For a moment, it seemed like the “Great Rotation” had run its course.

Following a disappointing jobs report this past Friday, stocks staged a huge relief rally, including the battered growth and tech stock arenas.

The rally may seem counterintuitive, but investors fear that a hot economy will derail the stock market with inflation and higher interest rates. That’s why they let out a sigh of relief when the employment report undershot expectations.

But that was short-lived, with growth stocks under pressure again to start the week.

Amid all the volatility, here are three key charts that will reveal what happens next.

This Level Better Hold

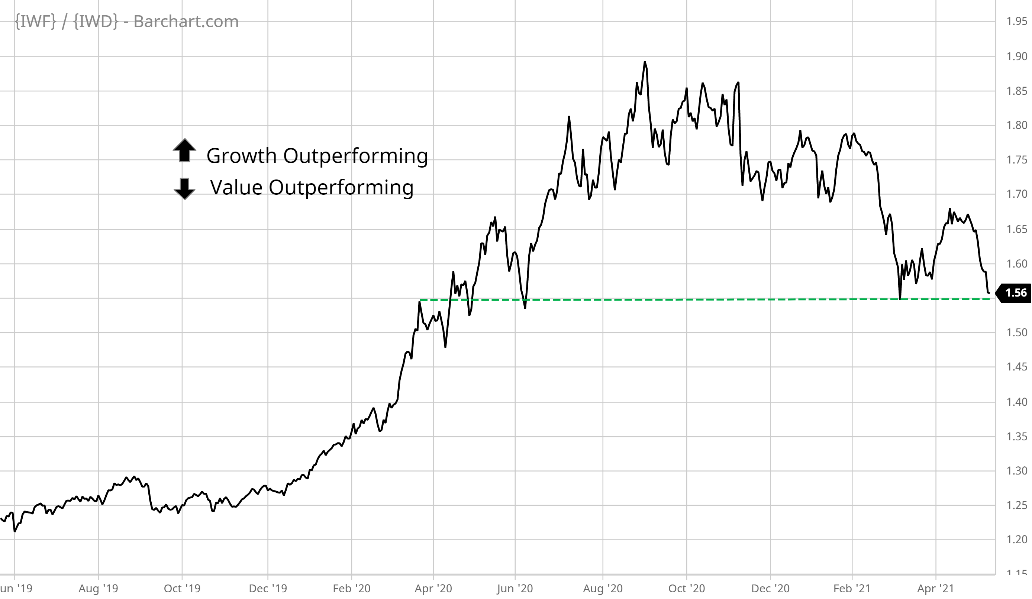

Relative strength charts provide valuable insight into the trends of any market sector.

The chart below is a ratio of growth stocks to value stocks. A rising line means growth is outperforming, which was the case from the end of 2019 through September of 2020.

(Click here to view larger image.)

But the line has been falling ever since, meaning that value stocks have been leading the way.

If you’re a growth investor, then you need to pay close attention to a critical chart level … one you don’t want to see break down.

The green dashed line shows the level I’m talking about. From a chart standpoint, it’s a key support level in the tug of war between growth and value investors.

Should the line break down below that level, expect more pain ahead for the growth and tech trades.

The next two charts will determine whether this level holds or not.

2 Keys to the Next Move in Growth Stocks

Ted and I have talked at great length about why interest rates matter for stocks. That significance increases with stocks trading at higher valuations.

Interest rates is something I highlighted in Bauman Daily’s most recent Your Money Matters video. During my discussion with Ted, I showed how interest rates were staging a key move in favor of growth stocks so far (when recording Friday afternoon).

Below is an intraday chart of 10-year Treasury futures going back to February. This is price, so yields are falling when this line is rising. It looked as if a key breakout was in place to support the growth trade.

(Click here to view larger image.)

But when Monday morning rolled around, longer-dated Treasury yields could not sustain their dip. It was yet another curveball and it explains why growth stocks are retreating again — they need that breakout to stop the decline.

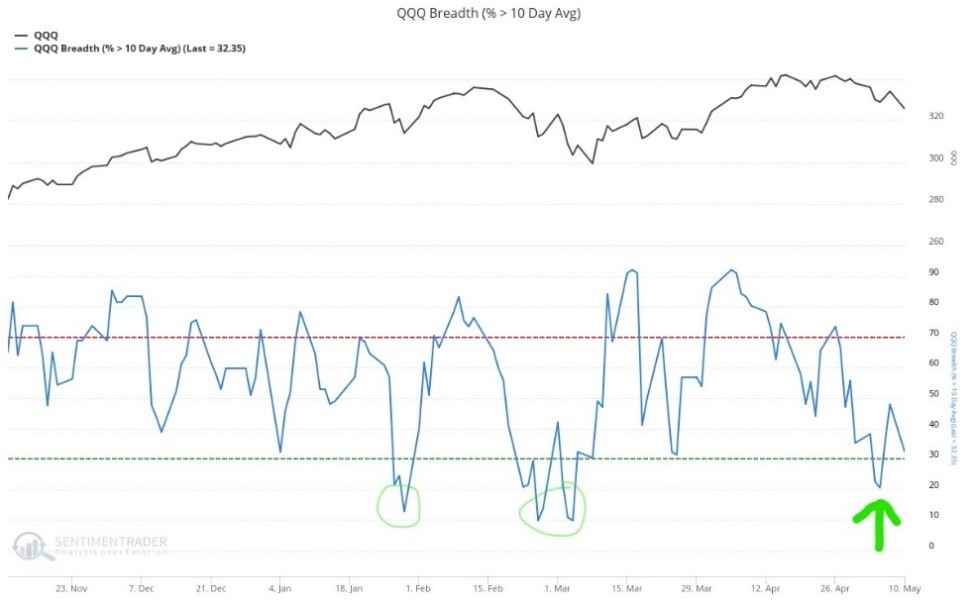

Here’s the last critical chart. This shows the percentage of stocks above their 10-day moving average in the Invesco QQQ Trust ETF (Nasdaq: QQQ), which tracks the Nasdaq 100 Index. It’s fast approaching oversold levels that have marked a bounce in the past. Getting there early this week would help stabilize the growth trade.

(Click here to view larger image.)

Here’s Where to Hide

I’ve provided you with three crucial charts to monitor the growth trade. We’re quickly approaching an important moment: Chart support, interest rates and breadth will determine the next move in the tech and growth trades.

Either type of investment is exciting because each provides the potential for big gains. But sitting through the volatility can be absolutely gut-wrenching, as we’ve seen since February.

If you find that the volatility is more than you can bear, then you need to check out Ted’s most recent article on a different type of “growth” stock. It’s one that beats all others over the long term, hands down.

Best Regards,

Clint Lee

Research Analyst, The Bauman Letter