Story Highlights

- The stock market fell after the Federal Reserve announced it would cut interest rates on July 31.

- If you acted on Chad Shoop’s advice to take advantage of the volatility, your trade was up more than 100%!

- Click here to learn more about how to grab quick gains during the market turmoil.

“Luck” is what people say when they don’t understand the work behind the success they see.

The Federal Reserve had a two-day meeting the last week of July. Low levels of unemployment and a healthy gross domestic product didn’t show a need for a rate cut.

So, I predicted the Fed wouldn’t cut its benchmark rate to please the stock market. But it followed through with the requested rate cut.

My original recommendation to take advantage of the outcome in the market, however, was correct.

On last Monday’s sharp downturn, the put options I recommended were up anywhere from 100% to 200%.

Those gains may seem lucky to some people. But the truth is, there was more than luck for the trades to pan out.

I’m going to explain why my trades were more than just lucky — they were accurate. You can have access to such trades and make the most from your money.

The Fed Cut Rates, But We Made Triple-Digit Gains

As we approached the highly anticipated Federal Reserve meeting, I expected a downward move for stocks.

I used that expectation to frame my view of the biggest meeting on the calendar at the time — the Fed’s two-day meeting.

The outcome was different from what I was expecting. But the results were the same.

The Fed cut rates, in part to please the stock market and in part to indicate a worrisome change in the economy.

But when the Fed didn’t signal more cuts, stocks sold off.

As stocks tried to bounce back, an official tweet from President Trump’s Twitter account indicated a setback in U.S.-China trade talks. It sent the stock market tumbling.

If you followed my recommendation and held put options heading into this volatile period, congratulations — you were sitting on triple-digit gains last Monday.

I got the Fed’s announcement wrong, but I got the market’s direction right.

My bearish precautions prior to the meeting weren’t lucky … there was a bit more going on here.

The Reason Behind the “Lucky” Gains

Watch my video below to learn more about the recent gains we made with put options.

See, what the Fed will do — or what President Trump will tweet — is largely unpredictable. We don’t know exactly how the stock market will react.

But when you are Chartered Market Technician (CMT), you have a good idea of what the market will do — just not the cause for it.

Case in point was the recent Fed meeting.

The Fed’s decision was a possible catalyst for what the charts were telling me.

And that was to expect a pullback.

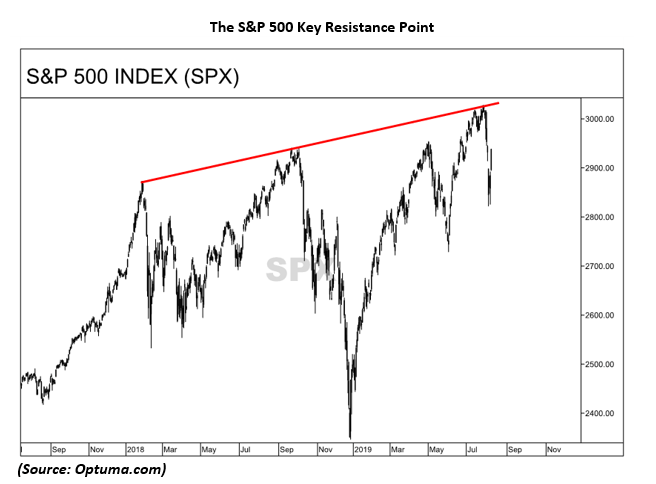

On the charts, I noticed the S&P 500 Index heading right into a key resistance point.

You can see it in red on the chart below:

For the index to break above the resistance point would have been extremely bullish.

And I maintained some bullish exposure in my portfolio. I held on to stock positions, as well as some call options. But I knew the risk of a pullback kept increasing as we approached it.

So I took precautions … and I recommended in Winning Investor Daily that you prepare as well.

Put Options to Take Advantage of Bearish Trends

In July, I was busy hedging positions in my premium services.

We added exposure to gold and inverse exchange-traded funds to benefit as stocks declined. In my earnings-based service, we added two bonus trades to benefit from the pullback in the market.

And in the two weeks heading up to the Fed meeting, I told you to hedge your portfolio by buying put options.

Those options gained more than 100% in the three days that followed the Fed’s meeting.

Now, you can call it luck if you want.

The reality is that I noticed a bearish trend in the market and helped my readers take advantage of it.

Once I notice a trend like that, I’ll find dialogue that matches what the charts are telling me — because that’s the likely outcome.

It doesn’t matter if I get the exact scenario right. As a trader, my goal is to make money.

It felt great to be able to take profits on last Monday’s downturn, instead of suffering severe losses.

Don’t get me wrong: We had positions losing value that day as well. But my bearish recommendations helped cushion those and keep us in trades longer without panicking.

You’ve likely heard the quote: “Better to be lucky than good.” And you may relate to it. But I don’t, because I know what it takes for “luck” to come through.

I prefer our founding father Thomas Jefferson’s take on luck: “I’m a great believer in luck, and I find the harder I work the more I have of it.”

The hard work you put into your investments will put you in a winning position. You’ll be at the right time and place to benefit from the stock market’s uncertainty.

If you were one of the “unlucky” traders who failed to enjoy the benefits of either the pullback or the rebound, you should join me.

I’ll teach you how to take advantage of sharp swings in the market.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert

P.S. Check out my YouTube channel. Hit the subscribe button so you won’t miss any of the new content I upload.