There’s finally some good news about the global pandemic.

On Monday, Pfizer Inc. (NYSE: PFE) and BioNTech SE (Nasdaq: BNTX) announced that their COVID-19 vaccine is more than 90% effective.

If the clinical trial continues to go as planned, it could mean the end of the pandemic. And then our lives can finally start to go back to normal.

Countries around the world have already begun to order the vaccine:

- Canada: 20 million doses.

- The U.K.: 40 million doses.

- The U.S.: 100 million doses.

- Japan: 120 million doses.

- The EU: 200 million doses.

Investment firm Morgan Stanley estimates that global sales of the vaccine will total nearly $13 billion in 2021.

The effectiveness of the vaccine is remarkable. But what’s even more remarkable is that BioNTech, a relatively small biotech firm based in Germany, played a large role in developing it.

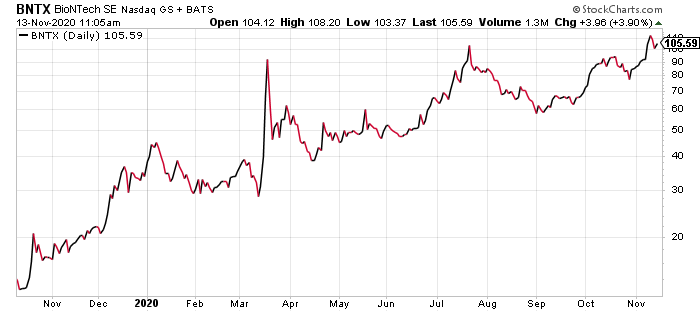

Read on to see how this little-known company’s stock price grew 650% in just over a year.

The Companies Behind the COVID-19 Vaccine

In March, Pfizer and BioNTech announced their partnership to develop a COVID-19 vaccine.

Pfizer, the world’s third-largest pharmaceutical firm, has been around for more than 170 years. It makes sense that it would play a leading role in the fight against COVID-19.

But you probably weren’t familiar with BioNTech prior to the big announcement on Monday.

The company was founded in 2008 by a married couple. Ugur Sahin is the CEO, while his wife, Ozlem Turici, is the firm’s chief medical officer.

(Source: BioNTech.)

Sahin and Turici, who are both the children of Turkish immigrants, have been studying diseases for decades. They founded their first company, Ganymed Pharmaceuticals, in 2001.

According to an interview, on the day they were married, the couple returned to the lab after the ceremony. And that type of commitment has paid off.

In October 2019, BioNTech debuted on the stock market with a valuation of $3.4 billion. Today, largely because of its work on the COVID-19 vaccine, the company is worth $25 billion — a 650% increase.

BNTX Soared 650% in a Little More Than a Year

The Hunt for 1,000% Winners

Despite the success of the vaccine, Pfizer’s stock is up only 4.6% in the last 12 months.

The $213 billion pharma giant has struggled throughout the pandemic. Meanwhile, the smaller, more innovative BioNTech has managed to thrive.

Even a modest investment in the little-known pharmaceutical company had the potential to turn into a huge windfall.

The key? As Ian King tells me, you have to pay attention to market valuation.

If you’re looking for the biggest gains, small companies positioned to disrupt massive industries have the greatest potential to skyrocket.

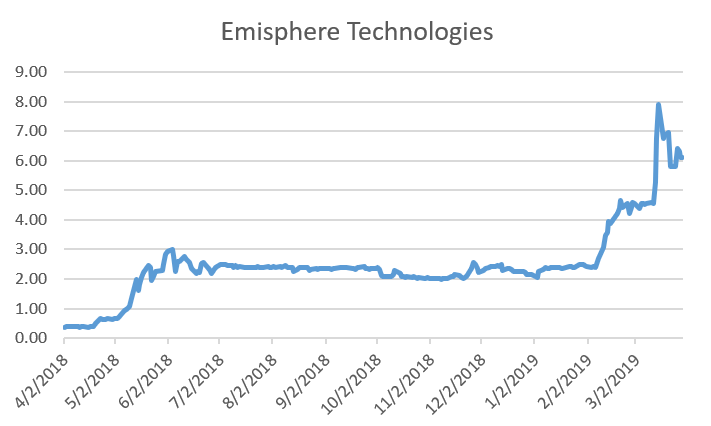

For example, Emisphere Technologies Inc. (OTC: EMIS) is a tiny drug company that was worth only $0.40 a share in March 2018.

By March 2019, EMIS was worth more than $6 a share — a gain of 1,550%.

An opportunity like that can turn a $10,000 investment into $166,000 in just one year!

So be sure to keep these types of companies on your radar.

And if you’re interested in jumping right in, look to Ian’s new trading strategy. It’s built to find small stocks with the potential to 10X your money in as little as 12 months.

Click here to see exactly how.

And stay tuned. On Monday, Ian’s writing about a method for small companies to sell shares on the stock market. It’s a great way for investors to take advantage of the hottest opportunities.

Your Monday edition of Smart Profits Daily will have all the details.

Regards,

Assistant Managing Editor, Banyan Hill Publishing