Conspiracies about it littered financial blogs when I started in this business 15 years ago. But today, no one cares.

To me, the “Plunge Protection Team,” or PPT, felt like a secret cabal manipulating the market and acting behind closed doors to avoid detection.

Turned out, that was at least half true.

In an age where the CIA acknowledges UFO sightings, nothing surprises me anymore.

The reality is that it avoids detection, but the PPT’s existence is no secret.

The official name for the PPT is the “Working Group on Financial Markets” … created by President Reagan in 1988.

The PPT’s objective is to advise the President of the United States during turbulent times in the stock market or economy.

Conspiracy theories claim the PPT does more than give advice. Some believe it intervenes to prop up stock prices if the market is beginning to plunge.

These days, the market doesn’t need the President’s working group anymore. The Federal Reserve is committed to propping up the market with low interest rates and bond buybacks. And it’s doing it right out in the open.

But be careful.

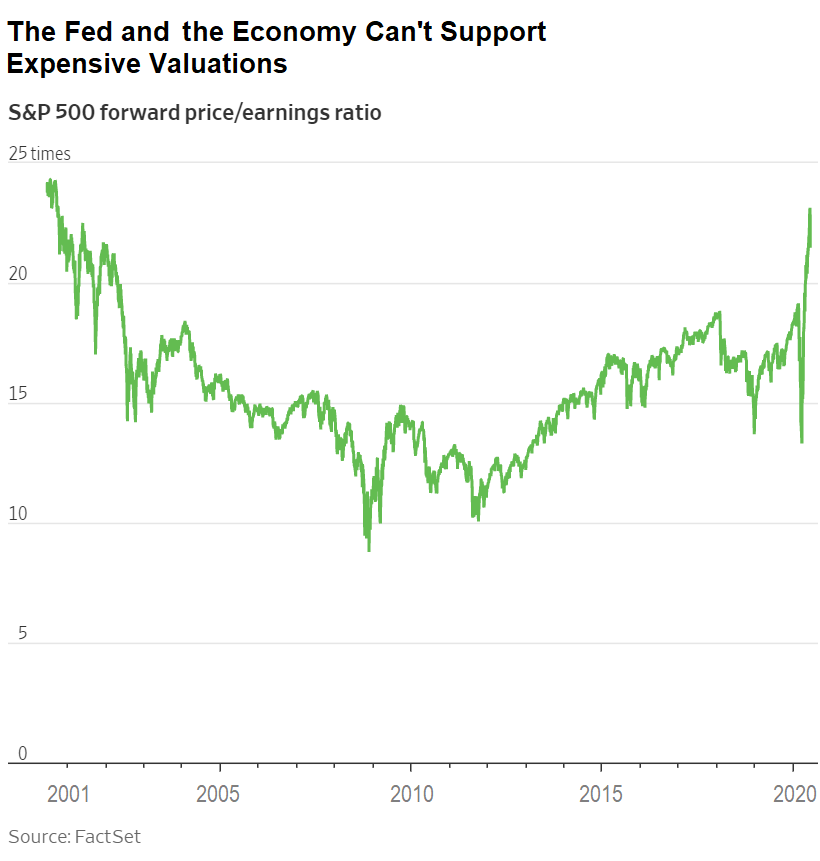

The Fed may have stepped into the PPT’s role, but its efforts this week might be a final sign of desperation. In the short term, it might not be able to prop up stocks anymore. The bad news is that this effort to arrest the market’s downside is exhausted, and the market is expensive.

Any further efforts to help the market will likely fail. Let me explain…

Fed’s Bailout Promises Promise Short-Term Disappointment

The market plunged last Thursday.

Then, Monday morning, it looked like the fall would continue.

Everything — stocks, commodity prices, the U.S. dollar — was falling when the trading session began.

Then the Fed stepped in.

It promised to inject another $250 billion to calm financial markets. One month ago, the Fed began buying exchange-traded funds (ETFs) that hold a basket of corporate bonds. These include investment-grade bonds and riskier “junk” bonds. This time, the money will buy up bonds of individual companies if they are rated investment grade. Investors are reluctant to invest, and the Fed’s purchases are meant to allay their fears.

The market stopped falling in March when the Fed first announced these intentions.

Since then, the S&P 500 Index climbed 42%.

That’s about to change.

Buy the Rumor, Sell the News

There’s a market idiom to explain how investors often trade on the news cycle.

Perhaps you’ve heard it: “Buy the rumor, sell the news.”

Traders and investors try to stay ahead of the market. So, they make trades on what they expect to happen next.

They “buy” the rumor.

By the time the news is confirmed, it’s no longer news. It has already been factored into the market.

So, they “sell” based on the news. And the market trend often reverses along with that sentiment.

We’re at that point again.

Yesterday’s start of $250 billion in Fed purchases is already old news. Its impact has already been factored in.

Consider the last time we were at this point.

The Fed unloaded a litany of bailouts and financial market injections beginning in the mid-2019. Obscure interest rate markets were tightening up. These tiny moves threatened to shock the financial system. So the Fed moved in a big way to loosen financial conditions.

The efforts became exhausted at the start of the stock market’s catastrophic plunge in March.

That was when the Federal Reserve’s emergency interest rate cut signaled desperation.

At the time, I shared my colleague Chad Shoop’s concerns on Twitter:

Agree with my friend @ChadShoopGuru here.

Fed emergency #ratecut validates worry about the #economic impact of #coronavirus.

Watch for the kneejerk rally in #stocks to fade … #StockMarketCrash2020 https://t.co/nCb3NbZShw

— John Ross (@JohnRossGuru) March 3, 2020

The Fed’s corporate bond-buying promises may be met with the same disappointing results. In March, the market fell 28% in less than three weeks.

Be careful not to get caught up in old news. The Fed is desperate to support stock prices, but we expect the market to fall 16% from here.

Good investing,

Editor, Apex Profit Alert