I’m going to get a little personal with you today, if I may.

Nothing salacious.

I’m talking about my finances.

You see, I track my retirement account in two groups.

One group contains stocks I buy primarily for their price appreciation. Like many investors, it’s weighted toward growth companies with long-term prospects.

The other contains dividend payers. It’s a mix of companies, real estate investment trusts, closed-end funds and exchange-traded funds (ETFs).

For the calendar year 2020, both groups of stocks beat the S&P 500.

In the year to date, however, the growth stocks have struggled to perform. As of today, they’re breaking even with the S&P 500.

But the dividend payers are doubling the market.

That tells me something important about investing strategies at this time of dangerous uncertainty … something investors of every age should be doing.

Like a Flock of Birds

If you’re an investor, you’ve almost certainly heard the term “flight to safety.”

If you’re an investor, you’ve almost certainly heard the term “flight to safety.”

For me, it evokes a typical scene from the African bush … a flock of Cape turtledoves disappearing into the trees as a hungry Verreaux’s eagle circles overhead.

Hungry predators are circling you right now.

Inflation. A strengthening dollar. Doubts about the Democrats’ ability to enact their sweeping infrastructure plans.

One of these predators has already claimed a scalp: Inflation fears have wrecked the growth trade that dominated markets last year.

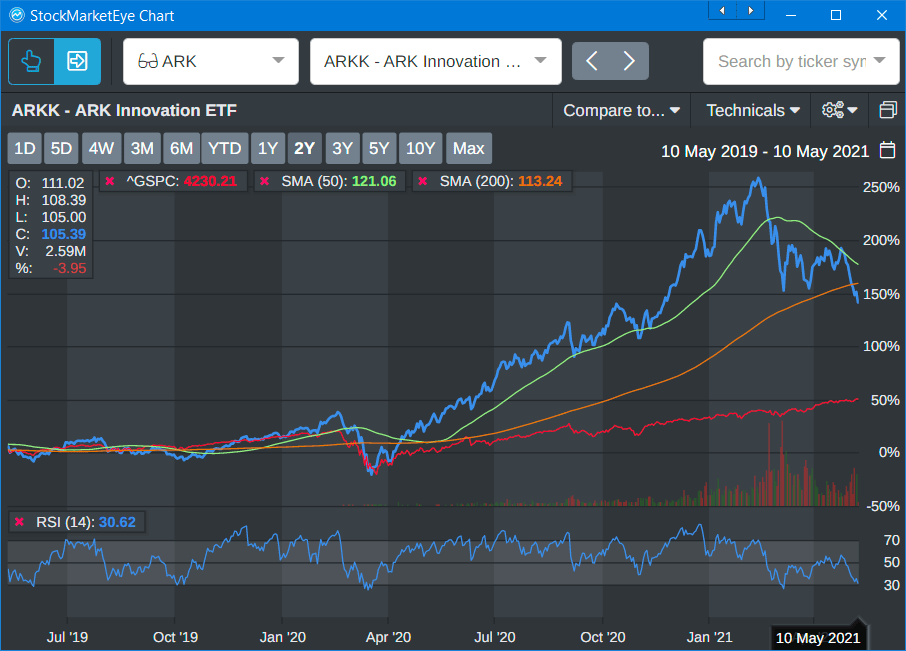

The chart below shows the ARK Innovation ETF (NYSE: ARKK), which holds a who’s who of 2020’s high flyers.

A plunge that started in February has picked up steam again this month. ARKK has broken below its 200-day moving average. It appears headed for the dreaded “death cross,” when the 50-day average does the same:

(Click here to view larger image.)

Oh, sure, there are days when growth seems to bounce back. But there are a lot of red selling columns on the right-hand side of this chart. And its relative strength index is headed below 30, which is extreme bearish territory.

When the Trend Isn’t Your Friend

Last year’s run-up in growth stocks — largely companies that have never turned a profit, but which can tell a good story — was all about sentiment.

Part of that sentiment was that low interest rates were good for growth stocks.

It’s true, they are, for the reasons Clint Lee and I have discussed several times since the beginning of the year.

