A subscriber to my newsletter asked me a question last week.

What do I think of airline stocks?

And more importantly, when will they go back up again?

Even in the best of times, most airlines are terrible investments. The costs are high. There’s lots of federal regulation, and for good reason, of course.

And as businesses, an airline consumes lots of cash whether the planes are flying or not.

It’s not for nothing that most of the major airlines have filed for bankruptcy at one time or another in past decades.

For instance, United Airlines went bankrupt in 2001 after the September 11 attacks.

Delta Airlines filed for bankruptcy in 2005.

American Airlines filed for bankruptcy in 2011.

These are the risks an airline investor faces.

There will be a few big winners coming out of this mess, though. But I think you should still wait to buy the stocks.

Here’s why…

This Airline Is a Survivor

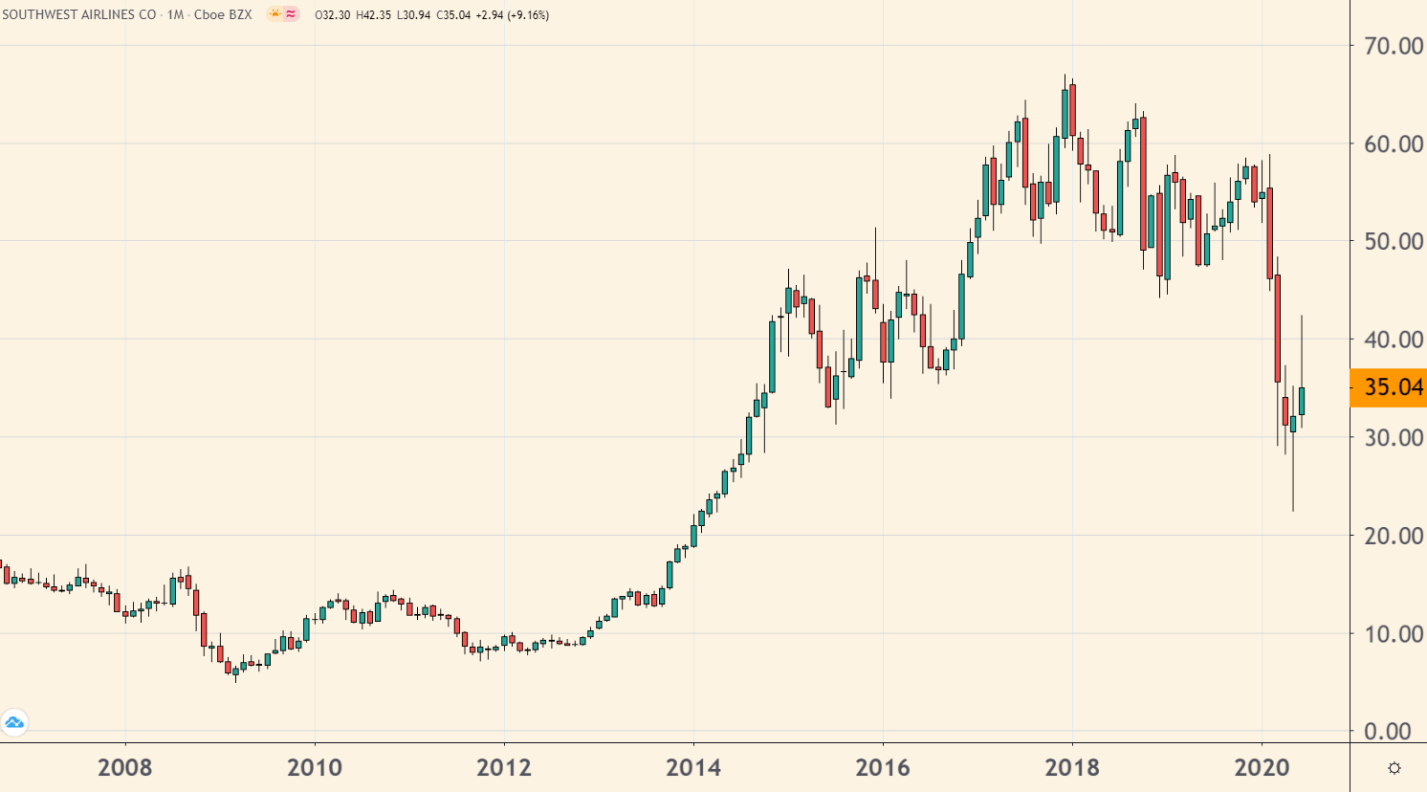

One airline stock to look at is Southwest Airlines Co. (NYSE: LUV):

LUV Is Still 40% Below Its February High

(Source: TradingView.com)

Goldman Sachs recently upgraded the stock. It rightly pointed out Southwest’s strong balance sheet, flexible schedule and low debt levels.

