Before I moved to the U.S., I lived in Dubai.

As a child, I learned quite a bit about the United Arab Emirates (UAE) — everything from its history to its economy.

The country, like most of its neighbors, is nearly synonymous with “oil.”

Oil was its one real natural resource — but that was enough.

It built its entire economy around that one commodity.

That led to the world’s tallest skyscraper and an indoor ski resort. All in the middle of a desert!

But oil can’t prop up its economy forever.

So the UAE is expanding into other sectors.

In the last decade, it’s become a hub for tourism and financial services.

It’s even pivoting to renewable energy.

But the thing that will propel its economy into the future isn’t any of those.

Dubai Is Off to a Strong Start

Dubai is jumping straight into crypto.

As I’ve told you before, cities like Miami are aiming to turn into the next crypto hub.

But this phenomenon goes beyond the U.S.

And the UAE is a great example.

This year, it’s passed out over 30 licenses to crypto companies. It’s also written new crypto-friendly laws.

As a result, several big names in crypto are moving into the neighborhood.

Crypto exchange Binance is hiring 100 people to support its operations in the Persian Gulf.

And FTX and Crypto.com announced plans to open regional offices there too.

These companies are a perfect fit for the UAE because it’s already embracing crypto.

You see, more than 25% of its millionaires invest in crypto. And several businesses in the region already accept crypto as payment.

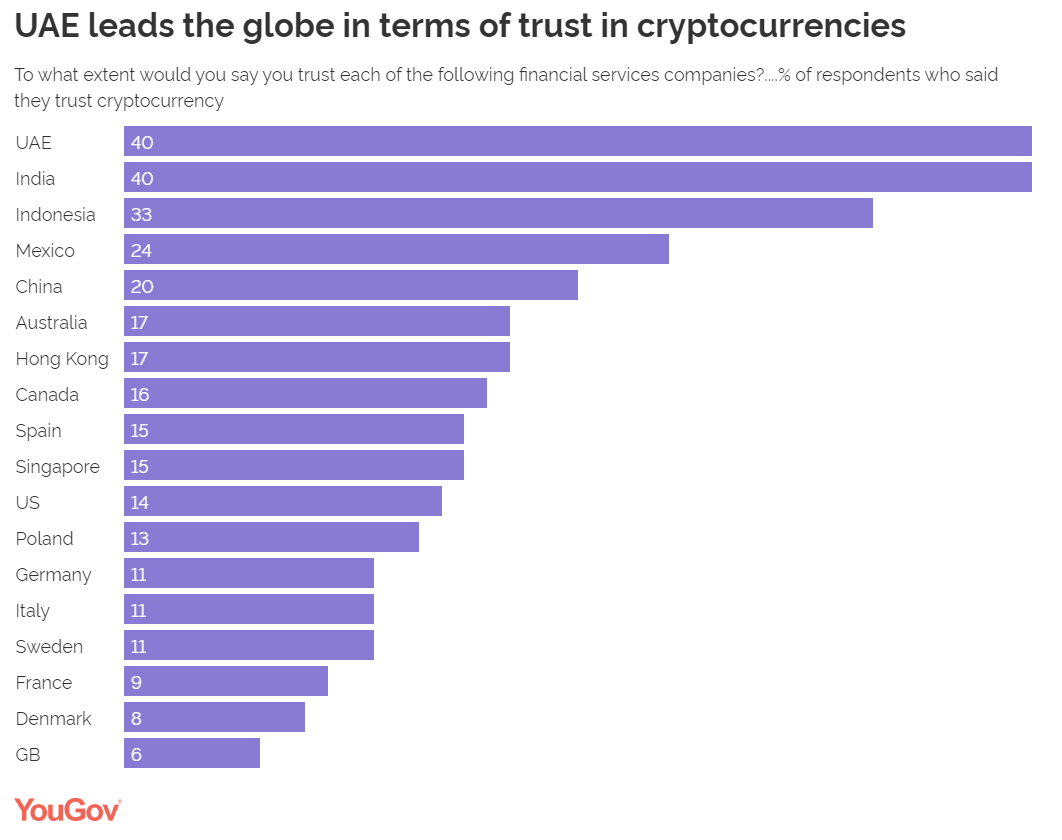

In fact, according to a YouGov survey, trust in cryptos was the highest among adults in the UAE.