But low interest rates aren’t that good for growth stocks. Their primary contribution was to give particularly aggressive bulls an excuse to pile into them. That produced valuations all out of proportion to any reasonable metric.

Here’s a chart I shared in Bauman Daily’s Your Money Matters video yesterday. It shows a range of valuation metrics for the U.S. stock market compared to their long-term highs over time.

(Click here to view larger image.)

Nearly every one of those metrics is close to 100%. That means it’s as high as it has ever been in modern stock market history.

There just isn’t much higher for the major indexes to go … at least without entering uncharted territory.

Recent stock valuations are like a ballistic missile.

Fed-fueled sentiment sent it rocketing upward last year. But that fuel has run out. Momentum kept the missile arcing upward until February, when it began its downward trajectory.

If you can’t depend on sentiment to drive investment gains, what can you do?

Fly to Safety With Dividends

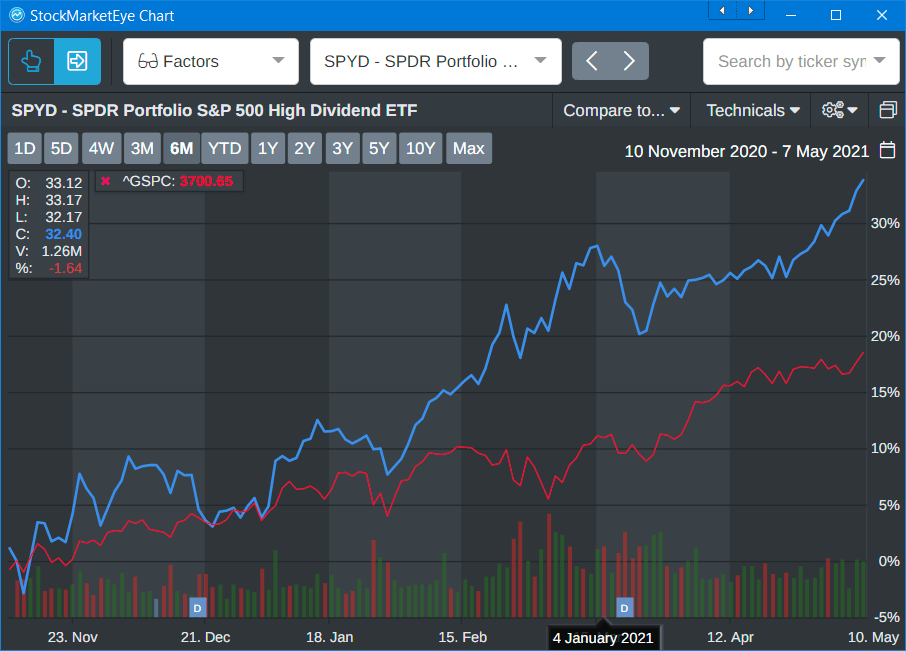

The chart below shows the SPDR Portfolio S&P 500 High Dividend ETF (NYSE: SPYD). It holds a cross-section of solid, profitable companies that pay higher-than-average dividends:

(Click here to view larger image.)

Since the beginning of this year, it’s broken away from the market. Like my own dividend portfolio, it’s nearly doubling the return of the S&P 500.

After a year where growth stocks dominated investor thinking, it may be hard to understand that result.

But it’s not an anomaly.

In fact, the outperformance of dividend payers is the long-term norm, as the following chart shows (note that this is total returns, including both price appreciation and reinvested dividends):

(Click here to view larger image.)

You’ll notice that companies that pay dividends outperform the market by a wide margin. But out of that group, those that grow their dividends over time leave everyone else in the dust.

That’s precisely the type of company I target in my own investment portfolio. I don’t just look for high yields off the bat. I look for companies with strong free cash flow and a history of using that to increase their dividends every year.

I do precisely the same thing in The Bauman Letter’s Endless Income model portfolio … which is also doubling the market this year.

Like the tortoise, stocks like that may underperform high-growth “hares” in specific cycles. But over time, if you stick with them and keep an eye on their dividend growth, you’ll do far, far better.

So, my fellow investor turtledoves, let’s flee to the safety of the dividend forest … and keep those hungry predators at bay!

Kind regards,

Ted Bauman

Editor, The Bauman Letter