What’s The Deal With Great Stuff Picks?

Great Ones! It’s that time again…

Time to make bubbles with our spit?

What? Lay off the Animaniacs for a bit. Y’all are starting to scare me.

No, today we are finally diving into the Great Stuff Picks Portfolio!

Now, I know a lot of you newbies out there might’ve seen the Great Stuff Picks Portfolio mentioned here and there, but you still have no idea what it is…

Great Stuff Picks Portfolio? What’s that? I’ve never heard of it! How much? Where can I find it?

So many questions! So many questions!

Don’t worry, we’re going to go over all of that right now…

Before we begin, there are some rules … um, a few provisos, some quid pro quos to go over:

• First, the Great Stuff Picks portfolio is a free service. As a free service, you don’t get all the bells and whistles of a paid portfolio research service. That means no dedicated portfolio page (i.e., it doesn’t live anywhere).

• Second, the Great Stuff Picks portfolio doesn’t have real-time trade alerts. You have to read Great Stuff daily for potential recommendations. In other words, if you miss a day of Great Stuff, you could very well miss a new recommendation. So you should really make Great Stuff a part of your balanced breakfast — it goes well with Lucky Charms — or as part of your evening ritual alongside a tasty beverage.

• Third, the Great Stuff Picks portfolio isn’t actively managed like other paid services. If I recommend a stock, when you choose to buy it — and at what price — is completely up to you. The same goes for exiting a recommendation. I’ll certainly let you know when I think it’s time to take profits. But your risk tolerance and investment goals are your own.

• Finally — and this should go without saying — neither I, nor any Great Stuff team member, owns or has a vested interest in any of the assets, stocks or companies recommended in the Great Stuff Picks portfolio. Them’s the rules, according to the Securities and Exchange Commission.

And now, without any further ado, here’s the portfolio you need to see:

Great Stuff Picks: The Big Picture

How about that? Not too shabby for a completely free protfolio, right?

I mean, we’re sitting on four 100%+ winners! Well … technically four 100% wining positions. Two of those positions are on the same stock: Advanced Micro Devices (Nasdaq: AMD).

I got kinda crazy snapping up AMD back in 2019. What can I say? It was an excellent time to buy AMD stock.

The other two 100% winners are semiconductor equipment maker Applied Materials (Nasdaq: AMAT) and hydrogen power juggernaut Plug Power (Nasdaq: PLUG). And y’all said hydrogen power wouldn’t go anywhere … just wait, Great Ones. I’m right on this one.

Now, the elephant in the room is: What have you done for us lately? I get it. Y’all want trades. But the thing is, I don’t make trades just for the sake of making trades.

For one, this is a free portfolio … I can do what I want, and y’all can take that advice or ignore it.

For two, I don’t see the benefit of trading just for trading — and that’s doubly true in current market conditions.

Take, for instance, Great Stuff’s picks for 2022:

• ChargePoint (NYSE: CHPT): up 14.12% since January 6.

• Nvidia (Nasdaq: NVDA): up just 0.29% since January 5.

• Coinbase (Nasdaq: COIN): down 18.44% since January 5.

• Advanced Micro Devices: down 23.92% since January 4.

Neither COIN nor AMD deserve to be down that much at this point. Both continue to outperform in their respective markets and are raking in considerable revenue. The only reason both are down is Wall Street’s growing disdain for “growth stocks” and anything even remotely “tech” related.

Because I have a preference for both tech and growth companies, 2022 has not been kind to the Great Stuff Picks portfolio.

Here’s the portfolio’s overall numbers from back in December:

• Average Open Position Gains: 89.5%.

• Open Position Win Rate: 83.3%.

• Lifetime Closed/Open Position Gains: 63%.

• Lifetime Closed/Open Win Rate: 75%.

Now, here’s the portfolio’s overall numbers right now:

• Average Open Position Gains: 46.95%.

• Open Position Win Rate: 65%.

• Lifetime Closed/Open Position Gains: 42.39%.

• Lifetime Closed/Open Win Rate: 68.75%.

