Editorial Director’s Note: This holiday week, we’re sending you some of the best content we published in the past 12 months. We hope you enjoy this special series. We’ll be back Monday, December 30, with brand-new research. And stay tuned! We’re excited to announce the name of Sovereign Investor Daily is changing to Smart Profits Daily on January 1. So be on the lookout for our new look and new name. — Jessica Cohn

“First they ignore you, then they laugh at you, then they fight you, then you win.”

This quote, often misattributed to Mahatma Gandhi, is a fine summation of the ongoing war between bitcoin and the world’s largest banks.

In September 2017, JPMorgan Chase CEO Jamie Dimon famously bashed bitcoin, calling the world’s largest cryptocurrency “a fraud.” He claimed he would fire any employee trading bitcoin for “being stupid.”

This was the “they ignore you” stage.

In the following few months, the price rose sixfold to peak near $20,000 in December 2017. And then the bear market ensued, in which prices dropped 85% to $3,200.

The bankers were surely laughing at bitcoin enthusiasts’ misfortune.

Behind the scenes, however, a cohort of banks were busy building a rival to bitcoin’s technology.

Last week the empire struck back, as JPMorgan Chase announced the first bank-backed cryptocurrency — a digital token named JPM Coin.

And this means the fight has just begun.

A New Digital Token

With a whopping $2.6 trillion in assets, JPMorgan Chase is the biggest bank in the U.S.

Every day, it moves $6 trillion around the world for corporations along an antiquated payment infrastructure that is overdue for a revamp.

Even while CEO Jamie Dimon was outwardly critical of bitcoin, bank employees were busy attempting to utilize the new blockchain technology to improve the bank’s payment and settlement business.

Its new digital token is built on an in-house blockchain called Quorum, an enterprise iteration of ethereum that has been in development for a few years.

In a few months, JPMorgan Chase will begin trials to move a small amount of customers’ funds using JPM Coin.

The digital token will allow the bank’s customers to instantly settle payments globally. It can also facilitate payments for new securities issuance and settlement.

How JPMorgan Chase’s Cryptocurrency Works

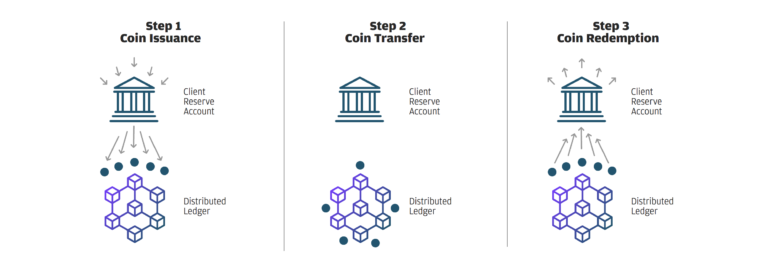

JPM Coin issuance is backed by customer deposits.

Each JPM Coin represents a U.S. dollar in a customer’s account, making it a centrally backed “stablecoin.” The value of JPM Coin is pegged to the value of the U.S. dollar.

Like bitcoin, JPM Coin runs on an underlying blockchain that records and validates transactions. This is a digital database that keeps track of who owns what within JPM Coin’s network of users.

When a customer wants to make an instant payment to another JPMorgan Chase customer, they redeem the tokens with JPMorgan Chase, which then credits and debits the customers’ respective accounts.

This will allow the bank to instantly settle customer transactions, which can typically take up to a few days over archaic payment rails.

This will allow the bank to instantly settle customer transactions, which can typically take up to a few days over archaic payment rails.

The World Trade Organization estimates that global companies spend $1.6 trillion in annual costs moving money around the world. If JPM Coin works as intended, this would be an enormous cost savings.

Look out, Ripple

JPM Coin works similarly to popular cryptocurrency Ripple (XRP), a digital asset used by the banks as a bridge to settle transactions.

XRP’s value is freely floated, and that means users can potentially lose money while utilizing the token. JPM Coin is a considerable improvement, as it will be tied to the U.S. dollars in customers’ accounts and not fluctuate in price.

Crypto investors are recognizing the challenge to XRP, selling the XRP/BTC spread down 15% in the past week.

Even though JPM Coin illustrates the improvements to the banking system from blockchain technology, it will never rival bitcoin.

The similarities between JPM Coin and bitcoin start and end with the fact that they both utilize an underlying blockchain to keep track of who owns what.

JPM Coin’s value is still controlled by the same hierarchical monetary system that controls the U.S. dollar or any other global currency that it represents in customers’ accounts.

It’s simply a faster way to use the existing global banking system.

Bitcoin, on the other hand, was created as an antidote to a government- and bank-controlled monetary system.

The People’s Revolt

Its pseudonymous creator, Satoshi Nakamoto, created a decentralized digital currency where supply and value couldn’t be controlled by centralized institutions.

Bitcoin arrived at a time when global banks spent decades privatizing profits and socializing losses. These too-big-to-fail institutions held enough sway over politicians to use taxpayer funds to bail them out.

The people’s revolt was an ideal backdrop for a nongovernment currency.

On January 3, 2009, the first block on bitcoin’s underlying blockchain was encoded with a headline that related the prevailing sentiment:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

A decade later, and payments on bitcoin’s network aren’t yet instantaneous. Often, it can take over an hour to validate a transaction.

If you’re sending money around the globe, an hour isn’t a big deal. However, an hour is too long to wait for a bitcoin payment at a coffee shop.

There are upcoming improvements to bitcoin, such as the Lightning network and the Bakkt exchange, that will facilitate instant payments. It’s no longer a matter of if this will happen, it’s a matter of when.

And this means bitcoin will look more like a traditional currency.

In summary, traditional banks are trying to make existing money look more like crypto, and crypto is trying to be more like existing money.

The winner of this battle will be decided by the people who choose to use the currency.

They can either stick with the same regime that drives the money supply into and out of financial crises, or they can try something different.

Regards,

Ian King

Editor, Automatic Fortunes