dropped by 86% since 2007, while coal has stayed the same. And as you can see below, the cost of wind power is right there with it.

With both solar and wind still falling, it’s only a matter of time before coal is completely phased out.

The point is that we’re going to need people to install and maintain all of these new energy stations. So, while there’s an inevitable drop in the number of coal workers in the decades ahead, we’ll have people working on solar panels and wind turbines instead.

The other trend is the health care that will be required for the aging baby-boom generation. Given that there has never been a generation this large in need of care, jobs in the medical field are expected to skyrocket. In fact, 11% of United States college students are majoring in a health-related field.

Investing in Job Growth

These are two areas of the economy where we can expect to see a boom over the next 10-plus years. Thankfully, there are ways to invest in them.

For health care, a good choice would be the SPDR S&P Health Care Services ETF (NYSE: XHS). This ETF holds 49 top-tier health care companies.

And for alternative energy, I recommend the Invesco WilderHill Clean Energy ETF (NYSE: PBW). This ETF gives you a stake in 40 alternative energy companies all over the world.

Based on the way things are going with job growth, these companies are going to be growing fast in the near future. That means stocks in these areas will grow as well.

Regards,

Ian Dyer

Editor, Rapid Profit Trader