This is promising for the UAE’s crypto ambitions.

Countries Are Duking It Out Over Crypto

But it won’t be easy for the UAE to become a global crypto hub overnight.

In fact, it’s in competition with several other countries.

Singapore, for one, is looking to become the biggest crypto hub in Asia.

With one of the most open economies in the world, it already was a safe haven. Crypto companies fled there to avoid harsh regulators in China.

But when Singapore tossed its hat into the ring to become a global crypto hub, over 170 crypto companies applied for a license to operate there.

The U.K. also has grand ambitions when it comes to crypto. It sees this sector as an extension of its current hub for financial services.

Back in April, the U.K. government set out its plans to become a crypto hub. It started with legislation to make stablecoins a nationally recognized form of payment.

And the list goes on. Even Malta and Switzerland are making moves to transform into crypto hubs.

Now, although there is room for multiple winners here, not every country will succeed.

But the winners are not as important as the number of participants in this race…

These Countries Are Betting on A Bright Future for Crypto

Even though crypto has been trending downward this year, countries around the world are ready to embrace it.

Countries everywhere, from the UAE to the U.K. to Singapore, are all ready to stake the future of their economies on crypto. That’s incredibly bullish for crypto.

I believe that we will see even more countries announce similar crypto hub goals in the near future.

Despite the current market conditions, the long-term future of crypto is bright.

In fact, the current market environment is setting up the next great bull run in crypto.

If you’d like more details, check out Ian King’s “The Next Million” event right here.

Regards,

Andrew Prince

Research Analyst, Strategic Fortunes

Morning Movers

From open till noon Eastern time.

Inspira Technologies (Nasdaq: IINN) is a medical device manufacturer that is up 76% this morning. The move came after the company announced that it developed a non-invasive optical blood sensor called Hyla, that alerts real-time changes in patients.

Resolute Forest Products Inc. (NYSE: RFP) manufactures and markets paper and wood pulp products internationally. The stock jumped 64% on the news that it is being acquired by Canadian company Paper Excellence Group in a deal worth about $2.7 billion.

Cano Health Inc. (NYSE: CANO) provides primary care medical services to patients in the U.S. The stock is up 16% on speculation that it could be a potential acquisition target for health insurer Humana.

Symbotic Inc. (Nasdaq: SYM) provides robotics and warehouse automation technology to improve efficiency for retailers and wholesalers. The stock climbed 16% after analysts at Needham initiated coverage on the stock with a buy rating.

Beyond Air Inc. (Nasdaq: XAIR) operates as a commercial medical device and biopharmaceutical company. It is up 14% after a series of insider purchases of the stock by the company’s directors and CEO.

Just Eat Takeaway.com (OTCMKTS: JTKWY) operates an online food delivery marketplace that connects consumers and restaurants. It climbed 13% after Amazon signed a deal with the company’s Grubhub business to bring food delivery to Amazon Prime customers.

Electricité de France S.A. (OTCMKTS: ECIFY) is a French utility company that generates electricity through nuclear, fossil fuel, hydro, solar, wind and biomass plants. It climbed 11% after the French government said it plans to nationalize the utility company.

Rivian Automotive Inc. (Nasdaq: RIVN), the electric vehicle manufacturer, is up 10% today. The stock rose after the company ramped up production in Q2 and reaffirmed its production guidance of 25,000 electric vehicles in 2022.

Mercer International Inc. (Nasdaq: MERC) manufactures and distributes paper and paper-based products. It is up 10% after analysts at Credit Suisse upgraded the stock to an outperform rating from neutral.

Veru Inc. (Nasdaq: VERU) is a biotechnology company with a primary focus on developing medicines for the management of cancers. The stock rose 9% after the company published positive Phase 3 trial data for its antiviral treatment for severe COVID-19.