You may not believe me, but corporate earnings are phenomenal.

October, staying true to its historical nature, was an extremely volatile month.

That volatility is masking the performance of corporations that have reported third-quarter earnings so far.

Results are showing a 22.5% earnings growth rate for the S&P 500 Index. The average over the past five years is just under a 5% growth rate.

President Donald Trump was right when he tweeted: “Companies earnings are great!”

The market just isn’t reflecting that at the moment.

Here’s why that could change real soon…

Positive Earnings Surprises

The volatility we are seeing right now can be tied back to a divergence in expectations that started with the last quarterly reports.

After the phenomenal results that corporations posted during the second quarter, many analysts didn’t heed the warnings that growth was set to slow. More companies than average were lowering guidance, while analysts lowered expectations at a less-than-average pace.

So it created this divergence in expectations for the rest of the year.

That’s why companies that report positive earnings surprises are losing value.

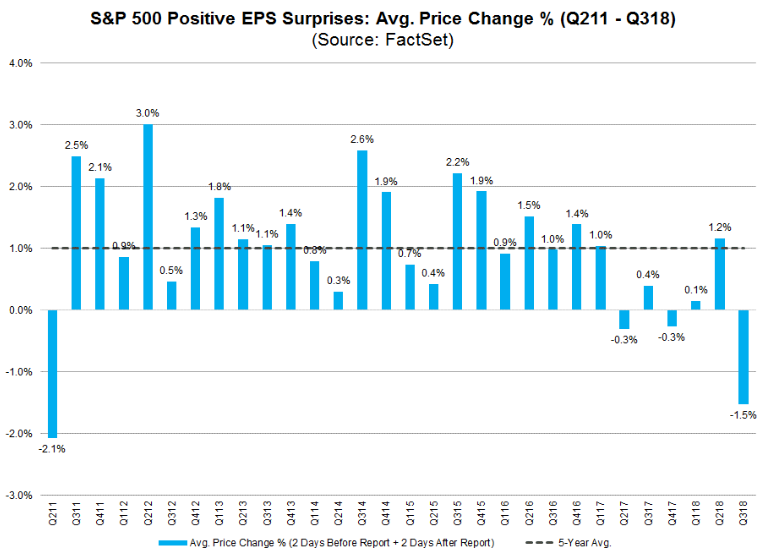

It’s the worst performance since 2011 in the days following a strong earnings report. Take a look:

A decline of 1.5% on average for companies that beat earnings expectations isn’t pretty.

But if the last time this occurred is any sign of what to expect next, a rebound to earnings-led price movement is expected. The following quarters in 2011 posted gains of 2.5% and 2.1%, respectively, as a reaction to positive earnings surprises.

The Economy Continues to Thrive

So while third-quarter results are fantastic, that 1.5% decline is catching investors off-guard.

Earnings growth for the second quarter came in at 25%. It’s around 22.5% for the third quarter, taking a step back.

This, along with the timing of various other market factors, like midterms, interest rates and tariffs, led to the pullback we just went through.

But it’s no time to sell.

Even as investors adjust expectations to a slower pace of growth, corporate earnings are still great.

The economy is still reaping the benefits of tax reform, and consumer sentiment is still holding near the highest levels it’s seen over the last decade.

This sets up an economy that continues to thrive despite ongoing concerns.

The bear market isn’t starting yet. And the next two years will be the “euphoric moment” for the stock market.

We’ll look for earnings to get back to the basics in the coming quarters, where companies that report strong earnings will be rewarded with stock market increases in the days that follow.

These will be gains that you simply won’t want to miss out on.

When it’s time to get out, we’ll let you know. Until then, we have to remain invested to reap the rewards from the bull market.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert