Social media is full of traders who “made it.”

Faceless accounts that brag about gains, photos of yachts above bios that tote fantastical cryptocurrency predictions.

They make it look like everyone’s winning. And even worse, it’s a painful reminder that you’re not winning…

I’m here to set the record straight.

Every few months, the market exposes a brutal reminder of the carnage that we don’t see on social media. The losses that happen behind closed doors.

In the last week of 2025, that reminder came in the form of a catastrophic $50 million wipeout.

Make no mistake, multiple traders lost their entire life savings. One of them even opened a GoFundMe to try and recoup the losses.

I’ve warned traders about these risks for years.

When you follow a self-declared “guru” who promises easy money and five-minute workdays, you’re not trading. You’re gambling your future.

And the house always wins.

I can’t tell you how many traders have come to me saying the same thing:

“Tim, I wish I’d found your process sooner. I believed the hype on social media. I blew up my whole account.”

It’s always the same story:

• They thought they had cracked the code.

• They thought their strategy was safe.

• They thought the risk was small. Until it wasn’t.

Don’t make the same mistake I’ve seen countless times.

Unfortunately, this message won’t reach everyone. But hopefully I’ll save a few of you from a road to disaster.

This is the story of how $50 million evaporated in a few days. And the lesson every trader needs to learn before it happens to them.

The Latest Implosion

In late December 2025, the market exposed yet another self-proclaimed trading genius.

His name is David Chau, but online he goes by “Captain Condor.”

Chau ran a private group of more than a thousand traders who paid over $5,000 a year to follow his “can’t-miss” strategy.

Every day, he and his followers bet on short-term options contracts tied to the S&P 500. The kind that expires within hours, known as 0DTEs.

The trades looked safe on the surface. For months, they produced small, steady wins. Chau bragged about the consistency on podcasts and social media. His followers believed he’d cracked the code.

Behind the scenes, he was using a Martingale system, doubling down after each loss to help recover quickly.

Yes, that approach works … Until it doesn’t.

On Christmas Eve 2025, the market hit record highs, thwarting Chau’s last big bet against the market.

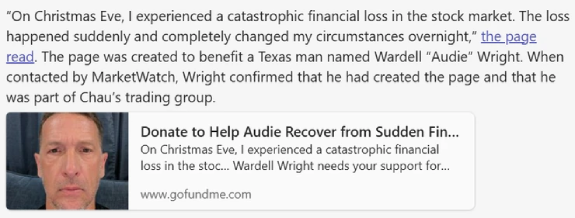

More than $50 million vanished in days. Some traders lost their life savings. One opened a GoFundMe just to pay bills.

Look at the post below:

And just like that, another “guru” was exposed for what he really is: A gambler dressed as a mentor.

Ill-equipped traders implode like this every few weeks. But usually the story doesn’t play out on the grand stage.

So how do you protect yourself from the next Captain Condor? How do you build real consistency instead of chasing easy profits?

That’s where my process comes in.

It’s built on real trade patterns, preparation, and proper risk management (no doubling, tripling, quadrupling down).

Let me show you exactly how it works.

A Real Trading Process

Captain Condor’s followers weren’t unlucky.

Things like this happen every day in the market. They’re not the last to follow a fake guru.

Market wizards promise returns for their followers. They might even have a few months of a track record to back it up. But the end result is always the same.

Complete annihilation.

The difference between my process and the Condor’s is the same difference between gambling and trading.

The idea of doubling down to recoup a loss — that’s a flawed mindset.

Losses are part of the process in the market. We don’t have to be afraid of them, we just have to control them.

Chau’s Martingale system operates under two incorrect assumptions:

1. I’m right, the market is wrong.

2. This loss is bad, I have to erase it right away.

Constantly doubling down on the same position after a loss invites the idea of eventual supremacy over the market. Traders think their thesis is correct, and they’re willing to die on that hill.

Not only that, they’re emotionally distraught after a loss. And they’re looking for a way to reverse it on the next trade.

1. I don’t double down. I understand that sometimes I’ll get it wrong.

2. Losses aren’t bad. It’s natural to lose while trading.

These are essential factors in the framework that I’ve traded for over 20 years. And it’s the same process that’s already helped more than 50 students become verified millionaires.

Not by luck, not by following my trade alerts blindly, but with discipline. They learned the rules, stuck to the system, and built their accounts step by step.

Plus, we have to acknowledge another side of this argument …

You don’t have to trade at all. Trading isn’t for everyone.

But those who do trade, do it the right way. Do it with a plan that limits your risk and keeps you in the game long enough to actually learn how to win with self-sufficiency.

Hopefully this gets through to some of you…

Stop chasing “easy money” setups.

Because eventually, that money will flow out of your account just as easily as it flowed in.

If you have any questions, email me at SykesDaily@BanyanHill.com.

Cheers,

Tim Sykes

Editor, Tim Sykes Daily