“Really, Charles?! A company founded in the 1880s??”

That was an email I got when I recommended The Coca-Cola Company (NYSE: KO) in Alpha Investor in November 2020.

Another subscriber wrote: “Man … you are really out of touch.”

My recommendation doesn’t sound so crazy now.

But back then, I think a few subscribers thought I was out to lunch.

And that was because of “disruptive innovation” stocks.

The products or services of these companies were supposed to change the world.

But I’ve seen this movie before, and didn’t believe one word of the hype.

Although investors were bidding these stocks to the moon, the companies were all talk.

In 2020, shares of…

- Peloton soared 434%.

- DocuSign were up 200%.

- And Roku climbed 148%.

It didn’t matter that they were unprofitable.

Who cared? They had great stories.

Investors weren’t concerned about valuations.

In fact, they threw caution — and their money — to the wind.

For the life of me, I never learned how to value a business that didn’t make money.

If you have any ideas, please send me an email (at RealTalk@BanyanHill.com).

If they’re not generating a profit, you’re basically just valuing them on their story.

Call me old school, but you can’t buy a hamburger with future profits.

Yet when I recommended Coca-Cola, Mr. Market priced it like a dying business.

But it’s not every day that you can buy an industry leader at a bargain price…

Staying Power

Coca-Cola is one of the most famous brands in the world and continues to grow.

How many companies that were founded in 1886 can say that today?

So, when the company was trading at a bargain … It was a no-brainer.

Because investors were too busy chasing after disruptive innovation stocks, it was on sale.

And when inflation started to soar in 2021, we liked Coca-Cola even more!

It’s one of the few companies that has pricing power.

That means it can increase prices to keep pace with inflation.

And we’re seeing our thesis continue to play out…

Coca-Cola reported earnings recently. Sales exceeded expectations, and the company raised its guidance.

Consumers around the world are willing to pay higher prices for Coca-Cola beverages.

That’s why the company is a breed apart.

Matter of Time

Since we added Coca-Cola to the Alpha Investor portfolio, disruptive innovators haven’t been so disruptive.

I told you I’m old school. I learned early on that “you can’t make a silk purse out of a sow’s ear.”

It doesn’t matter how many white papers analysts publish to support their thesis.

At the end of the day, if a company doesn’t turn a profit, you’re skating on thin ice.

Since making all-time highs in 2021…

- Peloton has plunged 93%.

- DocuSign is down 77%.

- And Roku is off 84%.

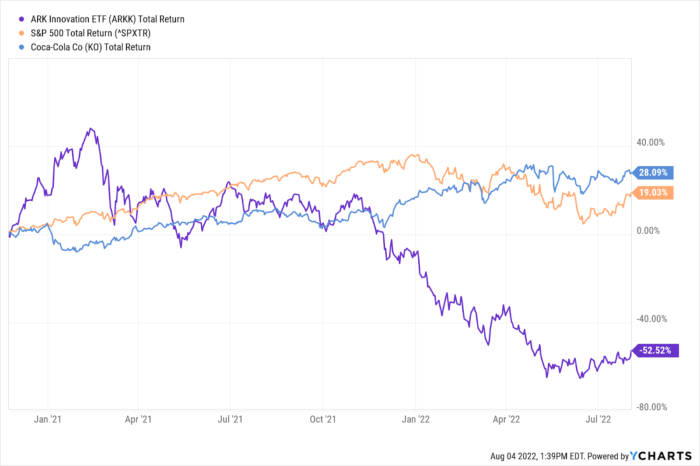

The chart below shows the performance of the S&P 500 … Coca-Cola … and the ARK Innovation ETF (a proxy for disruptive innovation stocks):

After we added Coca-Cola, the ARK Innovation fund soared 40%, while Coca-Cola was flat.

Boy, did we look dumb.

But over time, the stock price follows the worth of the business, not the other way around.

And Coca-Cola’s worth continued to rise — along with its stock price.

Since we added it on November 23, 2020, shares are up by 28%.

In that same time, it’s outperformed the S&P 500 (19% higher) … and left ARK in the dust (plunged 53%).

So, I’d like you to keep this in mind…

KISS

The key to investing is not to invest only in industries that’ll change the world.

Instead, it’s to find quality businesses when they’re trading at bargain prices — and hold them.

Nothing fancier than that.

In fact, the simpler the business, the easier it is to figure out.

You don’t need to buy complex businesses when you have no idea how they operate.

As Warren Buffett said:

“Investors should remember that their scorecard is not computed using Olympic-diving methods: Degree-of-difficulty doesn’t count.”

Because at the end of the day, it’s all about making money.

That’s why you’re part of the Alpha Investor family.

Now, I wouldn’t recommend buying shares of Coca-Cola today since they’re trading above our buy-up-to price.

But there’s another company in our portfolio whose thesis is also unfolding according to plan.

And it’s still trading on sale now.

Alpha Investors can check it out in my latest weekly update here.

And if you aren’t part of the family yet, you still have time to check out what it is.

Because now’s the perfect time to join us. Find out how right here.

Regards,

Founder, Real Talk