The airline has more than enough liquidity to survive, even with minimal to no flights, all the way to 2022.

A Different Kind of Airline

The other to consider is a small-cap airline stock, Allegiant Travel Co. (Nasdaq: ALGT):

ALGT Is up 68% in 8 Weeks

(Source: TradingView.com)

The airline caters to leisure travelers away from the main urban hubs and runs a very nimble, flexible outfit.

It has enough financial sources to stay in business with few or no flights until 2023.

One of the things I like most about Allegiant is that its chief executive officer, Maurice Gallagher, takes no salary or cash bonuses. He only pays himself with stock.

So the only way he gets richer is by running the airline smartly for the benefit of long-term shareholders.

Look for More Bad News for Airline Stocks

If now isn’t the ideal time to buy these airline stocks, when will that time be?

I think we’ll get a big hint by keeping one eye on the stocks and the other eye on the news headlines.

When the news remains really bad, but the airline stocks hold their own or even creep higher over a period of weeks, that’s usually a good sign.

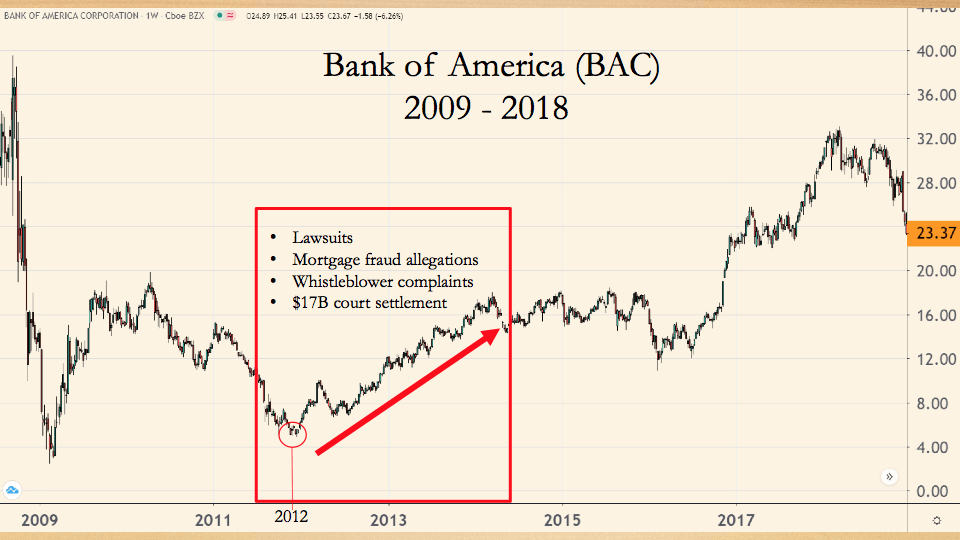

A good example from the past is banking stocks, specifically Bank of America Corp. (NYSE: BAC), after the 2008 financial crisis.

The stock fell sharply during the crisis, staged a small rebound in 2009 and 2010 — then fell another 70% through 2012.

By early 2013, though, the stock began to move higher:

The rally came with plenty of doubters.

Even then, the bank saw a wave of new lawsuits, mortgage fraud allegations and messy whistleblower complaints. It finally paid out a massive $17 billion settlement in 2014.

But by then, Bank of America’s stock was 150% higher.

So, to turn back to the airline stocks … that’s what you want to look for: more bad news —perhaps an airline bankruptcy or two or another panic about the virus.

The remaining airline stocks will start to creep higher, instead of going down.

We’re not quite there yet. But when it happens, you want to be ready to buy.

And airlines aren’t the only sectors that will rebound from bad news.

My colleague Ian King has identified the top stocks that are set to skyrocket as the Great American Rebound happens — and he’s giving all the details away in Automatic Fortunes.

Best of Good Buys,

Editor, Total Wealth Insider