Considering that the S&P 500 Index is down nearly 4% so far this year, I think we’re holding up pretty well. I mean, we’re still outperforming the market … even if the market and the Great Stuff Picks portfolio are both pulling back. We’re just pulling back more slowly while hitting some gains here and there along the way.

Hang in there, Great Ones. This too shall pass, and we’ll see those numbers climb back into the stratosphere in no time!

What is it that Paul over at Bold Profits likes to say? Strong hands!

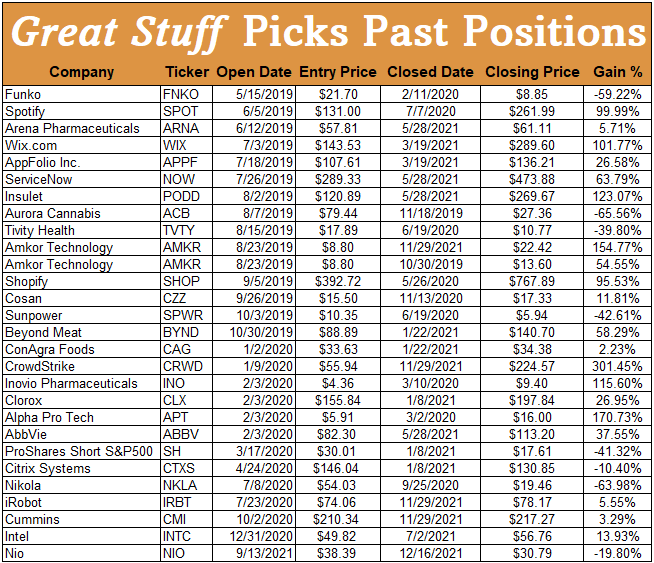

Great Stuff Picks: Ghosts Of Great Stuff Past

Ain’t that heading just the Dickens?

It occurred to me that y’all might want to see where the data for those “total average gain” percentages came from. Well, for the first time ever, I’m sharing the Great Stuff Picks closed positions chart.

Here you go:

As you can see, we’ve closed out six 100% winners in the past three years, with two other trades right on the cusp. We’ve also had our fair share of crap-outs … I’m looking at you, Nikola (Nasdaq: NKLA) and Aurora Cannabis (Nasdaq: ACB).

Both NKLA and ACB are proof that a company can check all the right boxes on performance, promises and growth markets … and still miss big time.

For the record, both companies were not entirely honest about their business models, expenditures and … in Nikola’s case, actual working products. After all, Nikola still hasn’t produced a hydrogen fuel cell semi-truck, and I’m beginning to think it never will.

Great Stuff Picks: The Wrap-Up

And that’s it — that’s the Great Stuff Picks portfolio review!

It has been nearly six months since the last Great Stuff Picks portfolio review. I promise it won’t take that long again.

Anywho… One final note before I go: You can sell any Great Stuff Picks position anytime you get too uncomfortable!

My risk tolerance might not be the same as yours. My investment goals may not be the same as yours. Do not keep holding a painful position just because you haven’t seen a “sell” notice from Great Stuff.

I extensively research and vet each and every Great Stuff Picks position, but I haven’t extensively researched and vetted your financial situation. You do what’s best for you.

And for the rest of ya? For all y’all looking to keep the great investing stuff flowing, look no further.

Picture this: You make the trade on Monday … relax for 48 hours … and then close it on Wednesday. With Adam O’Dell’s new two-day trading strategy, Wednesday Windfalls, it really is that simple!

In fact, Wednesday Windfalls readers have already had the chance to make out-of-this-world returns like 400% in two days … 440% in two days … and 519% in two days.

To get the details, go here now.

As always, thank you for coming to my Great Chat! If you have a stock or investing idea you’d like to see covered in the Great Stuff weekend edition, let us know at: GreatStuffToday@BanyanHill.com.

And if you have that burning yearning that only more Great Stuff can satisfy, you should check out our deets:

- Get Stuff: Subscribe to Great Stuff right here!

- Our Socials: Facebook, Twitter and Instagram.

- Where We Live: GreatStuffToday.com.

- Our Inbox: GreatStuffToday@BanyanHill.com.

Until next time, stay Great!

Regards,

Joseph Hargett

Editor, Great Stuff